GST Annual Return or GSTR-9

The GST registered taxpayers among other GST Returns are required to file one annual return. This annual return is to be filed through GSTR-9. However, by way of 43rd GST Council Meeting, the taxpayers with turnover of up to Rs. 2 crores have an option to not to file annual return. Moreover, in order to file GSTR-9, the taxpayer must file GSTR-1 and GSTR-3B.

What is GST Annual Return?

It is an annual return to be filed once for each financial year, by the registered taxpayers who were regular taxpayers, including SEZ units and SEZ developers.

Note:

GSTR-9A was used to be filed by Composition taxpayers and it now has been disabled due to the introduction of GSTR-4. In addition, it is now an Annual Return for composition dealers.

GSTR-9B is to be filed by e-commerce operators

Form GSTR-9C is require to file by every registered person whose aggregate turnover is above a certain threshold during the financial year, as notified by way of Notifications issued by Government of India from time to time. This return can now be self certify by the taxpayers with turnover of less than or equal to Rs. 5 crores from Financial Year 2020-2021 onwards.

Sales | GSTR 9 | GSTR 9C |

Up to 2 Cr | Optional | N/A |

More than 2Cr. – 5 Cr | Filing is mandatory | Optional (Benefit Given) |

More than 5Cr | Filing is mandatory | Filing is mandatory |

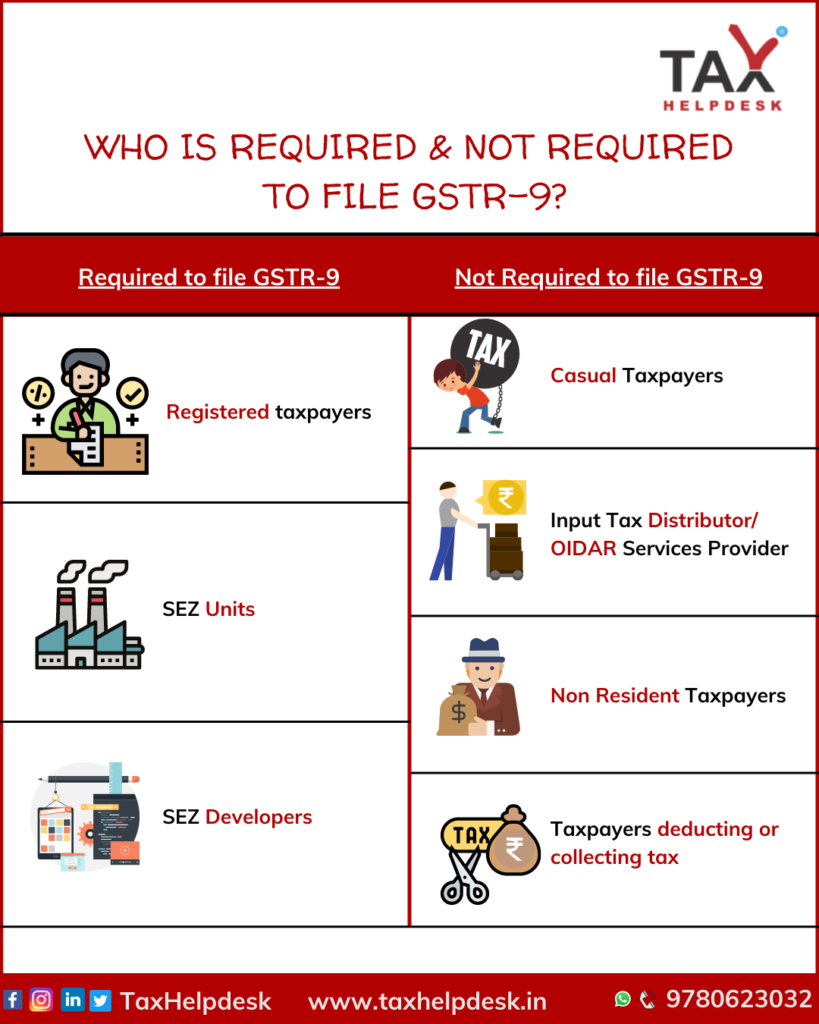

Who are required & not required to file Annual Return

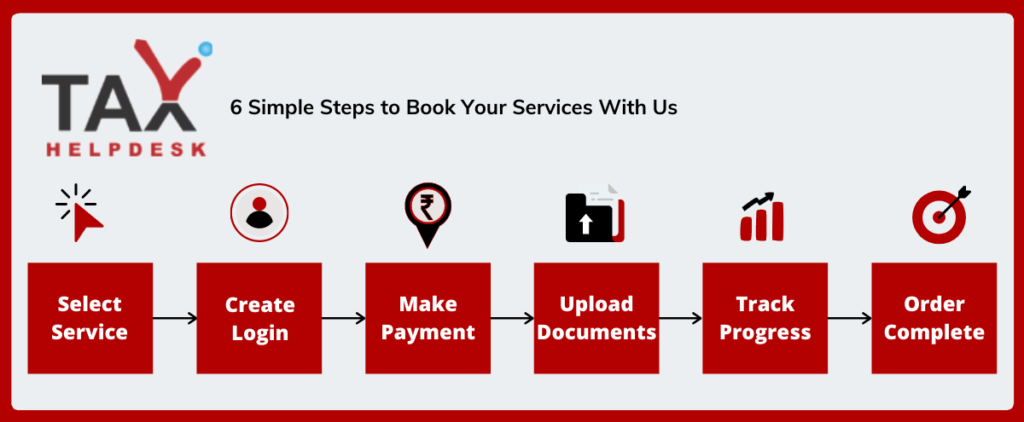

Follow these steps to get your GST Annual Return filed by TaxHelpdesk experts!

Once your order is placed, TaxHelpdesk’s professional team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assign and your order will process. Even more apart from this, you also will be able to check the status of the order in your assign account.

GSTR-9 to be filed for each GSTIN

Form annual return is require to file at GSTIN level i.e. for each registration. If taxpayer has obtained multiple GST registrations, under the same PAN, whether in the same State or different States, he/she is require to file annual return for each registrations separately where the GSTIN was registered as a normal taxpayer for some time during the financial year or for the whole of the financial year.

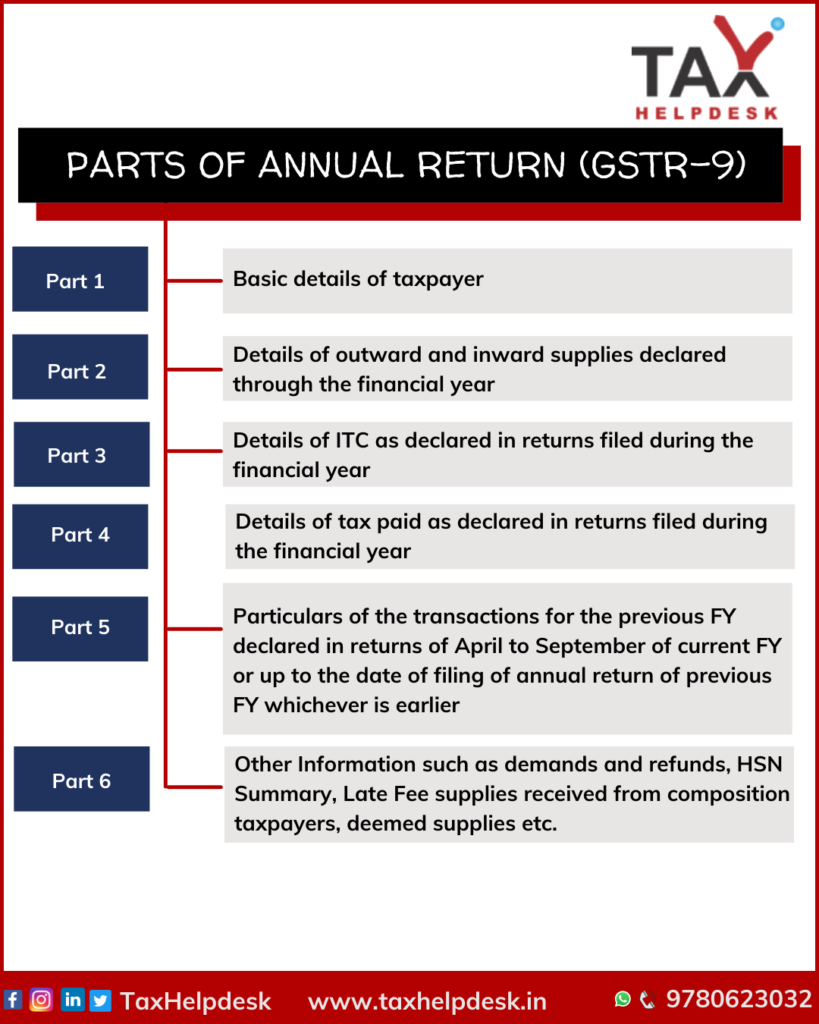

Parts of Form GSTR-9

Documents required for GST Annual Return Filing

– Balance sheet for the relevant financial year

– Profit and Loss Account

– Input Tax Credit of the previous year

– Details of purchases and sales

Process of filing of Annual Return

By when should you get your GSTR-9 filed?

The due date for filing Form for a particular financial year is 31st December of subsequent financial year or as extend by Government through notification from time to time.

Consequences of late filing of GSTR-9

Late filing attracts a minimum late fees of Rs 200 per day(Rs. 100 CGST and Rs. 100 SGST). In addition, the maximum of late fees that can execute is 0.25% of the taxpayer’s turnover in the relevant state or union territory.

FAQs

You need to file both Form GSTR-9 and Form GSTR-9A, for the respective periods.

The period during which the taxpayer remained as composition taxpayer, Form GSTR-9A need to file. This is for period for which the taxpayer is registered as normal taxpayer, Form GSTR-9 is required to be filed.

For example: If the taxpayer opt for Composition scheme from 1st April to 31st December, then Form GSTR-9A require to file for this period. Furthermore, if the taxpayer opt out of composition scheme and register as a normal taxpayer during period say 1st January to 31st March, then for this period Form GSTR-9 is required to be filed

Taxpayers who opt for the composition scheme need to file Form GSTR-9 for the period during which they were registered as a normal taxpayer.

No. You cannot file return in Form GSTR-9 without filing Form GSTR-1, and form GSTR-3B for all applicable periods during the relevant financial year.

Reviews

There are no reviews yet.