Bookkeeping & Accounting: An Overview

Bookkeeping is the practice of recording the business transactions in general ledger. This ledger contains all the financial transactions of the businesses since its inception.

On the other hand, accounting is the practice of analyzing the information in the ledgers and developing insights into the business’s financial decisions.

Utility of Bookkeeping & Accounting

There are various advantages attached to bookkeeping like:

- Abide with the legal requirements: Maintaining of books of accounts is a statutory requirement. The details recorded in the books of accounts are required in filing of taxes in a time bound manner.

- Helps management in decision making: Recording and maintaining books of accounts properly helps management to review the financial position of the organisation. Thus, results in to better decisions.

- Ease in getting funds: By showing properly maintained and accurate books of accounts, one can surely attract investors to invest in their venture.

- Managing Cash Flow: Regular tracking of the money that comes into the business helps in predicting the trends, paying to staff and suppliers, covering debts, etc.

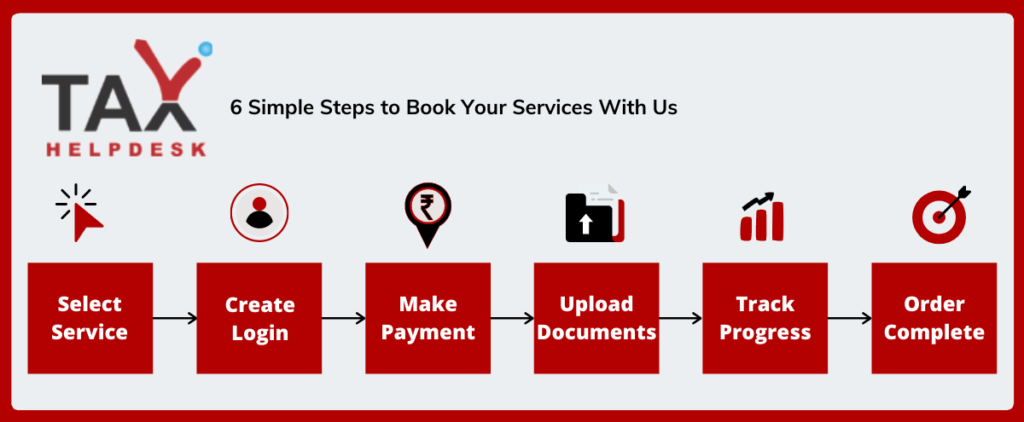

Procedure to book your services of Bookkeeping & Accounting with TaxHelpdesk

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, there will be an assignment of a Tax Expert. Thereafter, there will be processing of your order. Apart from this, you also will be able to check the status of the order in your respective account.

TaxHelpdesk's services include the following:

What all does Bookkeeping record?

Online bookkeeping services in India records the following transactions of the business:

1. Cash:

The Cash ledger records the Cash Receipts and Cash Payments of the business.

2. Accounts Receivable:

This transactions recorded in this ledger is used to generate invoices and send out bills to the credit customers.

3. Inventory:

Maintaining records of inventory helps in keeping a track of the stocks for the business.

4. Accounts Payable:

Accounts payable ledger enables the business to check the amount that it owes to the suppliers, from whom he has purchased supplies on credit.

5. Loans Payable:

If the business has borrowed money to make larger purchases, then Loans Payable ledger helps in tracking due dates and payments.

6. Sales:

The business can track its sales, whether credit or cash.

7. Payroll Expenses:

The cost of paying employees are covered in this ledger.

8. Purchases:

This includes finished goods or raw material. It is used in the Cash Budget and in calculating the business’s Cost of Good’s Sold on the Income Statement.

9. Owner’s Draw:

This is the amount the business owner takes from the firm.

Bookkeeping method followed in India

Bookkeeping services in India, the concept of double-entry using Golden Rules of Accounting are followed.

Role & Functions of Accounting

Accounting is the process of measuring, processing, and communicating financial information. It provides the business owner with information about the company’s resources, finances, and the results the business achieves through its use.

The function of accounting is to

– Prepare a record of the company’s financial affairs.

– The interpretation of the numbers prepared by the bookkeeper

– To determine the financial health of the business

– Preparing financial statements,

– Preparation of tax and other required financial materials.

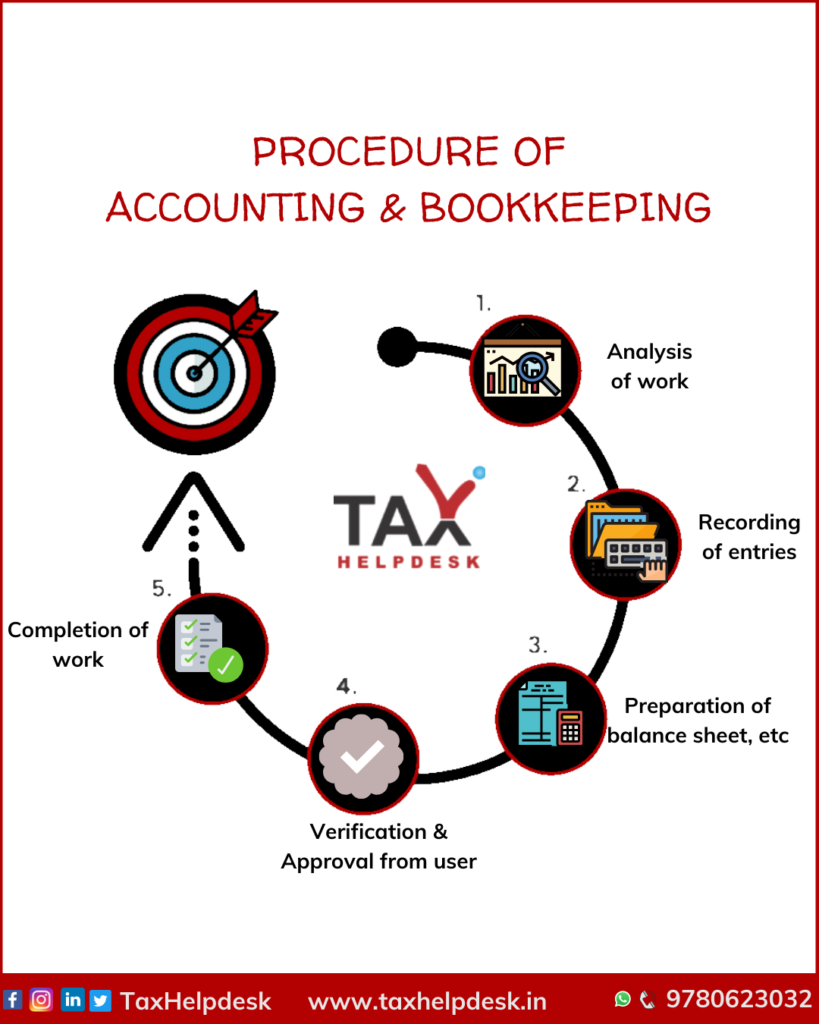

Procedure followed by TaxHelpdesk for Accounting & Bookkeeping

FAQs

Yes, bookkeeping can be done totally online leaving behind any window of errors or miscalculations.

Books of accounts/accounting records have to be maintained if the gross receipts are more than Rs. 1,50,000 in 3 preceding years for an existing profession. This also applies to a newly set up profession whose gross receipts are expected to be more than Rs. 1,50,000.

The accounting records to be kept have been prescribed in Rule 6F. The below professions are required to maintain Books of accounts/accounting records: Legal Medical Engineering Architectural Accountancy Technical consultancy Interior decoration Authorized representative — A person who represents another person for a fee before a tribunal or any authority constituted under any law. It does not include an employee of the person so represented or a person who is carrying on the profession of accountancy. Film artist — This includes a producer, editor, actor, director, music director, art director, dance director, cameraman, singer, lyricist, story writer, screenplay or dialogue writer and costume designers. Company secretary If you are a freelancer pursuing any of these listed professions and your gross receipts are more than Rs. 1,50,000, these rules shall apply to you as well.Each year’s books must be kept for a period of 6 years from the end of that year.

Audit of accounts is compulsory by a Chartered Accountant for the following persons

| Tax Payer | Compulsory Audit required when |

| A person carrying on Business | If total sales, turnover or gross receipts are more than Rs. 1 crore |

| A person carrying on Profession | If gross receipts are more than Rs. 50 lakh |

| A person covered under presumptive income scheme section 44AD | If income of the business is lower than the presumptive income calculated as per Section 44AD and the person’s total income is more than the maximum income which is exempt from tax. |

| A person covered under presumptive income scheme section 44AE | If income of the business is lower than the presumptive income calculated as per Section 44AE. |

| A person covered under presumptive income scheme section 44ADA | If income of the profession is lower than the presumptive income calculated as per section 44ADA and the person’s total income is more then the maximum income which is exempt from tax. |

If the person is required to maintained books of accounts and fails to do so, then it may be charged with a penalty of Rs 25,000. In some cases where there are international transactions and person has failed to maintain information and documents for such transactions, then penalty @ 2% of the value of each international transaction can be imposed.

If the person required to get its accounts audited, fails to get the accounting records audited or furnish audit report as per the requirements of Section 44AB, then a penalty may be levied under section 271B of the Income Tax Act. The minimum penalty that can be charged is 0.5% of the total sales, turnover or gross receipts. The maximum penalty is Rs 1,50,000.

Reviews

There are no reviews yet.