The taxable event in GST is supply of goods or services or both.

Article 366(12A) of the Indian Constitution defines “goods and services tax” as any tax on supply of goods, or services or both except taxes on the supply of the alcoholic liquor for human consumption. The Central and State governments have simultaneous powers to levy supply under GST on Intra-state supply. However, the Parliament alone have exclusive power to make laws with respect to levy of goods and services tax on Inter-state supply.

Through the introduction of GST, various taxable events like manufacture, sale, rendering of service, purchase, entry into a territory of State etc. have been done away with in favour of just one taxable event i.e. supply.

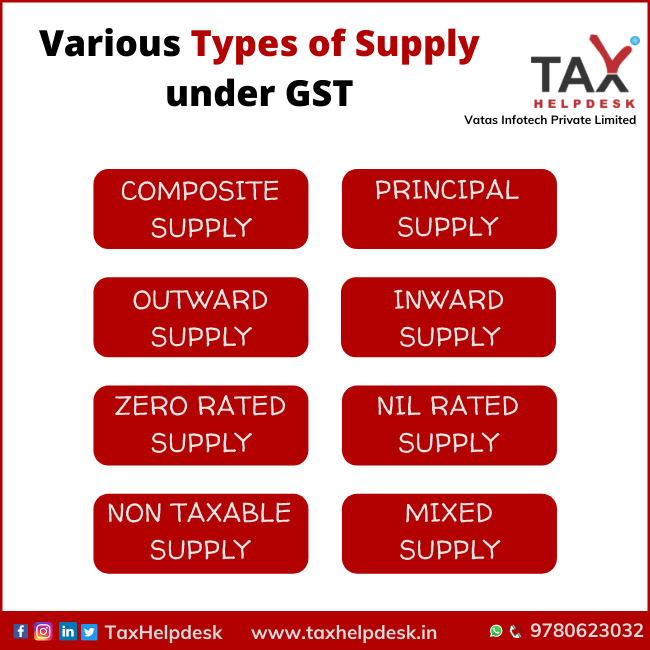

In this article, we will talk about different kinds of supply under GST. They are as follows:

Composite Supply Under GST

The definition of ‘composite supply’ has been defined under Section 2(30) of the Central Goods and Services Tax Act, 2017 (hereinafter: CGST Act). Composite supply means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply. The definition is coupled with an illustration which has also got statutory value.

Also Read: How to calculate GST?

The definition of composite supply implies that when supply is made which consists of different forms of supply including goods or services but which are necessarily, naturally and integrally connected to the main supply, then the entire supply should be taken as a single supply which has got essential character of principal supply.

Principal Supply

Principal Supply has been defined under Section 2(90) of the CGST Act. It states that Principal supply means the supply of goods or services which constitutes the pre-dominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary.

In other words, if the composite supply consists various supplies which are bundled and integrally connected to the main supply, the supplies which get bundled in the supply leading to the principal supply will be treated as an ancillary supply. For the purpose of classification, taxability and exemption the entire supply will be treated as a single supply and the principal supply will be relevant and main factor for such determination.

Illustration:

Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply;

Inward & Outward Supply

Inward Supply has been defined under Section 2(67) and Outward Supply has been defined under Section 2(83) of the CGST Act. These two supplies are to be read together.

While ‘inward supply’ refers to receipt of goods or services or both whether by purchase, acquisition or any other means with or without consideration, the ‘outward supply’ refers to supply of good or services or both, by any mode, made or agreed to be made by such person in the course or furtherance of business.

Zero Rated Supply

Zero rated supply has been referred to as under Section16 of the IGST Act. This type of supply is confined to the following two situations:

(a) export of goods or services or both; or

(b) Supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

Under the provisions of the IGST Act, the refund of Input Tax Credit can be claimed although no tax is paid and the provision also enables a registered person to claim refund in respect of goods and services supplied under bond or letter of undertaking without payment of IGST and also to claim refund of unutilized input tax credit and to claim refund of IGST if it has been paid on supply of goods and services.

Example: Overseas Supplies and supplies to SEZ

Nil Rated Supplies

Goods or services on which GST rate of 0 % is applicable are called NIL rated goods or services. Such goods or services, on which GST rate of 0% is applicable, are listed in schedule 1 under GST rate schedule. Input tax credit of inputs and or input services used in providing supply attracting Nil rate is not available i.e. no input tax credit on Nil rated supplies.

Examples: Jaggery, Salt, grains, Cereals etc.

Non Taxable Supply

Non-Taxable Supply Has Been Defined Under Section 2 (78) Of The CSGT Act, 2017. It Refers To Supply Of Goods Or Services Or Both Which Is Not Leviable To Tax Under This Act Or Under The IGST Act.

The dispute arises as to which supply would constitute a non-taxable supply. It may be seen from the definition of ‘non-taxable supply’ referred above that non-taxable supply should essentially be supply, i.e., it should satisfy the ingredients of the supply under the act viz. supplying service or goods for a consideration in the course of furtherance of business. If a supply satisfies these ingredients but yet they are not taxable under this Act, then such supply becomes non-taxable.

For example, the Act excludes alcoholic liquor for human consumption and petroleum products for the present, though these transactions may come under the scope of supply under the Act, because the charging section excludes alcoholic liquor for human consumption, the same is not taxable under this Act.

Similarly Section 9(2) of CGST Act indicates that the tax on the supply of petroleum crude, High Speed Diesel, motor spirit (known as petrol), etc. will be levied with effect from such date as may be notified by the Government. Currently, these products are not chargeable under GST. Therefore, they will be considered to be as non taxable supplies.

Exempted Supply

Section 2(47) of the CGST Act defines ‘Exempt supply’. It refers to supply of any goods or services or both which attracts NIL rate of tax or which may be wholly exempt from tax under Section 11, or under Section 6 of the Integrated Goods and Services Tax Act (hereinafter: IGST Act), and it also includes non-taxable supply. No GST will be charged on these goods & services for company and business, GST paid on the assets, purchases or expenses for their businesses. Supplies are taxable but do not attract GST and for which ITC cannot be claimed in case of Exempt Supplies.

Examples: Live Fish, Fresh Milk & fruits, unpacked food grains, fresh vegetables, Curd, Bread etc.

Following points are to be noted for exempted supply:

– There is no GST applicable on outward exempted supplies;

– Input tax credit of inputs and / or input services used in providing exempted supply is not available i.e. no input tax credit on exempted supplies;

A registered person supplying exempted goods or services or both shall issue ‘bill of supply’ instead of tax invoice

Mixed Supply

The definition of ‘Mixed Supply’ is given under Section 2(74) of the CGST Act. Mixed supply refers to two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply. The definition is coupled with an illustration which has got an equal statutory value.

Illustration:

A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately

Also Read: GST Invoices: B2B, B2CL and B2Cs

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram, Twitter and Linkedin!

Pingback: GST Registration on basis of State & Turnover | TaxHelpdesk

Pingback: Know About 43rd GST Council Meeting | TaxHelpdesk