Remuneration is a form of compensation given by the company to its directors for the services they have rendered. This remuneration can be in the form of salary, fees, or usage of company’s assets.

Capacity of Directors

In any company, the directors can hold the position in following capacities:

– Executive Director

– Non executive Director

– Managing Director

– Independent Director

– Small Shareholder Director

– Women Director

– Additional Director

– Alternate Director

Also Read: Quarterly Return Monthly Payment Scheme Under GST

Applicability of GST on remuneration paid to the directors

As per the GST laws, if the services provide from an employer to its employees in accordance with the employment agreement, then it is neither consider as supply of goods nor as supply of services. Therefore, GST will not be applicable in such cases. On the other hand, if the services are not classified as employer employee relationship, then GST will be applicable. This is in accordance with the CBIC’s circular on applicability of GST on director’s remuneration vide CGST circular no. 14/10/2020 dated 10th June, 2020.

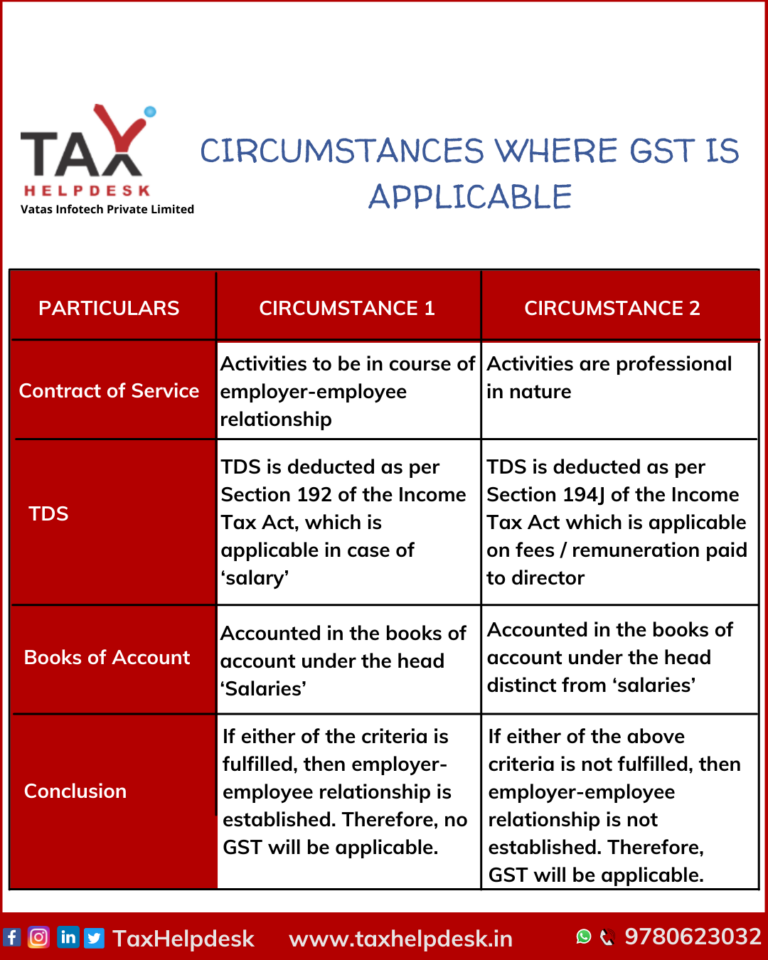

How to determine whether GST is applicable or not?

In order to determine whether GST is applicable or not, we need to check whether there is an employer-employee relationship or not. You can check the following two circumstances:

Who is liable to pay GST – Company or Director?

Once it decide that GST is applicable, the next question that arises is who is liable to pay GST? The answer for the same lies in Serial No. 6 of Notification No. 13/2017 – Central Tax (Rate) dated 28.06.2017. In addition, it states that services provide by Director of a company or body corporate to the said company or the body corporate is liable to tax under reverse charge. Thus, the company is liable to pay GST under the Reverse Charge Mechanism.

How Much GST is to be paid?

The company, which is a recipient of the service has to pay GST @18% on the total amount of the director’s remuneration.

Instances of GST on Director’s Remuneration

| S.No. | Scenario | Applicability of GST on Director’s Remuneration |

|---|---|---|

| 1. | Director receiving remuneration as an employee | Not applicable for GST. Director’s remuneration received as an employee falls under the purview of employee-employer relationship and is subject to TDS (Tax Deducted at Source). |

| 2. | Director providing services as an independent | Applicable for GST. If a director provides services to a company as an independent entity and the aggregate turnover of the director’s services exceeds the specified threshold (Rs. 20 lakhs for most states, Rs. 10 lakhs for some special category states), GST registration and charging GST on the remuneration is required. |

| 3. | Director’s remuneration from a company registered under Composition Scheme | Not applicable for GST. Companies registered under the Composition Scheme are not required to charge GST on the Director’s Remuneration. |

| 4. | Director’s remuneration from a non-profit organization | Not applicable for GST. Director’s remuneration received from a non-profit organization is exempted from GST. |

| 5. | Director’s remuneration received from a foreign company | Not applicable for GST. Director’s remuneration received from a foreign company is outside the scope of GST in India. |

If you know more GST or want to take TaxHelpdesk experts’ consultation, then simply drop a message in the chatbox or leave a comment in the comment box. You can also drop us a message on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!