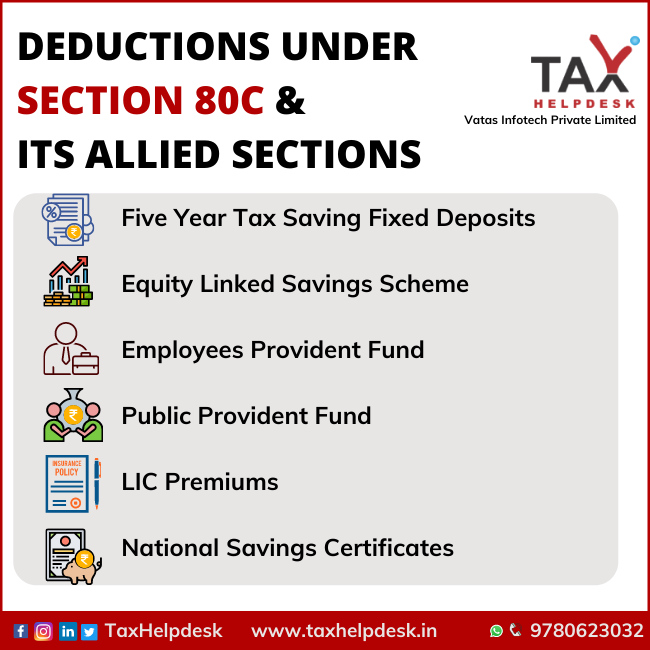

Deductions under Section 80C & its allied sections

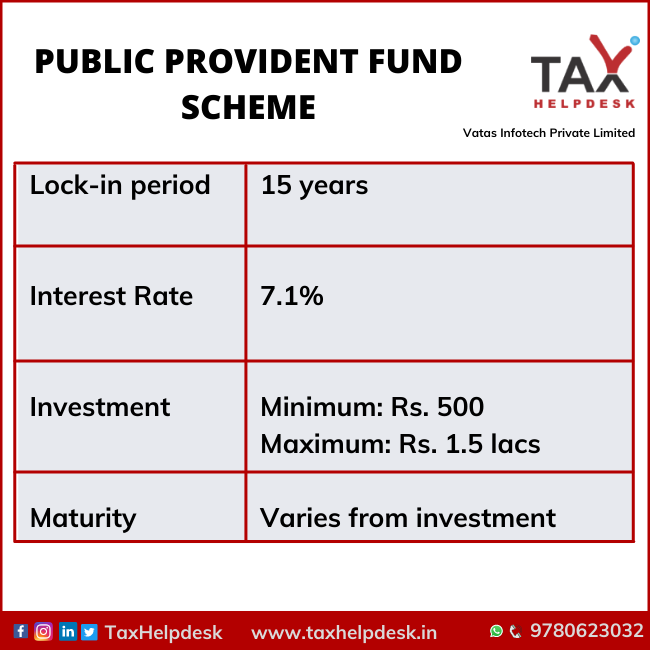

Section 80C and its allied sections allow a maximum deduction of up to Rs. 1.5 lacs every year from the taxpayer’s total income and an additional deduction amount of Rs. 50,000 can be claimed under Section 80CCD(1b).