Goods and Services Tax or GST is an indirect tax which is levied on manufacture, sale and consumption of goods and/or services. Goods and services tax laws came into force on 1st July, 2017 and subsumed majority of the indirect taxes like sales tax, service tax, VAT, etc. The introduction of GST calculator bought a major reformation to the taxation field as well as to the economy.

You should know Different types of GST before using GST calculator

Different types of goods and services tax levied and collected by Government are:

| Type of GST | Description | Taxable Goods/Services |

|---|---|---|

| CGST (Central GST) | Collected by the Central Government | Goods and services supplied within the same state |

| SGST (State GST) | Collected by the State Government | Goods and services supplied within the same state |

| IGST (Integrated GST) | Collected by the Central Government | Goods and services supplied between different states |

| UTGST (Union Territory GST) | Collected by Union Territories | Goods and services supplied within Union Territories |

Also Read: GST Registration on the basis of State and Turnover

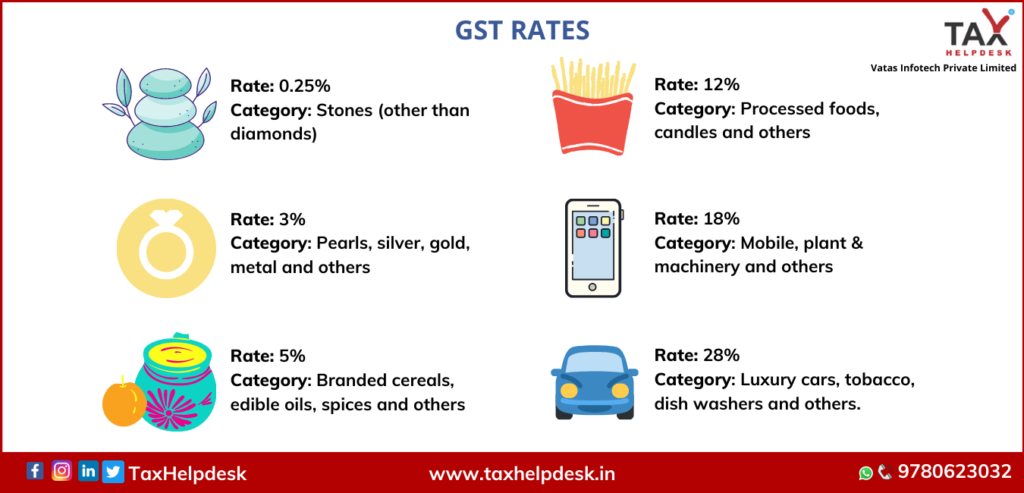

Rates of GST

The GST rates are divided into 6 parts: 0.25%, 3%, 5%, 12%, 18% and 28%. The details are:

Zero rated GST

There are also some GST items which are zero rated. These items are as follows:

How to calculate by GST calculator?

The formula to calculate GST is as follows:

1. Add GST:

GST Amount = (Original Cost x GST rate)

Net Price = Original Cost + GST Amount

Also Read: Know about Credit Note under GST

Illustration:

Let’s assume that a product is sold for Rs. 5,000 and GST applicable to that product is 5%.

GST Amount = Rs. (5000 x 5%) = Rs. 250

Net Price = Rs. (5,000 + 250) = Rs. 5,250

2. Remove GST

GST Amount = GST included amount / (1 + GST Rate)

Illustration:

Let’s assume that GST included amount of the product is Rs. 5250.

GST Amount = Rs. 5250 / (1 + 5%) = 5250 / 1.05 = Rs. 5,000

Now keep this formula in mind while calculating your GST liability.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!

Pingback: Reverse Charge Mechanism Under GST | TaxHelpdesk

Pingback: GST on Director’s Remuneration on RCM basis | TaxHelpdesk

Pingback: GST Compliance Calendar: July, 2021 | TaxHelpdesk

Pingback: Get to Know About 43rd GST Council Meeting | TaxHelpdesk

Pingback: Various Types of Supplies Under GST | TaxHelpdesk

Pingback: Know the Relevance of Supply under GST Laws | TaxHelpdesk