In the series of deductions under the Income Tax Act, the last Deductions in case of disability is of Section 80U, which provides tax benefits to individuals, in case they or any of their family members are suffering from any specified disability

What is Section 80U?

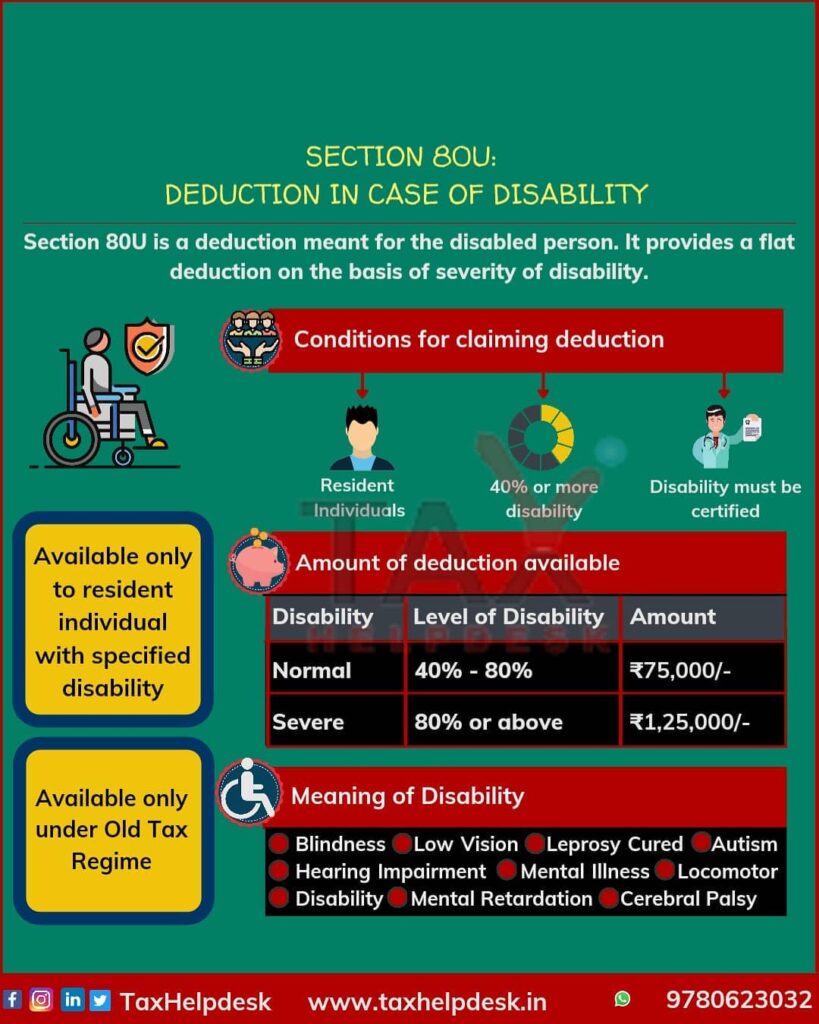

As stated above, Section 80U is a deduction meant for the disabled person. This section provides a flat deduction on the gross total income of the individual on the basis of severity of disability of the disabled person. Further, this Deductions in case of disability is not dependent on the amount of the expenditure.

Also Read: 10 Ways To Save Your Taxes!

What Is Disability And Severe Disability?

For the purpose of this section, Deductions in case of disability has been defined as one of the following:

– Blindness

– Low vision

– Leprosy-cured

– Hearing impairment

– Loco motor disability

– Mental retardation

– Mental illness

On the other hand, severe disability is a condition where the disability is 80 percent or more and it also includes multiple disabilities, autism and cerebral palsy.

Who Can Claim Deduction Under Section 80U?

The deduction under Section 80U can be claimed only by the disabled persons. This person must be certified as a person with a disability by the Medical Authority in order to claim the tax benefit under Section 80U.

Are There Are Conditions To Claim Deductions Under Section 80U?

Yes, there are three conditions which the individual needs to meet to claim deduction under Section 80U:

– He should be a resident individual

– He should have opted for Old Tax Regime

– He should not claimed deduction under Section 80DD

– He should be suffering from at least 40% disability

– The disability must be certified by the recognised medical authorities

Also Read: Deductions On Interest On Deposits In Savings Account: Section 80TTA

How Much Deduction Is Available Under Section 80U?

Since the deduction under Section 80U is dependent on the severity of disability, the quantum of deduction under this Section is as follows:

| Disability | Level of disability | Amount |

|---|---|---|

| Normal disability | 40% or above | Rs. 75,000 |

| Severe disability | 80% or above | Rs. 1,25,000 |

This deduction is over and above the deductions of Rs. 1.5 lacs stated under Section 80C.

What was the need of Section 80U when Section 80DD was already there or vice versa?

The deductions limits are same under Section 80DD and Section 80U. But there are two major differences between Section 80DD and Section 80U, which is as follows:

| Particulars | Section 80DD | Section 80U |

|---|---|---|

| Deduction available to | It is available to the family members and the dependent of the taxpayer who is having a disability | It is available only to the individual taxpayer with a disability himself |

| Applicability | It is applicable if a taxpayer deposits a specified amount as an insurance premium for taking care of his/her dependent disabled person. | This deduction is not dependent or any insurance or amount of expenditure. |

Illustration

| Cases | Type of Individual | Tax Regime | Level of Disability | Deduction under Section 80DD | Deduction under Section 80DD | Reasons |

|---|---|---|---|---|---|---|

| Case 1 | NRI | Old Tax Regime | 40% | No | Not available | Deduction under Section 80U is available only to Resident Individuals |

| Case 2 | Resident | New Tax Regime | 40% | No | Not available | Deduction under Section 80U is available only under Old Tax Regime |

| Case 3 | NRI | New Tax Regime | 20% | No | Not available | Deduction is available only to resident Individuals opting for Old Tax Regime and the level of disability must be 40% or more |

| Case 4 | Resident | Old Tax Regime | 20% | No | Not available | Disability should be 40% or more, to claim deduction under Section 80U |

| Case 5 | Resident | Old Tax Regime | 40% | Yes | Not available | The individual can claim deduction either under Section 80DD or Section 80U |

| Case 6 | Resident | Old Tax Regime | 40% | No | Available | Deduction of Rs. 75,000/- will be available under Section 80U |

| Case 7 | Resident | Old Tax Regime | 70% | No | Available | Deduction of Rs. 75,000/- will be available under Section 80U |

| Case 8 | Resident | Old Tax Regime | 80% | No | Available | Deduction of Rs. 1,25,000/- will be available under Section 80U |

| Case 9 | Resident | Old Tax Regime | 90% | No | Available | Deduction of Rs. 1,25,000/- will be available under Section 80U |

FAQs

The individual can claim this deduction at the time of filing of Income Tax Return. For the purposes of keeping record of the fact that the person is eligible to take the deduction under this Section, he is required to get certificate from a recognized medical authority in a prescribed format which is contained in Form 10 –IA.

No, it is available only under Old Tax Regime.

The deduction under Section 80DD and Section 80U cannot be claimed simultaneously. If you have incurred expenditure for medical treatment of a disabled dependent relative and you are also a disabled person, then you can claim the deductions only under any one of the sections.

In the current Financial Year, you can claim deduction on the basis of expired certificate but to get deduction in subsequent year you need to get a new certificate.

If you still have doubts regarding Section 80TTB, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Decoding Section 87A: Rebate Provision under Income Tax Act | TaxHelpdesk