Overview of Partnership

As per Section 4 of Indian Partnership Act, 1932 “Partnership” is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.” Therefore, partnership firm is a business entity which has been created by persons who have agreed to share the profits and losses in a predetermined ratio of a business.

Partner, Partnership Firm and Partnership Firm Name

As per the governing Act, partner has been defined as persons who have entered into partnership with one another are called individually, “partners” and collectively “a firm”, and the name under which their business is carried on is called the “firm-name”.

Note:

A partner must be of sound mind and should have reached the age of majority. However, a minor can be admitted to the benefits of the partnership.

What are the various types of Partnership?

Under the governing Act of 1932, partnership are of following types:

Partnership at Will and Particular Partnership: As per Section 7 of the Act, where no provision is made by contract between the partners for the duration of their partnership, or for the determination of their partnership, the partnership is known as “partnership-at-will”. On the other hand, Section 8 of the Act defines Particular Partnership as a partnership which is carried for particular adventures or undertakings.

Registered Partnership and Unregistered Partnership:- The Act does not mandate compulsory registration of the partnership firm. The Act does not attract penalty if the firm is not registered. However, the partner of unregistered firm cannot file a suit in the court. No suit can be filed in the court by or on behalf of a firm against any third to enforce a right arising from an agreement, unless the firm is registered. Also, an unregistered firm or any of its partners cannot claim set off or other proceedings in a dispute with the third party.

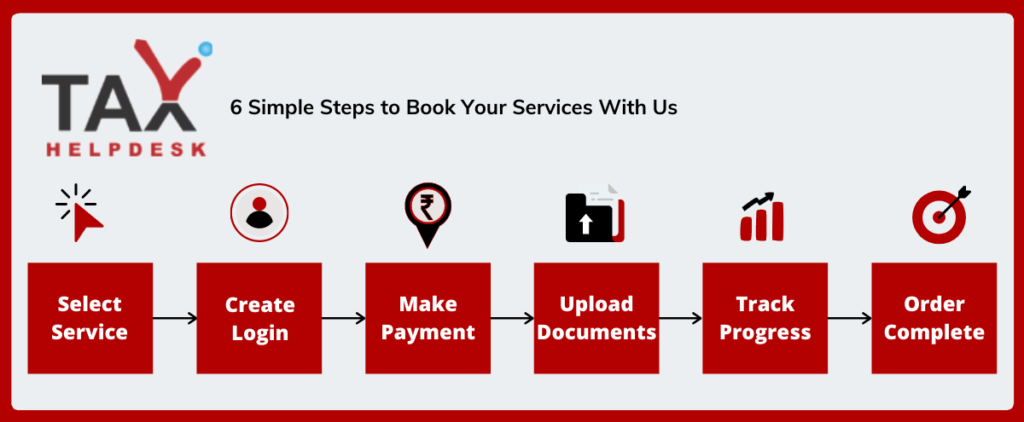

How will TaxHelpdesk help you in registering your Partnership Firm?

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

Steps involved in registration of Partnership Firm

A Partnership Firm can be registered in 5 simple steps:

Details of documents required for Partnership Firm Registration

Following are the documents required for the registration of Partnership Firm:

– Details of the name of the firm

– Address of the place of the business

– Full name of the partners

– Full address of the partners

– Identity proof of the partners

– No Objection Certificate from the landlord, where the firm is situated

– Date on which each partner joined the firm

– Duration of the firm

– Partnership Deed

Pros and Cons of Partnership Firm

[wptb id=7349]

FAQs

There must be a minimum of 2 persons to form a partnership firm. The firm can have maximum 100 partners.

A firm cannot become partner of another firm but a company can become partner of a firm.

Following are the details which are required to be provided: (a) The firm-name, (aa) The nature of business of the firm, (b) The place or principal place of business of the firm, (c) The names of any other places where the firm carries on business, (d) The date when each partner joined the firm, (e) The names in full and permanent addresses of the partners, and (f) The duration of the firm.

The statement shall be signed by all the partners, or by their agents specially authorised in this behalf.Following are the other forms of registration and procedure of Partnership Firm: (a) Change with name, (b) Change of place of business, (c) Opening of branches and closure, (d) Change in the partners or change in their address, (e) Release of minor’s partnership, and (f) Dissolution of partnership (See Sec.60, 61, 62 and 63 of the Act).

Yes, any records can be inspected or copy can be obtained on payment of prescribed fees.

Reviews

There are no reviews yet.