BLOG

Latest Blog

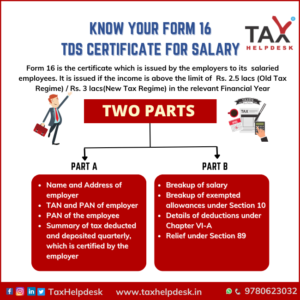

All You Need To Know About Form 16: TDS Certificate For Salary

The employers issue Form 16 TDS certificate to their employees. It is proof of tax deduction at source from the employee’s salary. Further, the genesis of this Form can be … All You Need To Know About Form 16: TDS Certificate For Salary Read More »

Read MoreCan I claim HRA even if I’m staying at my parents’ house?

Salaried individuals residing in rented house are entitled to tax exemption on House Rent Allowance (HRA) under Section 10(13A) of the Income Tax Act, 1961. But are you aware of the fact that you, as a salaried individual you can take advantage of this exemption while staying at your parents’ home.

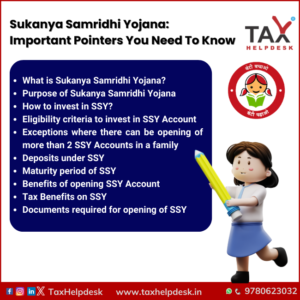

Read MoreSukanya Samridhi Yojana: Important Pointers You Need To Know

Sukanya Samridhi Yojana or SSY, as the name suggests is a scheme for the welfare of the girl child in India. This scheme was launched by the Prime Minister Narendra … Sukanya Samridhi Yojana: Important Pointers You Need To Know Read More »

Read MoreCertificates of TDS Types: All You Need To Know

Types of TDS Certificates are Form 16, 16A, 16B and 16C. These certificates are issued by the person deducting TDS to the assessee from whose income TDS was deducted while making … Certificates of TDS Types: All You Need To Know Read More »

Read MoreKnow Whether you can claim Input Tax Credit on Food?

The input tax credit on food and beverage supplies are blocked credit for registered person. That is, one cannot claim Input Tax Credit on Food. However, there are certain exceptions … Know Whether you can claim Input Tax Credit on Food? Read More »

Read MoreKnow About TDS Rates for the FY 2023-24

The TDS rates for the FY 2023-24 can help you to determine your tax liability. So, make sure to read this blog till the end and do share with your … Know About TDS Rates for the FY 2023-24 Read More »

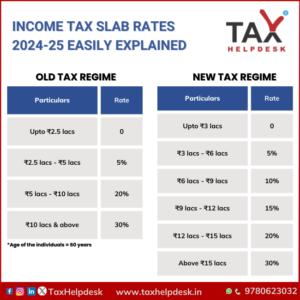

Read MoreIncome Tax Slab Rates 2024-25 Easily Explained

The Income Slab Rates 2024-25 can help you understanding not only you tax liability but can also help you in saving taxes. Book Income Tax Consultation Income Tax Slab Rates … Income Tax Slab Rates 2024-25 Easily Explained Read More »

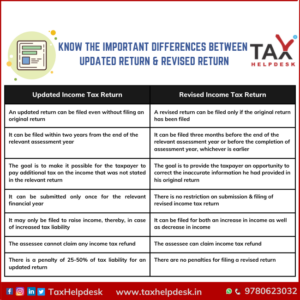

Read MoreKnow the important differences between updated return & revised return

Updated Return & Revised Return are major parts when it comes to filing of Income Tax Return. And, the concept of updated return was introduced recently through the Union Budget, … Know the important differences between updated return & revised return Read More »

Read More