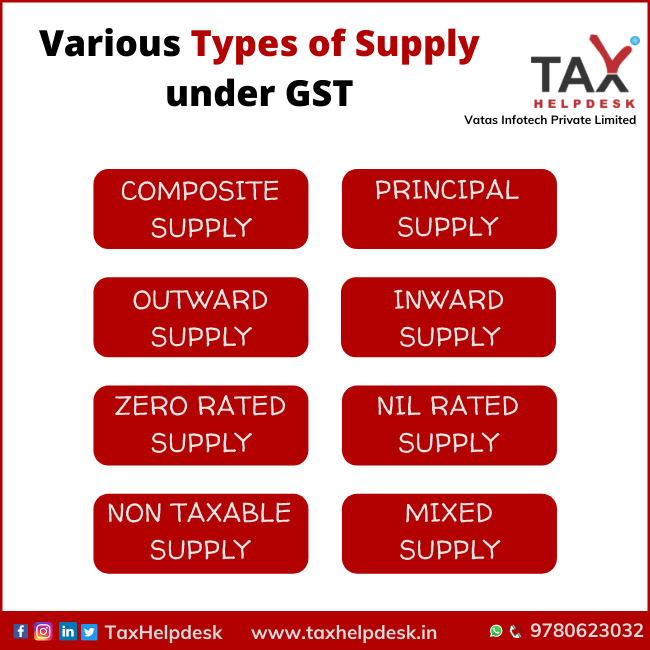

Various Types of Supply Under GST

Article 366 of the Indian Constitution defines “goods and services tax” as any tax on supply of goods, or services or both except taxes on the supply of the alcoholic liquor for human consumption. The Central and State governments have simultaneous powers to levy GST on Intra-state supply. However, the Parliament alone have exclusive power to make laws with respect to levy of goods and services tax on Inter-state supply.