Who should file EPF Return?

Employee Provident Fund or EPF Return must be filed every month by all the establishments having EPF Registration. Having an EPF Registration makes it mandatory to file the EPF Returns.

Under the EPF scheme, both employer and employee contribute 12% of basic pay, throughout the tenure of the employment. Employer’s 3.67 percent is transferred into EPF account of employee. Rest 8.33 percent from employer’s side is diverted in Employees Pension Fund (EPF). This amount can be withdrawn by the employee

– At the time of retirement (On or after 58 years of age)

– If unemployed for two months of time

– Death before the specified retirement age

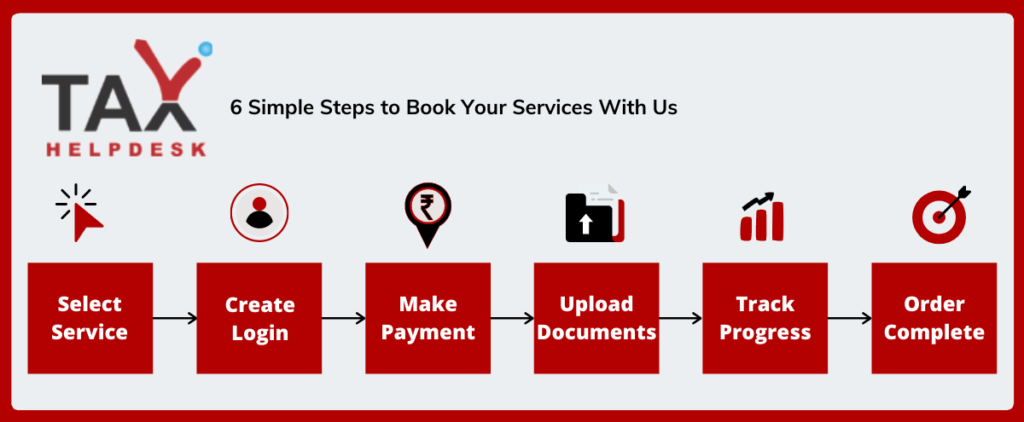

Steps to follow to book your EPF Return filing with TaxHelpdesk

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

Forms to be submitted by Employer under EPF Returns

Form | Purpose |

Form 5 | Registration form for new employees for Employee Pension Scheme and Employee Provident Fund |

Form 10 | Form to update details of employee leaving the organisation |

Form 3A | Monthly contributions made by the employer and employee for Employee Pension Scheme and Employee Provident Fund |

Form 6A | Consolidated annual contribution statement |

Form 12A | Form for exemption from paying income tax on surplus income for non-profitable trusts |

Account Statement | Annual accounts statements to be filed annually |

Procedure of filing of Employee Provident Fund Return

Documents required for filing of EPF Return

– Amount of contribution by employer in EPF

– Amount of contribution by employee in EPF

– ECR Challan copy

– Details of UAN (KYC complied) of employees

Penalty for delay in PF payment by employer

Delay in payment of PF by employer having PF registration will attract penalty as follows:

Period of Delay | Rate of Penalty (p.a.) |

Up to 2 months | 5% |

2 – 4 months | 10% |

4 – 6 months | 15% |

Above 6 months | 25% |

FAQs

The filing of returns has to be done by the 25th of each month through unified portal.

ECR stands for Electronic Challan cum Return. It is an electronic monthly return to be uploaded by employers through the Employer e-Sewa portal. The approval of uploaded ECR will result in the generation of a Challan using which the employer has to remit the dues through online payment.

The forms to be submitted for filing of EPF Returns are Form 3A and Form 6A.

UAN is Universal Account Number, which is allotted by EPFO. It acts as an umbrella for the multiple member IDs allotted to an individual by different establishments.

The EPFO has directed that EPF returns shall be allowed to be filed only for those members whose Aadhaar numbers are seeded and verified with the UAN, with effect from June 1, 2021. Therefore, aadhaar card becomes mandatory for filing of EPF Returns.

Reviews

There are no reviews yet.