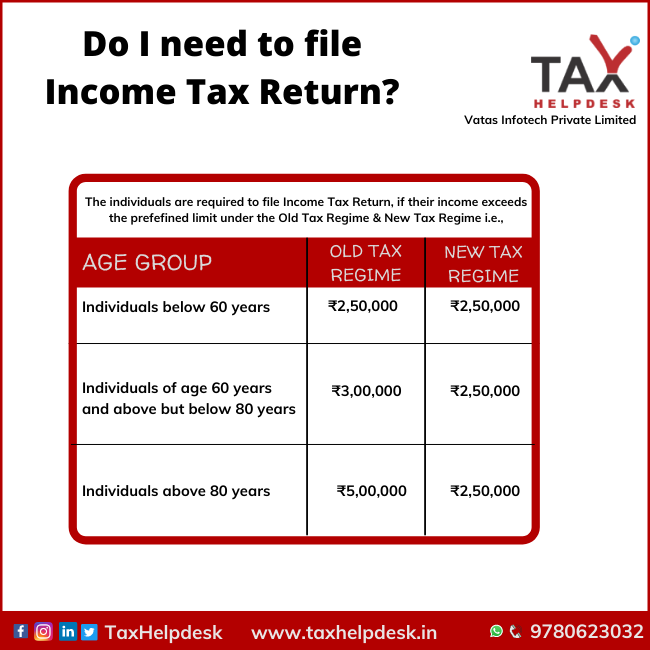

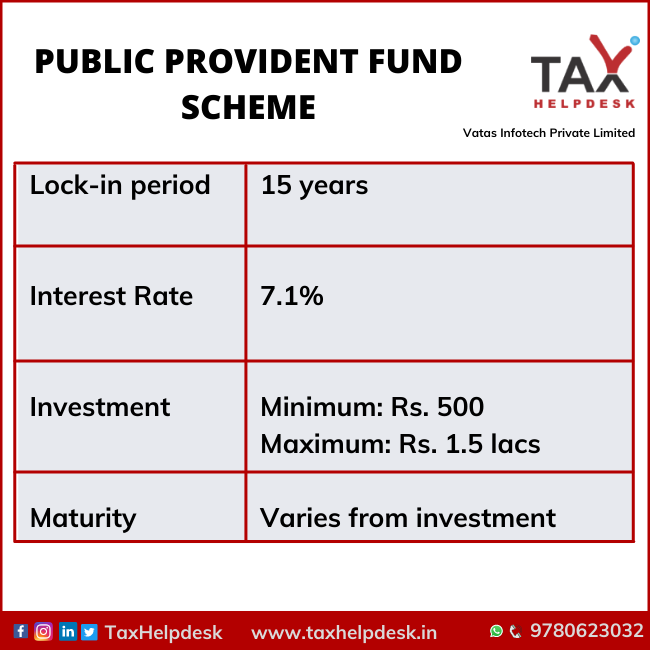

Exemptions, Allowances, and Deductions under the Old & New Tax Regime

Exemptions, allowances and deductions help in the reducing the tax liability of the taxpayers. However, all the exemptions, allowances and deductions are not available under both the tax regimes. While …

Exemptions, Allowances, and Deductions under the Old & New Tax Regime Read More »