The employers issue Form 16 TDS certificate to their employees. It is proof of tax deduction at source from the employee’s salary. Further, the genesis of this Form can be seen under section 203 of the Income Tax Act, 1961 as TDS. It is a part of the income under the head ‘salary’.

When is Form 16 Issued?

Form 16 is a form that the employer issues on the deduction of tax from the employee’s salary. The tax so deducted by the employer has to be deposited in the government’s account.

Also Read: Know Types of TDS Certificates

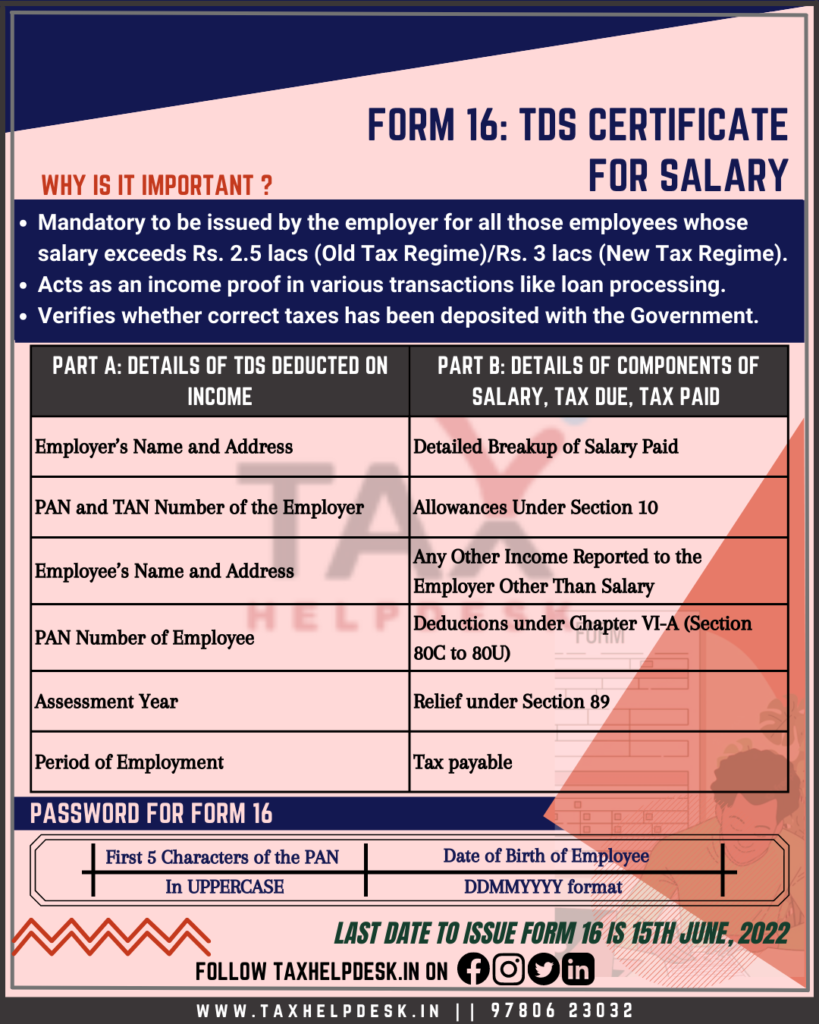

Relevance Of Form 16

It is an essential proof of tax deduction at source by the employer. This certificate shows in detail the summary of the salary of the employee, allowances and other amount payments to the employee and applicable TDS on the same. This issuance of this form is annually as per the provisions of the Act and is useful for filing of Income Tax Returns.

Also Read: 10 Best Ways to Save Taxes

Basics of Form 16:

– Form 16 is a TDS Certificate for salary

– Issuance of Form 16 is in the case where the employee is having a salary of more than Rs. 2.5 lacs (Old Tax Regime) / Rs. 3 lacs (New Tax Regime) in a financial year.

– If the income is below the exemption limit of Rs. 2.5 lacs/Rs. 3 lacs, then there will be no issuance of Form 16.

– If the employee has worked with more than one employer during the relevant financial year, then he will be issued two Form from respective employees.

– Lastly, Form 16 also contains the details of the deduction of TDS from the employer and other details of income that the employee provides to the employer.

Details Required From Form 16 For Filing Income Tax Return

For the current Financial Year 2024-2025, Assessment Year 2025-2026, the employee needs the following details to file his ITR:

- Salary

- Allowances exempted under Section 10

- Total amount of salary received from current employer (=1 – 2)

- Deductions under Section 16. It includes Standard Deduction, Entertainment Allowance and Tax on Employment.

- Total amount of deductions under Section 16.

- Income chargeable under the head ‘Salary’ (= 1+ 3- 5)

- Any other income reported by the employee (this includes Income or loss from house property reported by employee offered for TDS and income under the head Other Sources offered for TDS)

- Total amount of other income reported by the employee

- Gross total income (= 6 + 8)

- Breakup of Deductions under Chapter VI-A

- Aggregate of Deductions under Chapter VI-A(Gross & Deductible Amount)

- Total income (= 9 – 11)

- Tax Payable or Refund Due

Parts of Form 16

An employer can generate and download Form 16 through the TRACES website. There are two parts of Form 16: Part A and Part B.

PART A: The components of Part A are:

PART B: Part B is the annexure to Part A and the components of Part B are:

- Breakup of salary

- Details of exemptions allowances under Section 10

- Specific donations under Chapter VI-A

- Relief under Section 89

List of Deductions are:

80CCD(1)

4. Relief under Section 89

Also Read: Tax Exemption in Salary: Everything You Need to Know

Have you filed your ITR yet? If not, then

FAQs

Form 16 will be issued by both the employers in case of job change in a financial year.

TDS certificate in Form 16 is issued when TDS has been deducted. In case no TDS has been deducted by the employer, he may not give you a Form 16.

If there is a mismatch of TDS between Form 16 and Form 26AS, then the employee might get served demand notice from Income Tax Department and it can also lead into legal tussle!

If you still have doubts regarding Form 16, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Deduction under Section 80E – Interest paid on Higher Education | TaxHelpdesk

Pingback: How to check if employer is depositing your TDS with the government? | TaxHelpdesk

Pingback: Form 16: Relevance, overview & parts of for...

Pingback: How to register on TRACES (TDS)? | TaxHelpdesk