Overview of Goods and Service Tax Registration

Goods & Services Tax, commonly known as GST is the greatest tax change in India. It is constantly improving and expanding the taxpayer base in India, by bring various taxpayers under the GST regime. Furthermore, it has annulled and subsumed various taxes into a uniform law for Indirect Taxes under the new goods and service tax registration system, all businesses engage with purchasing or selling of goods/services or both need while taking GST registration. In addition, without GST, a person can neither collect GST from his customers nor can claim any Input Tax Credit of tax paid by him and in worst cases, he could be punished too.

Registration under GST is compulsory for businesses whose aggregate turnover in case of goods exceeds Rs. 40 lacs (Rs. 10 lacs for North-Eastern and Hill states) and in case of services, Rs. 20 lacs

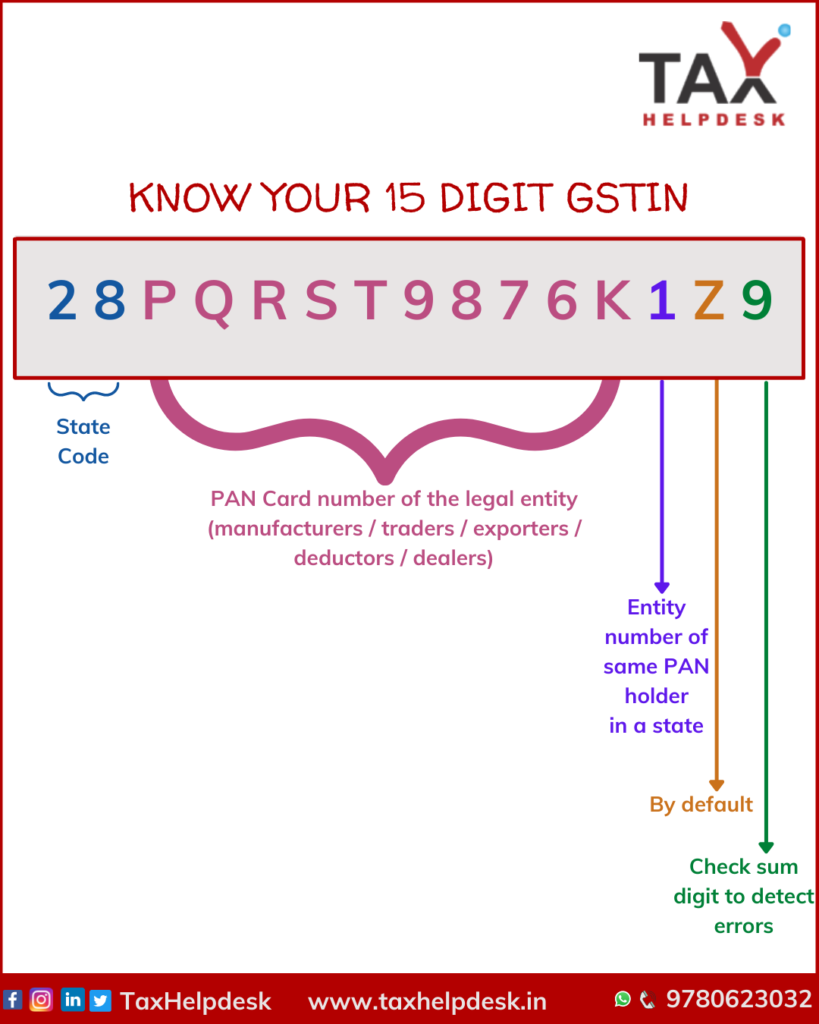

In every State/Union Territory, all the taxpayers having a business place shall be allotted PAN based 15 digit GST Identification Number (GSTIN). Further, a given PAN based legal entity would have one GSTIN per State, that means a business entity having its branches in multiple States will have to take separate State wise registration for the branches in different States.

utility of Goods and Service Tax Registration

- Legitimately recognised as provider of goods or services.

- Appropriate bookkeeping of taxes paid on the input goods or services which can use for instalment of GST. Moreover, this is due on supply of goods or business or both by the business.

- As per law, gather tax from his buyers and pass on the credit of the taxes paid on the goods or services provided to buyers or beneficiaries.

Getting eligible to profit different advantages and benefits under the GST laws.

Who has to obtain GST Registration compulsorily?

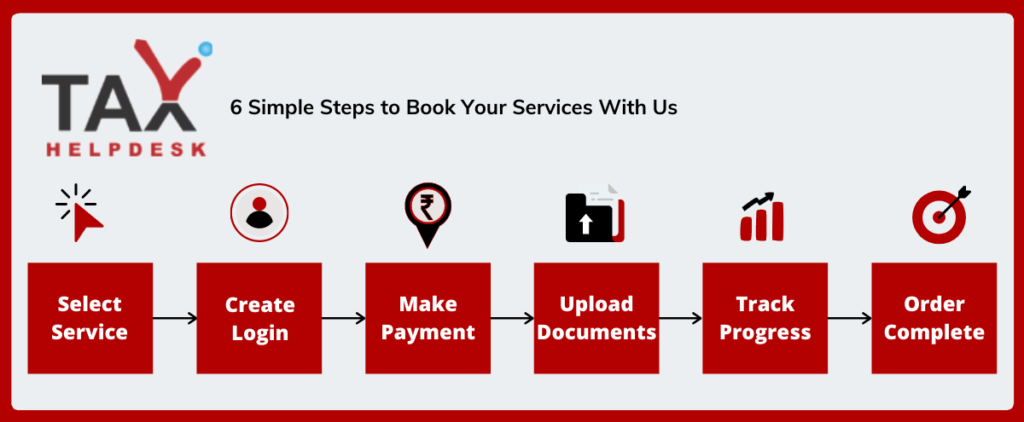

How to obtain your GST Registration from TaxHelpdesk?

Once your order is placed, TaxHelpdesk’s expert team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax professional will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your account.

Structure Of GST Registration/GSTIN

Types of GST Registration

Under the GST Act, there are four types of registration namely:

Normal Taxpayer: Most businesses in India fall under this category and no amount is to pay to become a normal taxpayer. Moreover, there is also no expiry date for taxpayers who fall under this type of category.

Casual Taxpayer: Individuals who wish to set up a seasonal shop or stall can go for Casual Taxpayer registration. Amount equal to the GST liability need to deposit in advance. In addition, the duration of the GST Registration 3 months and it can extend or renew afterwards.

Composition Taxpayer: Taxpayer whose aggregate annual turnover is below Rs. 1.5 crores (Rs. 75 lacs for NE states and hill states) can opt for this scheme, a fixed rate of amount need to deposit and no Input Tax Credit can avail.

Non Resident Taxable Person: If you live outside India, but supply goods to individuals in India, opt for this type. Furthermore, a deposit equal to the appropriate GST liability need to pay and duration for this type is usually 3 months, but it can extend or renew.

How to apply for GST Registration?

Document lists for GST registration

– PAN Card copy of the applicant

– PAN Card copy of at least one proprietor/partner/karta/director

– Aadhaar card copy

– Proof of place of business

– Proof of business registration or incorporation certificate

– Bank account details

– Mobile and email address

– Authorisation letter/board resolution for authorised signatory

– Digital Signature

Time frame for GST Registration

Particulars | Time Involved |

Applying for GST Registration Number | 1-2 days |

Verification of documents | 3-5 days |

Physical copy of GST Registration Number | 3 days |

FAQs

Any supplier who carries on any business at any place in India & whose aggregate turnover exceeds Rs. 40 lakhs in a financial year is liable to get registration and obtain GSTIN. However, the said limit is reduce to Rs 10 lakhs to the states in Article 279A (4)(g) of the constitution viz Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand.

The “Aggregate Turnover” means total turnover of a person having the same PAN in respect of the following:

(a) All taxable supplies including interstate supplies

(b) Exempt supplies

(c) Exports of goods and/or service

In addition, the above shall be computed on all India basis and excludes taxes charged under the CGST Act, SGST Act and the IGST Act.

Yes, it is mandatory to obtain GSTIN in case of certain category of persons. Moreover, the major categories are given below:

(a) Persons making any Inter-State taxable supply of Goods / Services.

(b) Persons who are required to pay tax under Reverse Charge Mechanism (RCM), or

(c) Persons who are required to deduct tax under GST (TDS).

(d) Persons who supply goods and/or services on behalf of other registered taxable persons whether as an agent or otherwise

(e) Input service distributor

(f) Casual taxable persons or Non-resident taxable person.

Reviews

There are no reviews yet.