Concept of Limited Partnership Firm

The concept of Limited Liability Partnership, also known as LLP cam into being through its governing Act – The Limited Liability Partnership Act, 2008. This Act came into force in the year 2009 and since then, there has been more than a lakh of registration of LLPs in India. The limited liability partnership is a partnership formed and registered under this Act. In limited liability partnership, the liability of the partners is limited to their share in the partnership. In case of loss, the partners cannot be forced to pay the amount exceeding their share in the partnership. In order to start a LLP, it must be registered with the Ministry of Corporate Affairs.

What is Limited Liability Partnership Agreement?

Section 2(o) of the governing Act defines limited partnership agreement as – “it means any written agreement between the partners of the limited liability partnership or between the limited liability partnership and its partners which determines the mutual rights and duties of the partners and their rights and duties in relation to that limited liability partnership.” Therefore, the agreement of LLP is the gist of all the duties, rights, liabilities and shares of the partners in the firm

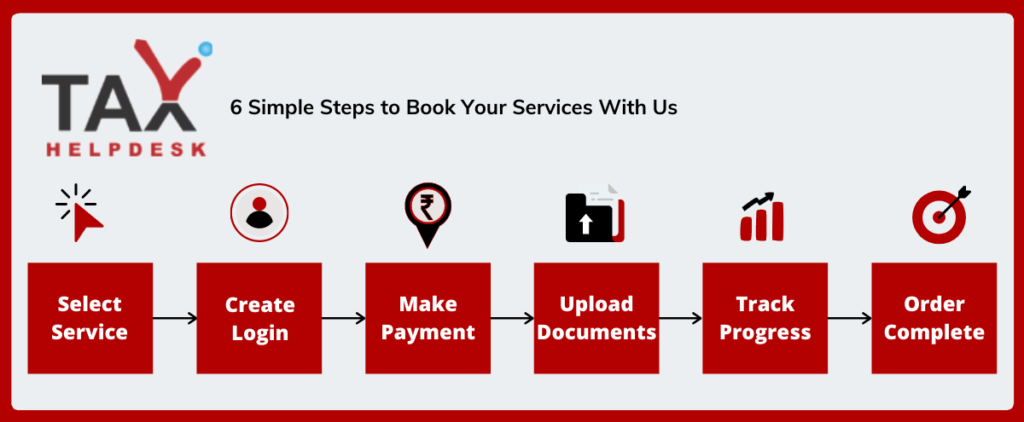

How to get your LLP registered through TaxHelpdesk?

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

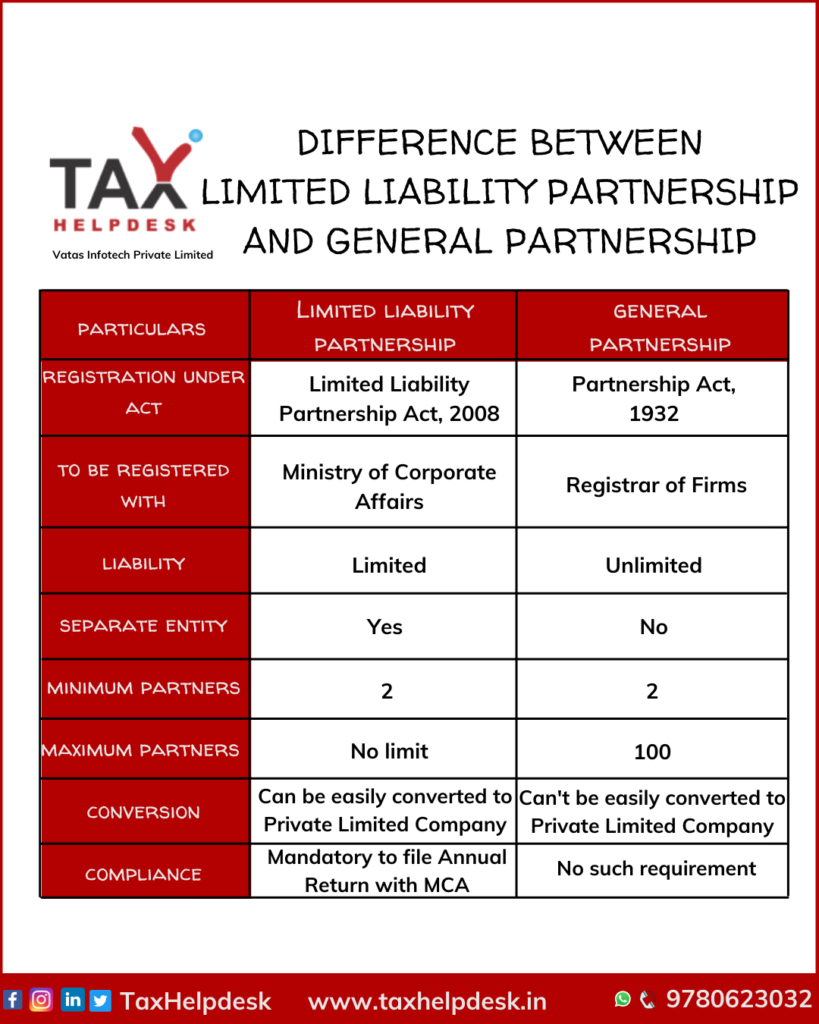

Difference between Limited Liability Partnership & General Partnership

Procedure of Registration of LLP

The registration procedure of Limited Liability Partnership involves 6 easy steps:

Documents that are to be submitted for LLP Registration

Documents to be submitted by Proposed Partners

– Scanned copy of PAN Card or Passport (Foreign Nationals & NRIs)

– Scanned copy of Voter’s ID/Passport/Driver’s License/Aadhaar Card

– Scanned copy of Latest Bank Statement/Telephone or Mobile Bill/Electricity or Gas Bill

– Scanned passport-sized photograph

– Specimen signature (blank document with signature [partners only])

Documents to be submitted for Registered Office

– Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Electricity or Gas Bill

– Scanned copy of Notarised Rental Agreement in English

– Scanned copy of No-objection Certificate from property owner

– Scanned copy of Sale Deed / Property Deed in English (in case of owned property)

Time Framework for obtaining LLP Registration

The time that is generally taken for registration of registration of LLP from the date of submission of all the documents is as follows:

[wptb id=7364]

Positives & Negatives of getting LLP Registration

[wptb id=7367]

FAQs

No, there is no need to have any prescribed minimum capital in order to get LLP registered. One can start a LLP with any amount of capital. There is no need to show any proof of capital invested during its incorporation. Partners can contribute in the form of tangible as well as intangible property.

Yes, it is necessary that LLP should have an office address. This is so because the same address will be used to receive the communication from Ministry of Corporate Affairs. The premises of the office can be commercial/non commercial/industrial.

Any individual or even a company/firm/LLP can become a partner in LLP. However, only an individual and is above 18 years of age, can become a designated partner in LLP.

Any private company/ unlisted public company that is willing to get converted into LLP need to apply through Form 18 (Application and Statement for conversion of a private company/ unlisted public company into limited liability partnership (LLP)). Form 18 needs to be filed along with Form 2 (Incorporation document and Subscriber’s statement).

The governing Act does not place any restriction on the citizenship or residency of the individual willing to become partner of LLP in India. However, in such a case one of the designated partners must be a resident of India.

No, NPOs cannot enter into LLP agreement as the very objective for setting up LLPs in the governing Act is ‘carrying on a lawful business with a view to profit’. Therefore, LLP cannot be incorporated for undertaking “Not-For-Profit” activities.

tax_admin –

*Government and charges extra!