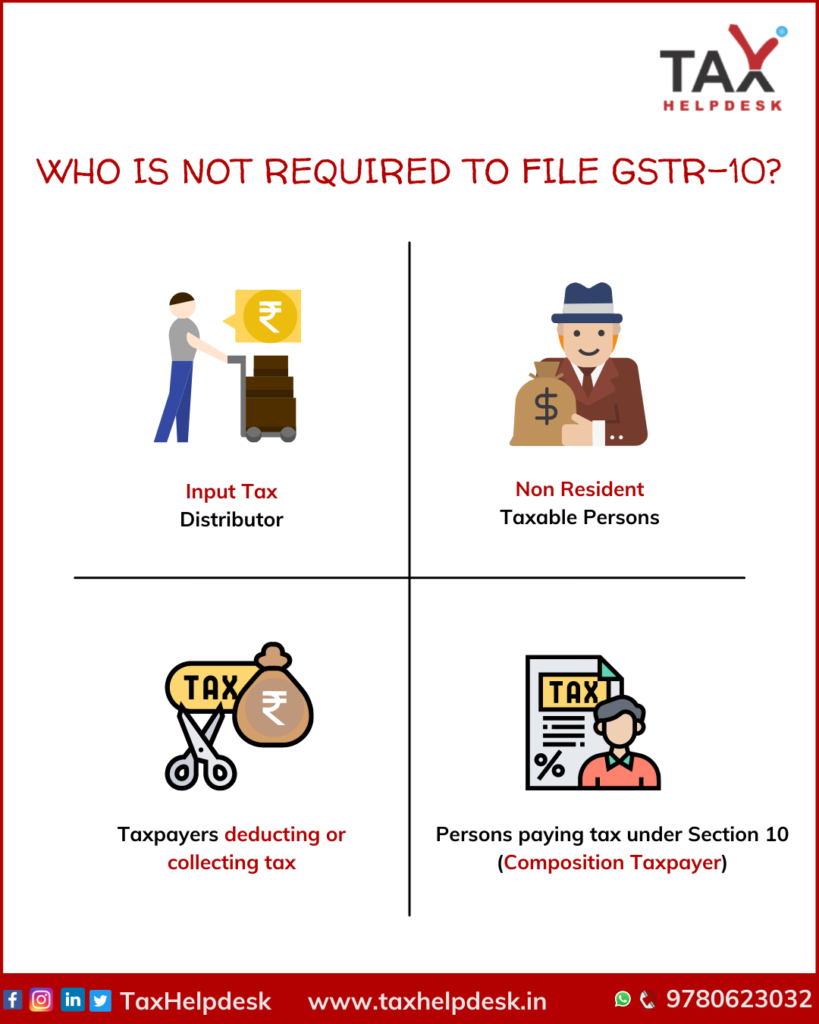

The taxpayers who want to get their GST Registration surrendered or cancelled have to file a Final Return i.e., GSTR-10.

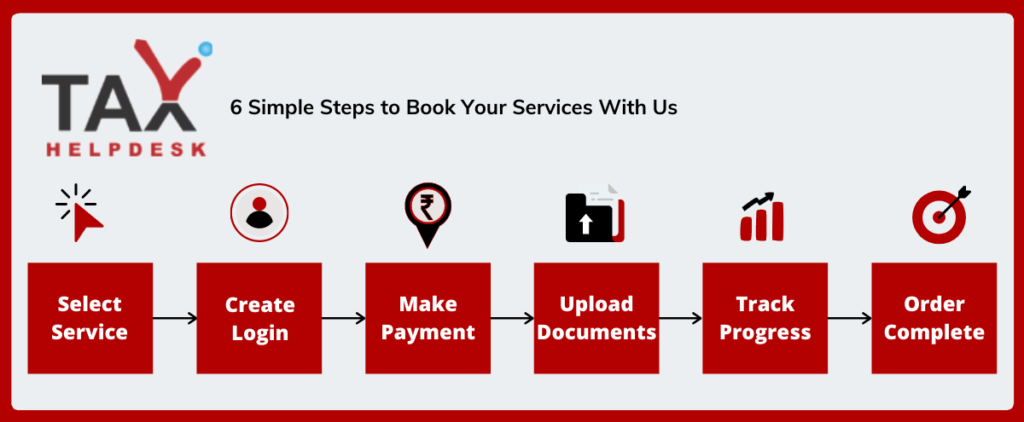

Plan includes:

– Preparation and Filing of GSTR-10

– Making entries of closing stock

– Full assistance in filing of GSTR-10

GST

SERVICE: GSTR-10 or GST Return to be filed on cancellation of GST Registration

CATEGORY: GSTPRICE: ₹999.00

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.