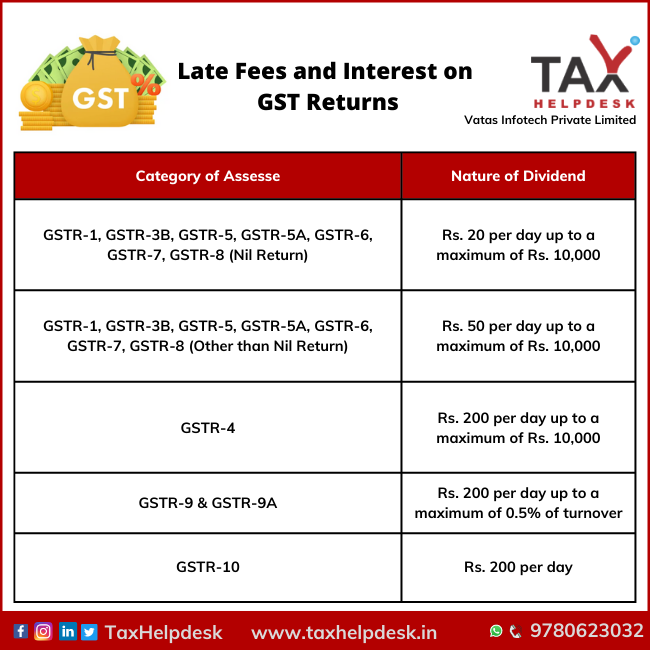

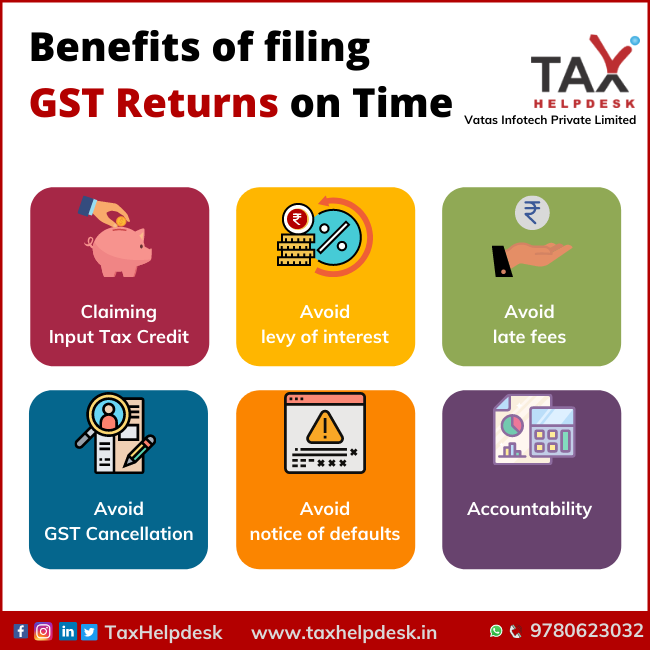

Know about Late Fees and Interest on GST Returns

Late fees and interest under GST are imposed if the GST Returns are not filed on or due dates. Having said this, the GST registered person are required to file …

Know about Late Fees and Interest on GST Returns Read More »