To promote the habit of savings with the people, the Income Tax Act was amended in the year 2013 and a new Section namely Section 80TTA was inserted.

What Is Section 80TTA?

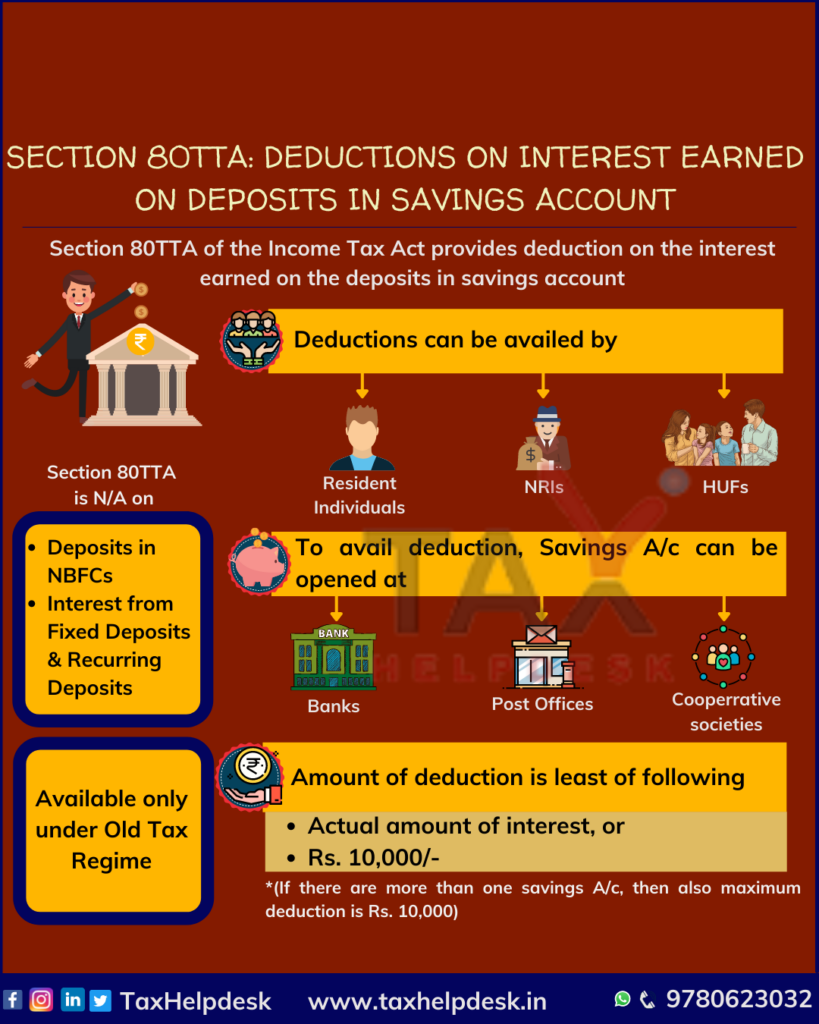

Section 80TTA of the Act provides deduction on the interest earned on the savings account with a bank / cooperative society / post office. In other words, the deduction is allowed only on interest earned on savings account and not on interest earned or fixed deposits / timed deposits.

Who Can Avail The Deductions Under Section 80TTA?

The deductions under Section 80TTA can be claimed by the Individuals, aged below 60 years of age or HUFs on the interest earned on all their savings bank and post office accounts.

Also Read: Deduction Under Section 80E – Interest Paid On Higher Education

How much amount can be claimed as a deduction under Section 80TTA?

The actual amount of interest earned or Rs.10,000, which is lower is allowed for deduction under Section 80TTA on the interest earned from savings account. If the individual/HUF has multiple savings accounts in different banks, then the maximum deduction that can be claimed for all savings accounts put together is Rs.10,000/-.

Also Read: 10 Ways To Save Your Taxes!

Note:

Deduction under section 80TTA is over and above the Rs. 1.5 lacs limit under Section 80C.

Where all the savings account can be opened to claim deduction under Section 80TTA?

The savings account can be opened at either one or all of the following institutions

- Banks: Banking companies formed as per the regulations of the Banking Regulations Act, 1949. These include all the banks and banking institutions formed in compliance with Section 51 of the said Act.

- Post Offices: All the Government of India post offices that have the facility of savings account.

- Cooperative Societies: Cooperative Societies registered by the government and eligible to have savings accounts as a feature of their banking system.

Which institutions savings account do not qualify for deduction under Section 80TTA?

The exclusions from 80TTA are:

– Deposits in Non-Banking Finance Companies (NBFCs)

– Interest from Fixed Deposits (FD)

– Interest from Recurring Deposits (RD)

Illustration

Ramesh, who is 55 years old has received interest of Rs. 9,800 against various fixed deposits with banks.

In this case, Ramesh will not be claim any deduction Section 80TTA. This is because he has received interest on fixed deposits and not savings account.

Karishma, who is 48 years old has received of Rs. 12,000 against interest in savings account.

In this case, Karishma will be able to claim deduction of upto Rs. 10,000 under Section 80TTA.

No, Section 80TTA deduction is available only under the Old Tax Regime.

Yes, both Resident and Non Resident can claim deduction under Section 80TTA.

If you still have doubts regarding Section 80TTA, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Section 80U: Deduction in case of disability | TaxHelpdesk

Pingback: Deductions on interest earned by Senior Citizens | Section 80TTB | TaxHelpdesk

Pingback: Best ways to save taxes (other than Section 80C) | TaxHelpdesk

Pingback: Things You Should do to Save Your Taxes | TaxHelpdesk