Types of GST Forms

Under the Goods and Services Tax law, there are various forms other than the GST Return Forms. These forms are classified into 13 types are as follows:

– GST Registration Forms

– Composition Scheme Forms

– Forms for enrolment under Section 35

– Input Tax Credit Forms

– Refund Forms

– Electronic Ledgers Form

– Audit forms in GST

– Advance Ruling forms in GST

– Appellate Authority of Advance Ruling Forms

– Transitional Credit Forms

– E-way bill forms

– E-invoicing forms

– Inspection forms

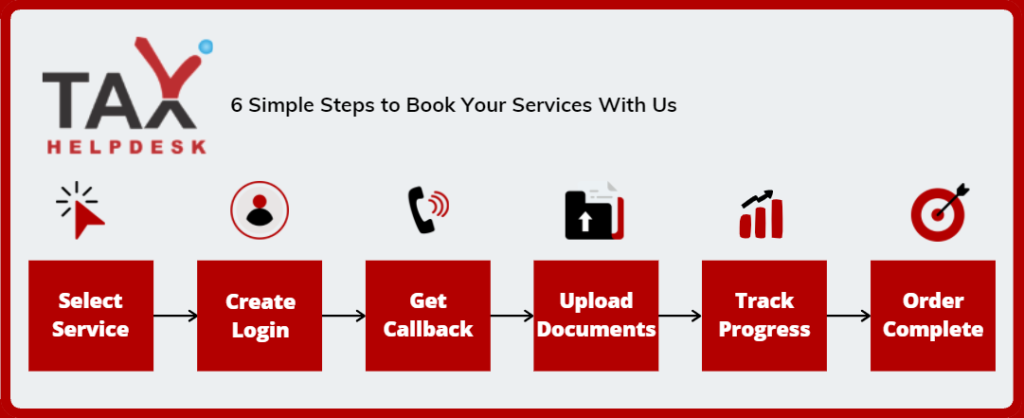

Be tax complied through TaxHelpdesk

After placing of service request, the tax experts from TaxHelpdesk will get in touch with the user within 24 working hours. If any document will be required by the user, then he shall be intimated about the same by the concerned TaxHelpdesk expert. The document can be uploaded by the user in his account.

GST Registration Forms

|

Forms |

Particulars |

|

GST REG-01 |

Application for GST Registration |

|

GST REG-02 |

Acknowledgement for Registration |

|

GST REG-03 |

Notice Asking for Additional Information/Clarification/Documents relating to Application for registration/amendments/cancellation |

|

GST REG-04 |

Application for providing clarification/additional information/documents for registration |

|

GST REG-05 |

Order of Rejection of Application for Registration/Amendment/Cancellation |

|

GST REG-06 |

Registration Certificate |

|

GST REG-07 |

Application for Registration as Tax Deductor at source (u/s 51) or Tax Collector at source (u/s 52) |

|

GST REG-08 |

Order of Cancellation of Registration as Tax Deductor at source or Tax Collector at source |

|

GST REG-09 |

Application for Registration of Non Resident Taxable Person |

|

GST REG-10 |

Registration of person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person |

|

GST REG-11 |

Application for extension of registration period by casual/non-resident taxable person |

|

GST REG-12 |

Order of Grant of Temporary Registration/ Suo Moto Registration |

|

GST REG-13 |

Application/Form for grant of Unique Identity Number (UIN) to UN Bodies/Embassies/others |

|

GST REG-14 |

Application for Amendment in Registration Particulars (For all types of registered persons) |

|

GST REG-15 |

Order of Amendment |

|

GST REG-16 |

Application for Cancellation of Registration |

|

GST REG-17 |

Show Cause Notice for Cancellation of Registration |

|

GST REG-18 |

Reply to the Show Cause Notice issued for Cancellation |

|

GST REG-19 |

Order for Cancellation of Registration |

|

GST REG-20 |

Order for dropping the proceedings for cancellation of registration |

|

GST REG-21 |

Application for Revocation of Cancellation of Registration |

|

GST REG-22 |

Order for revocation of cancellation of registration |

|

GST REG-23 |

Show Cause Notice for rejection of application for revocation of cancellation of registration |

|

GST REG-24 |

Reply to the notice for rejection of application for revocation of cancellation of registration |

|

GST REG-25 |

Certificate of Provisional Registration |

|

GST REG-26 |

Application for Enrolment of Existing Taxpayer |

|

GST REG-27 |

Show Cause Notice for cancellation of provisional registration |

|

GST REG-28 |

Order of cancellation of provisional registration |

|

GST REG-29 |

Application for cancellation of provisional registration |

|

GST REG-30 |

Form for Field Visit Report |

Composition Scheme Forms

Forms | Particulars |

GST CMP-01 | Intimation to pay tax under section 10 (composition levy) by users who migrated to GST |

GST CMP-02 | Intimation to pay tax under section 10 (composition levy) |

GST CMP-03 | Intimation of details of stock on date of opting for composition levy (Only for persons registered under the existing law migrating on the appointed day) |

GST CMP-04 | Intimation/Application for withdrawal from composition Levy |

GST CMP-05 | Notice for denial of option to pay tax under section 10 |

GST CMP-06 | Reply to the notice to show cause |

GST CMP-07 | Order for acceptance/rejection of reply to show cause notice |

GST CMP-08 | Statement for payment of self-assessed tax |

Forms for enrolment under Section 35

Forms | Particulars |

GST ENR-01 | Application For Enrolment Under Section 35(2) – Applicable only for unregistered persons. |

Input Tax Credit Forms

Forms | Particulars |

FORM GST ITC-01 | Declaration for claim of input tax credit under sub-section (1) of section 18. |

FORM GST ITC-02 | Declaration for transfer of ITC in case of sale, merger, demerger, amalgamation, lease or transfer of a business under sub-section (3) of section 18. |

FORM GST ITC-03 | Declaration for intimation of ITC reversal on inputs, inputs contained in semi-finished and finished goods and capital goods in stock under sub-section (4) of section 18. |

FORM GST ITC -04 | Details of goods/capital goods sent to the job worker and received back. |

Refund Forms

Forms | Particulars |

GST RFD-01 | Application for Refund |

GST-RFD-01 A | Application For Refund (Manual) |

GST-RFD-01 B | Refund Order Details |

GST RFD-02 | Acknowledgement |

GST RFD-03 | Deficiency Memo |

GST RFD-04 | Provisional Refund Order |

GST RFD-05 | Payment Advice |

GST RFD-06 | Refund Sanction/ Rejection Order/Interest on delayed refund order (same as refund order) |

GST RFD-07 | Order for complete adjustment of sanctioned Refund |

GST RFD-08 | Notice for rejection of application for refund |

GST RFD-09 | Reply to show cause notice |

GST RFD-10 | Application for Refund by any specialized agency of UN or Multilateral Financial Institution and Organization, Consulate or Embassy of foreign countries, etc |

Electronic Ledgers/Payments Form

Forms | Particulars |

FORM GST PMT-01 | Electronic Liability Register of registered person (Part–I: Return related liabilities Electronic Liability Register of taxable person (Part–II: Other than return related liabilities) |

FORM GST PMT-02 | Electronic Credit Ledger |

FORM GST PMT-03 | Order for re-credit of the amount to cash or credit ledger on rejection of refund claim |

FORM GST PMT-04 | Application for intimation of discrepancy in Electronic Credit Ledger/Cash Ledger/Liability Register |

FORM GST PMT-05 | Electronic Cash Ledger |

FORM GST PMT-06 | Challan For Deposit of Goods and Services Tax |

FORM GST PMT-07 | Application for intimating discrepancy in making payment |

FORM GST PMT-08 | Form for declaring self-assessed tax liability to claim ITC |

FORM GST PMT-09 | Form to reallocate balance available in electronic cash ledger to major/minor heads |

Audit forms in GST

Forms | Particulars |

FORM GST ADT – 01 | Notice For Conducting Audit |

FORM GST ADT – 02 | Form GST ADT – 02 |

FORM GST ADT – 03 | Communication to The Registered Person For Conduct Of Special Audit Under Section 66 |

FORM GST ADT – 04 | Information Of Findings Upon Special Audit |

Advance Ruling Forms in GST

Forms | Particulars |

FORM GST ARA -01 | Application Form For Advance Ruling |

FORM GST ARA -02 | Appeal To The Appellate Authority For Advance Ruling |

FORM GST ARA -03 | Appeal To The Appellate Authority For Advance Ruling |

Appellate Authority of Advance Ruling Forms | |

Forms | Particulars |

FORM GST APL-01 | Appeal To Appellate Authority |

FORM GST APL-02 | Acknowledgment For Submission Of Appeal |

FORM GST APL-03 | Application To The Appellate Authority Under Sub-Section (2) Of Section 107 |

FORM GST APL-04 | Summary Of The Demand After Issue Of Order By The Appellate Authority, Tribunal Or Court |

FORM GST APL-05 | Appeal To The Appellate Tribunal |

FORM GST APL-06 | Cross-Objections Before The Appellate Tribunal |

FORM GST APL-07 | Application To The Appellate Tribunal Under Sub Section (3) Of Section 112 |

FORM GST APL-08 | Appeal To The High Court Under Section 117 |

Transitional Credit Forms

Forms | Particulars |

FORM GST TRAN-1 | Transitional ITC / Stock Statement |

FORM GST TRAN-2 | Transitional ITC |

E-way bill forms

Forms | Particulars |

FORM GST EWB-01 | E-Way Bill |

FORM GST EWB-02 | Consolidated E-Way Bill |

FORM GST EWB-03 | Verification Report |

FORM GST EWB-04 | Report Of Detention |

E-invoicing form

Forms | Particulars |

FORM GST INV-1 | Generation of Invoice Reference Number |

Inspection Forms

|

Forms |

Particulars |

|

FORM -1 |

Authorization For Inspection Or Search |

|

FORM GST INS-02 |

Order Of Seizure |

|

FORM GST INS-03 |

Order Of Prohibition |

|

FORM GST INS-04 |

Bond For Release Of Goods Seized |

|

FORM GST INS-05 |

Order Of Release Of Goods/ Things Of Perishable Or Hazardous Nature |

Reviews

There are no reviews yet.