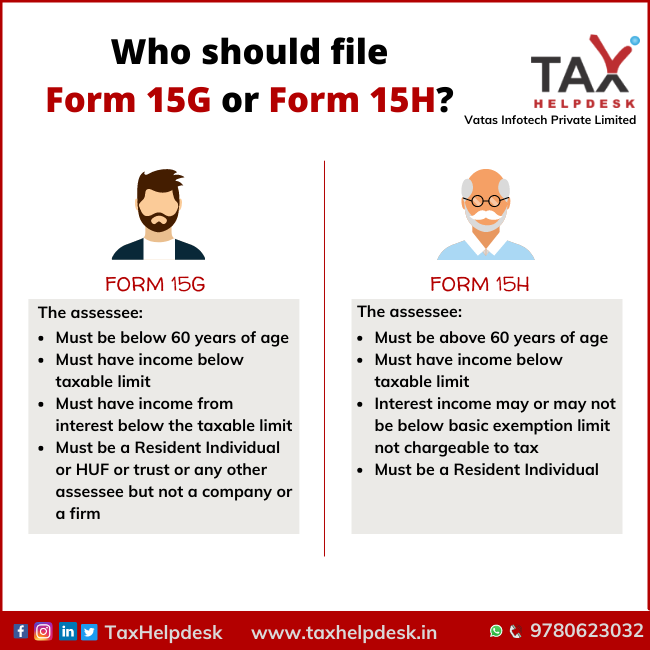

Know Who should file Form 15G and Form 15H?

Form 15G and Form 15H are self declaration forms that the assessee submits to the bank requesting not to deduct TDS on Interest Income, as their income is below the basis exemption limit. The assessee has to provide his PAN Card with the form.