Definition of Private Limited Company

Section 2(68) of Companies Act, 2013 defines private limited companies as those companies whose articles of association restrict the transfer-ability of shares and prevent the public at large from subscribing to them. This is the basic criterion that differentiates private companies from public companies. A private limited company must have a minimum paid up capital of Rs. 1 lac.

Minimum and Maximum Number of Members

The basis minimum requirement is that a Private Limited Company should have minimum of two members and can have up to maximum 200 members

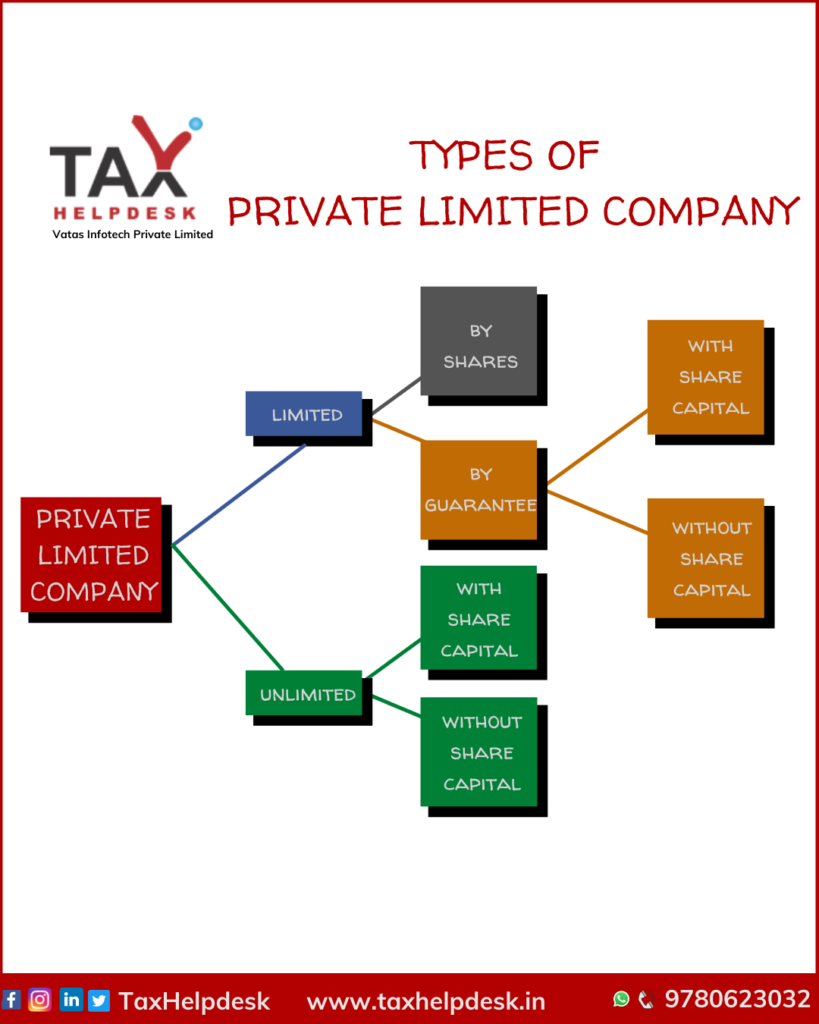

Types of Private Limited Companies

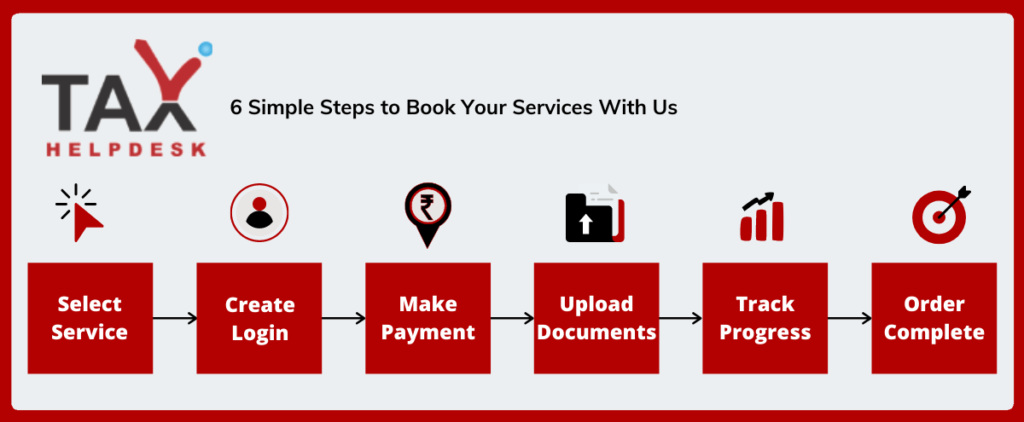

How can you get your company registered through TaxHelpdesk?

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

Process of Registration of Private Limited Company

A private limited company can be registered in 6 simple steps:

Note:

Once the name is reserved for the proposed company, one shall proceed for making an application of Incorporation through filing of SPICe + Part B Form which is web based form and it should be accompanied with SPICe-MOA, SPICe-AOA, AGILE- PRO and SPICe-9, where the other information is required to be filled in all the required details of director’s, subscriber’s details and other required details of the company.

Documents to be submitted for registration of Private Limited Company

Documents to be submitted by Directors

– Scanned copy of PAN Card or Passport (Foreign Nationals & NRIs)

– Scanned copy of Voter’s ID/Passport/Driver’s License/Aadhaar Card

– Scanned copy of Latest Bank Statement/Telephone or Mobile Bill/Electricity or Gas Bill

– Scanned passport-sized photograph

Documents to be submitted for Registered Office

– Scanned copy of Latest Bank Statement/Telephone or Mobile Bill/Electricity or Gas Bill of the owner of the property where the registered office of the company is situated.

– Scanned copy of Notarised Rental Agreement in English

– Scanned copy of No-objection Certificate from property owner

– Scanned copy of Sale Deed/Property Deed in English (in case of owned property)

Timeline for registration of Private Limited Company

Time period taken from the date of application on submission of all the required documents:

| Particulars | Days |

|---|---|

| Application of PAN Card of Proposed Directors | 15 days |

| Application of TAN Card of Proposed Directors | 7 days |

| Application of DIN of Proposed Directors | 1-2 days |

| Application of DSC of Proposed Directors | 3-7 days |

| Drafting of MOA and AOA | 2-3 days |

While most of the above activities can be done concurrently, it takes at least 15 days to get a Private Limited Company registered.

Why should you and should not go for Private Limited Company

Reasons to opt for Private Limited Company registration

– Separate Legal Entity

– Perpetual Succession

– Ease of transfer of business

– Limited Liability protection for directors and Shareholders

– Ease of fundraising

Reasons not to opt for Private Limited Company registration

– Too many compliances formalities

– Mandatory division of ownership

– Complicated winding up formalities

– Mandatory registration

FAQs

No. there is no need to be present physically. Since all the documents are uploaded online, physical presence is not required.

Yes, a private limited company must hire an auditor, no matter what its revenues. In fact, an auditor must be appointed within 30 days of incorporation of the company. Compliance is important with a private limited company, given that penalties for non-compliance can run into lakhs or rupees and can even lead to the blacklisting of directors of the company.

AOA stands for Articles of Association and MOA stands for Memorandum of Association. These are the documnents which contain the rules, regulations and objectives of the organisation. They define, among other things, the exact business and the roles and responsibilities of it’s shareholders and directors.

It requires a minimum paid up capital of Rs.1,00,000/-

The eligibility requisites of a director are that it is required to be above 18 years of age and must be a natural person. He may or may not be citizen or residence of India. Even a foreign national can be a director of private limited company in India.

Reviews

There are no reviews yet.