Know about Import and Export Code

Import and Export Code, also known as IEC is 10 digit number issued by the Director General of Foreign Trade (DGFT), Government of India. It is a compulsory perquisite for the persons involved in either importing or/and exporting goods or/and services from India. Therefore, whosoever wants to expand their business beyond the boundaries of India, needs IEC. Without IEC, one cannot import its goods or services outside India. Furthermore, IEC is required to avail benefit schemes from DGFT, Customs and Promotion Council.

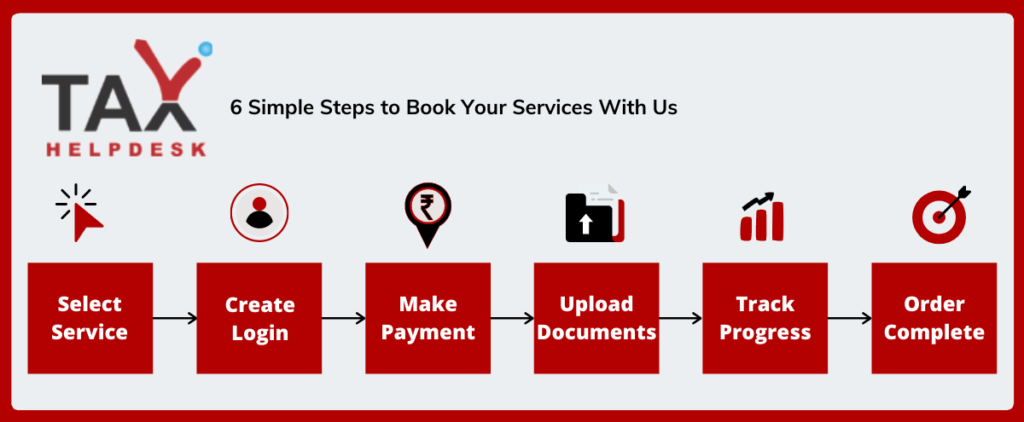

How to obtain your Import and Export Code Registration from TaxHelpdesk?

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents required for import export code, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

Uses of Import & Export Code Registration

The traders who have to export their goods outside India can get it done only after obtaining a proper license, commonly known as Import & Export Code Registration. The uses of obtaining this code, to name a few are:

– Access to international markets

– No compliance for IEC Registration

– No annual maintenance fees

– The process of obtaining license is completely online

Cases in which Import & Export Code is not mandatory

Note:

– IEC is not required to be obtained for the traders who are registered under GST. In such cases, the PAN of the trader shall be construed as new IEC code for the purpose of imports and exports. Further, IEC is not required to be taken in case the goods exported or imported is for personal purposes and is not to be used for any commercial purpose.

– Export/ Import done by the Government of India Departments and Ministries, Notified Charitable institutions also do not require IEC.

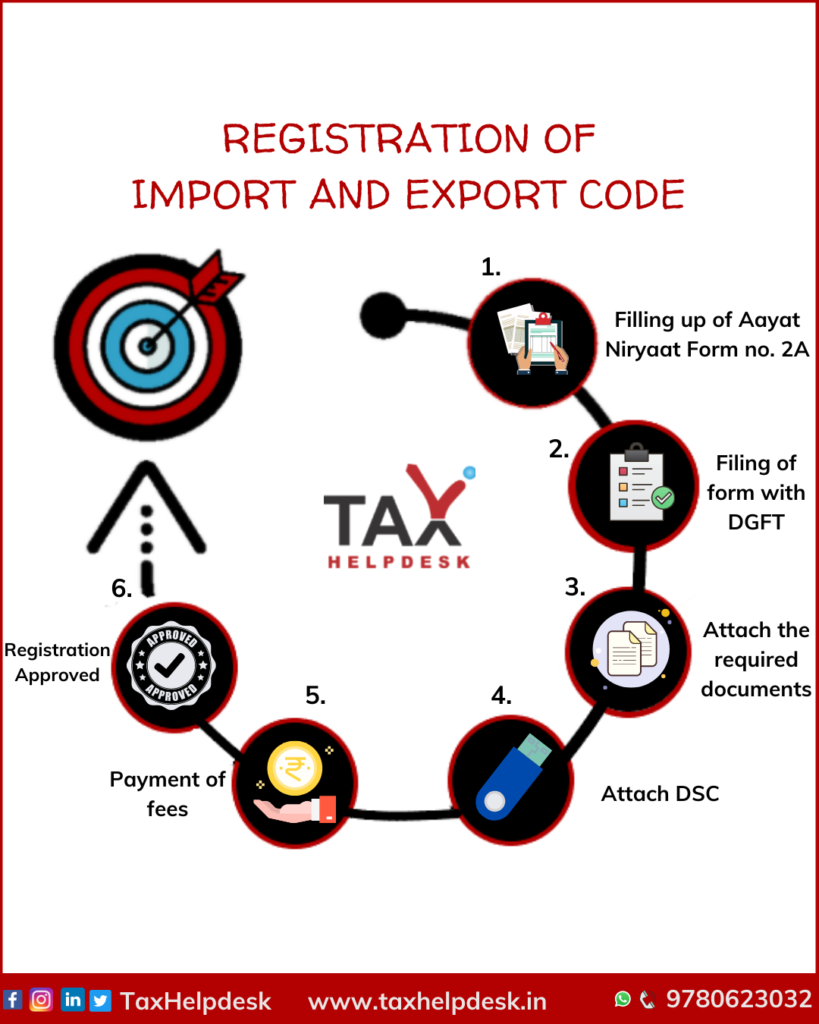

Import & Export Code Registration Steps

Documents required to be submitted for IEC Registration

– PAN Card copy of Individual/Firm/Company

– Identity proof of Individual/Firm/Company

– Cancelled cheque copy of Bank’s Current Account of Individual/Firm/Company

– NOC from the landlord, where the business is situated

Time involved in obtaining registration of Import & Export Code

Time period taken from the date of application on submission of all the required documents:

Particulars | Time |

Application for IEC Registration | 2 days |

Obtaining of IEC Registration Number | 7 days |

FAQs

No, an individual/firm/company cannot have more than one IEC. If more than one IEC have been issued, then that should be surrendered to the regional office for cancellation as earliest as possible

Yes, it is possible to surrender the IEC Registration by informing the issuing authority.

No, IEC registration does not involve any filing of taxes. However, custom duties may be imposed.

Yes, IE Code can be modified. It involves filling of new application form with fees to be paid again.

Yes, IEC is used by the customs department so as to ensure that the exports are done easily. The information is sent to the department electronically on the day of issue of IEC.

Yes, NRIs or foreign nationals can obtain IEC registration subject to RBI/FIPB guidelines.

The IEC remains for a lifetime unless surrendered.

Reviews

There are no reviews yet.