The government aims at securing the future of all the individuals, including the senior citizens. Therefore, in line with this duty, certain deductions are provided to individuals as well as senior citizens through the Income Tax Act. The individuals aged below 60 years are provided deductions under Section 80TTA and the senior citizens, aged 60 years and above through Section 80TTB.

What is Section 80TTB?

Section 80TTB was introduced in the Income Tax Act through the Union Budget, 2018 and is applicable from the Financial Year 2018-2019. Through this provision, the citizens can claim a specified amount as a deduction from their respective gross total income.

Also Read: 10 Ways To Save Your Taxes!

Who Can Claim Deductions Under Section 80TTB?

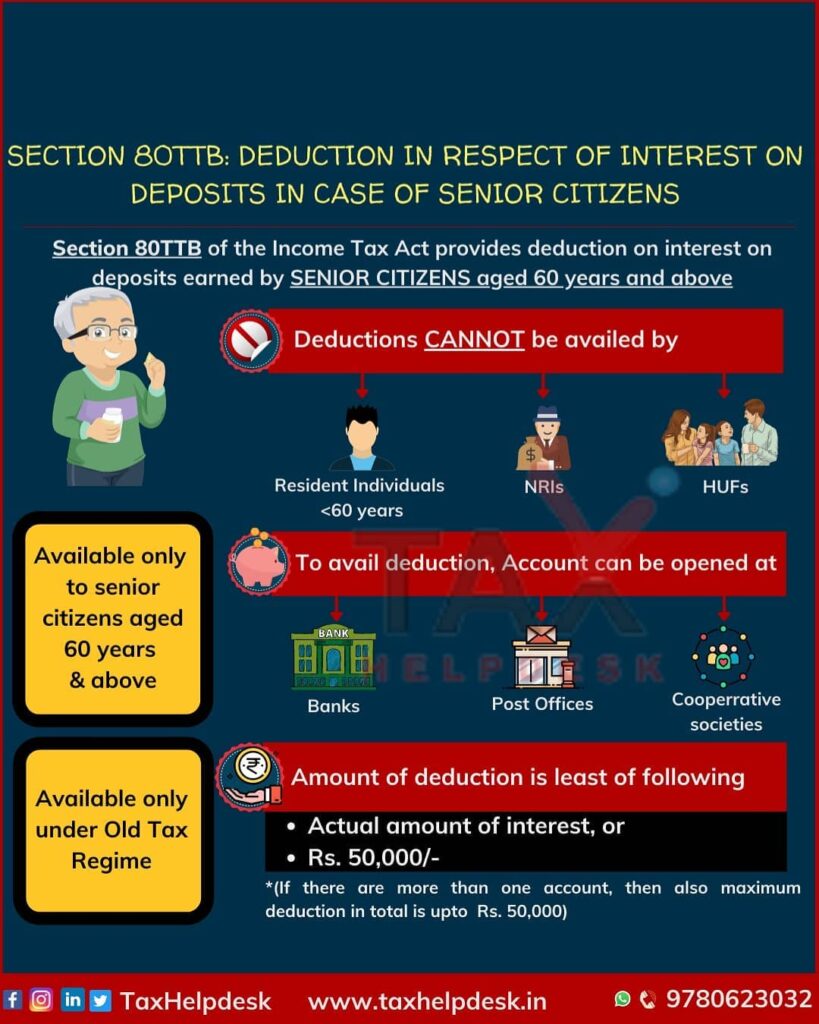

Section 80TTB is applicable on the resident senior citizens, who is at any time of the relevant Financial Year is of the age 60 years and above. Therefore, only the senior citizens can claim the deductions under this Section.

Who Cannot Claim Deductions Under Section 80TTB?

Deductions under Section 80TTB is applicable only on resident individuals. Following are the persons who cannot claim deductions under this Section:

- Non-senior citizens (aged below 60 years)

- Non resident senior citizens

- HUFs.

- Senior citizens having interest income from the deposit held by, or on behalf of a firm, an Association of Persons (AOP) or a Body of Individuals (BOI).

Where Should You Invest To Claim Deduction Under Section 80TTB?

Following are the incomes, wherein you can claim deduction under Section 80TTB:

- Interest on bank deposits (savings or fixed);

- Interest on deposits held in a co-operative society engaged in the business of banking, including a co-operative land mortgage bank or a co-operative land development bank; or

- Interest on post office deposits.

- If there are more than one account, then also maximum deduction in total is upto Rs. 50,000.

Also Read: Section 80G: Deductions On Donations

How Much Deduction Can Be Availed Under Section 80TTB?

The senior citizens can claim a deduction of up to the amount of the interest or Rs. 50,000, whichever is lower.

Note:

This deduction is exclusive of the deduction of Rs. 1.5 lacs available under Section 80C and its allied sections.

What was the need of inserting Section 80TTB when Section 80TTA was already introduced?

The deductions available under Section 80TTB is similar to the deductions available under Section 80TTA. However, under Section 80TTA, deductions are available on interest amount of only savings account in bank / post office / co-operative banks from the gross total income of the individual taxpayer or a HUF up to Rs 10,000. The difference between these two provisions can be well understood through the following table:

| Particulars | Section 80TTA | Section 80TTB |

|---|---|---|

| Applicability | Resident Individuals, NRIs and HUFs below 60 years | Resident Individuals aged 60 years and above |

| Deduction available on | Interest on savings account only | Interest on all kinds of deposits |

| Quantum of deduction | Amount of interest or Rs 10,000, whichever is lower | Amount of interest or Rs. 50,000, whichever is lower |

| Particulars | Taxpayer below 60 years (Abhishek) | Senior Citizen above 60 years (Amitabh) |

|---|---|---|

| Savings interest | 9,000 | 9,000 |

| FD interest | 5,50,000 | 5,50,000 |

| Other income | 1,50,000 | 1,50,000 |

| Gross total income | 7,09,000 | 7,09,000 |

| Less: Deduction under Section 80TTA | 5,000 | Not Applicable |

| Less: Deduction under Section 80TTB | Not Applicable | 50,000 |

| Reasons | Abhishek will get deduction of only Rs. 5,000 because as per Section 80TTA, the deduction is available only on the savings account interest. The deduction amount is amount of interest or Rs. 10,000/-, whichever is lower. | Amitabh will be able to get full deduction of Rs. 50,000/- because the deduction is available in the savings or fixed account interest. The deduction amount is amount of interest or Rs. 50,000/-, whichever is lower. |

Deductions under Section 80TTB can only be claimed by resident senior citizens. Therefore, NRI cannot claim deduction under Section 80TTB.

The deduction under Section 80TTB is available only under Old Tax Regime.

If you still have doubts regarding Section 80TTB, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Best ways to save taxes (other than Section 80C) | TaxHelpdesk