Know Reasons Why You Should File Your Income Tax Return

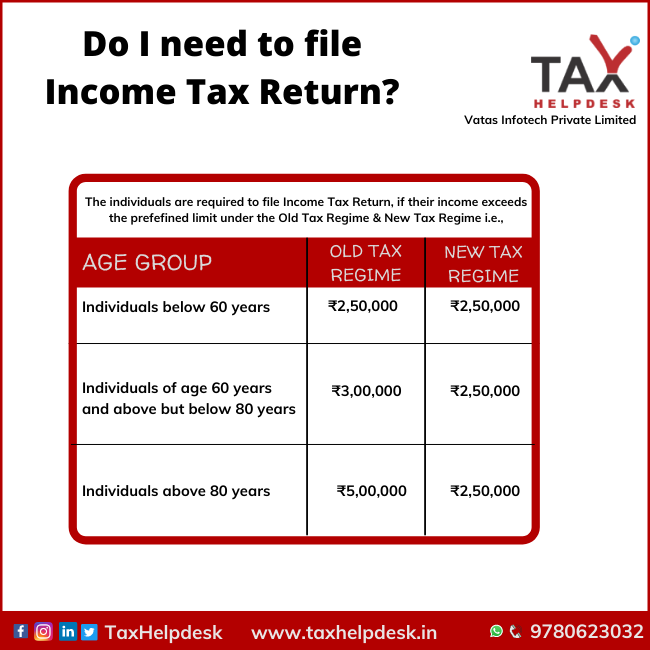

Generally, Income Tax Return is to be filed by the individuals, if their income exceeds the threshold limit of Rs. 2.5 lacs, set up by the Ministry of Finance, Government …

Know Reasons Why You Should File Your Income Tax Return Read More »