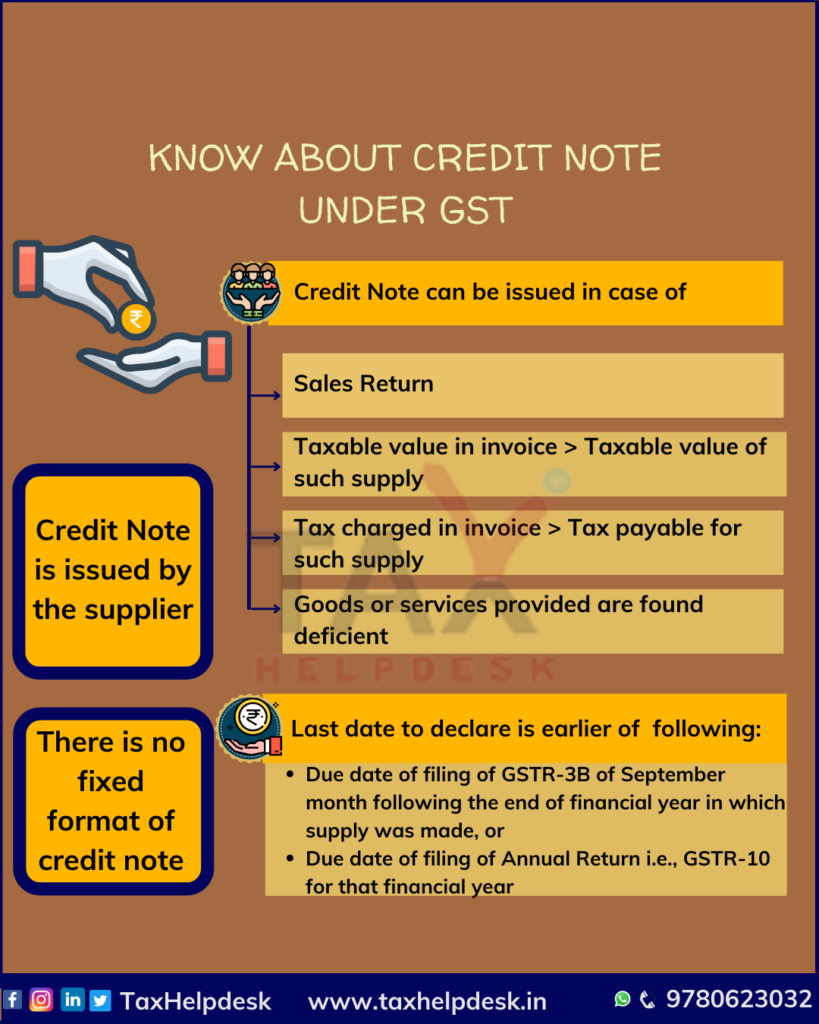

Credit Note under GST is issued by the supplier after it has issued the invoice to the buyer. It is applicable under certain circumstances only.

Credit Note

Credit Note under GST is issued by the supplier after it the invoice to the buyer. It is under certain circumstances only. A supplier of goods or services or both is mandatorily to issue a tax invoice. However, during the course of trade or commerce, after the invoice has been issued there could be situations like:

- The supplier has erroneously declare as a value which is more than the actual value of the goods or services.

- The supplier has erroneously declare as a higher tax rate than what is applicable for the kind of the goods or services or both.

- The quantity receive is less than what has been declared in the tax invoice.

- The quantity of the goods or services or both is not to the satisfaction of the recipient. Thereby necessitating a partial or total reimbursement on the invoice value.

- Any other similar reasons.

Who can issue note?

As suggested above, the Credit Note is issued by the supplier to the recipient i.e., buyer. Once the credit note has been issued, the tax liability of the supplier will reduce.

Meaning of Credit Note

Where a tax invoice for supply of any goods or services or both and the taxable value or tax charge. Further, in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the the supply of goods are returned by the recipient. This is where goods or services or both supplied are found to be deficient, the person. The person who supply such goods or services or both, may issue to the recipient what is called as a credit note containing the specific particulars.

Also Read: Various types of supplies under GST

Format of credit note

There is no prescribe format but credit note from a supplier must contain the following particulars, namely:

- Name, Address and Goods and Services Tax Identification Number of the supplier;

- Nature of the document;

- A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash. In addition, slash indicate as “-” and “/” respectively, and any combination thereof, unique for a financial year;

- Date of issue;

- Name, address and Goods and Services Tax Identification Number or Unique Identity Number, of the recipient;

- Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is not register.

- Serial number and date of the corresponding tax invoice or, as the case may be, bill of supply;

- Value of taxable supply of goods or services, rate of tax and the amount of the tax credited to the recipient; and

- Signature or digital signature of the supplier or his representative.

Adjustment of tax liability

The person who issues a credit note in relation to a supply of goods or services or both must declare the details. This details of such credit note in the return for the month during which such credit note but not later than September following the end of the financial year. This in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier. In other words, the output tax liability cannot reduce in cases where credit note issue after September.

Also Read: How to calculate GST?

Meaning thereby, the adjustment of tax liability can be done by:

– Due date of filing of GSTR-3B of September month following the end of financial year in which supply was made, or

– Due date of filing of Annual Return i.e., GSTR-10 for that financial year,

whichever is earlier.

Criteria for matching output tax liability of Supplier

In order to become eligible for a reduction in output tax liability, a supplier must raise a credit note. The specifics of a credit note furnish by the supplier for outward supply for a specific tax period must match:

- With the corresponding reduction in the claim for input tax credit by the recipient in his valid return for the same tax period or any subsequent tax period; and

- For duplication of claims for reduction in output tax liability.

The claim for reduction in output tax liability by the supplier that matches with the corresponding reduction. Moreover, in the claim for input tax credit by the recipient shall be finally accept and communicate to the supplier.

Communication of discrepancy

In case of information mismatch, the discrepancies are communicate to both parties. Various circumstances under which discrepancies shall notify include:

- The claim for reduction of output tax is higher than the corresponding reduction in input tax credit claim.

- The details of the Credit note not declare by the recipient in return for the subsequent period.

Moreover, for discrepancies concerning duplication of claims, communication should only be made to the supplier. In such a situation, the supplier need to making suitable rectifications in his return of the month. Failure to do so will result in adding a discrepancy amount to the output tax liability of the supplier.

Also Read: Rules related to setting off of Input Tax Credit

Similarly, if the discrepancy has been from the recipient’s side, he is liable to rectify it in the same month in which the discrepancy is made available. If not rectify, the discrepancy amount will add to the tax liability of the recipient along with the payable interest rate.

Illustration

On 1st January, 2021, Khan Sons & Co., a registered supplier from Delhi, supplied goods worth Rs. 1,00,000 to Kapoor Sons & Co., also a registered trader in Delhi.

On the same day, Khan Sons & Co. release as a tax invoice, and Kapoor Sons & Co. cleared the payment.

Later, Kapoor Sons & Co. found that some goods were of inferior quality, therefore, need to return the goods. Goods worth Rs. 50,000 were sent back.

Here, Khan Sons & Co. must issue a credit note to Kapoor Sons & Co. for return of goods and GST charged.

This credit note will act as proof that the amount equivalent to goods returned is to credit to Kapoor Sons & Co. account. As per the original invoice clause, Kapoor Sons & Co. should reduce the amount it owes to Khan Sons & Co. which will result in reducing tax liability.

Conclusion

The credit note is a convenient and legal method by which the value of the goods or services in the original tax invoice amend or revise. The issuance of the credit note will easily allow the supplier. This is in order to decrease his tax liability in his returns without requiring him to undertake any tedious process of refunds.

FAQs

The credit note cannot be issued where the incidence of GST and interest on such supply has been passed on to any other person.

The records of the credit retain until the expiry of 72 months from the due date of furnishing of annual return. This return is for the year pertaining to such accounts and records. Where such accounts and documents are maintained manually.

It should be kept at every related place of business mentioned in the certificate of registration. Furthermore, it shall be accessible at every related place of business where such accounts and documents are maintained digitally

If you want to know more about Credit Note or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

The author has taken views from the CBIC’s Portal.

Pingback: GST Calculator: How to Calculate GST? | TaxHelpdesk