Each one of us has an unsaid duty towards the society and to help people in need. In order to do so, many of us would have made or planned to make donations. Keeping in mind the donations that are made or to be made by the people, Section 80G of the Income Tax Act provides deductions on the amount contributed to charitable institutions or specified trusts.

Deductions for donations

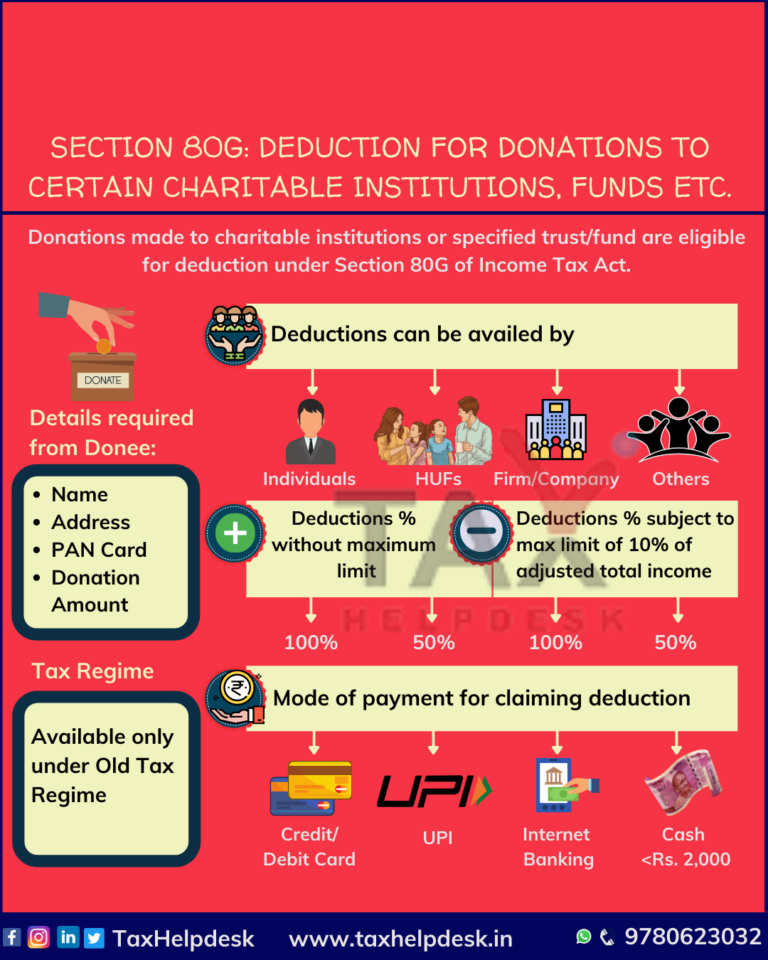

The donations made to charitable institutions or specified trusts can be claimed as deduction under Section 80G of the Act. However, in order to claim the deduction, the type of donation must be the one as specified under Income Tax Act. Therefore, not all types of donations are eligible for donations under the Act.

Who can claim deductions under Section 80G?

The following persons can claim deductions under Section 80G

– Individuals

– HUFs

– Firms

– Company

– Any other legal person

Also Read: 10 Ways To Save Your Taxes!

How Much Donation Can Be Claimed As Deduction?

The donation under Section 80G are broadly categorized under two categories

I) Donations without any qualifying limit

II) Donations with a qualifying limit

In both the cases, 100% or 50% of donation amount can be claimed as deduction under Section 80G.

Donations eligible for 100% deduction without any qualifying limit

- National Defence Fund set up by the Central Government

- Prime Minister’s National Relief Fund

- National Foundation for Communal Harmony

- An approved university/educational institution of National eminence

- Zila Saksharta Samiti constituted in any district under the chairmanship of the Collector of that district

- Fund set up by a State Government for the medical relief to the poor

- National Illness Assistance Fund

- National Blood Transfusion Council or to any State Blood Transfusion Council

- National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation, and Multiple Disabilities

- National Sports Fund

- National Cultural Fund

- Fund for Technology Development and Application

- National Children’s Fund

- Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund with respect to any State or Union Territory

- The Army Central Welfare Fund or the Indian Naval Benevolent Fund or the Air Force Central Welfare Fund, Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

- The Maharashtra Chief Minister’s Relief Fund during October 1, 1993 and October 6, 1993

- Chief Minister’s Earthquake Relief Fund, Maharashtra

- Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of the earthquake in Gujarat

- Any trust, institution or fund to which Section 80G(5C) applies for providing relief to the victims of the earthquake in Gujarat (contribution made during January 26, 2001, and September 30, 2001) or

- Prime Minister’s Armenia Earthquake Relief Fund

- Africa (Public Contributions – India) Fund

- Swachh Bharat Kosh (applicable from FY 2014-15)

- Clean Ganga Fund (applicable from FY 2014-15)

- National Fund for Control of Drug Abuse (applicable from FY 2015-16)

Donations Eligible For 50% Deduction Without Qualifying Limit

- Jawaharlal Nehru Memorial Fund

- Prime Minister’s Drought Relief Fund

- Indira Gandhi Memorial Trust

- Rajiv Gandhi Foundation

Donations with a qualifying limit

Under this category, the qualifying limit is 10% of adjusted total income. The adjusted total income is the sum of all the income under of the heads less the following amounts

- Amount deductible under Section 80C to 80U (but not Section 80G)

- Income on which tax is not payable

- Long-term capital gains under Section 112, 112A which have been included in GTI

- Short term capital gains under Section 111A

- Income referred to in Sections 115A, 115AB, 115AC, or 115AD.

Donations Eligible For 100% Deduction With Qualifying Limit

- Donations to the government or any approved local authority, institution or association to be utilized for the purpose of promoting family planning.

- Donation by a Company to the Indian Olympic Association or to any other notified association or institution established in India for the development of infrastructure for sports and games in India, or the sponsorship of sports and games in India.

- Any other fund or any institution which satisfies the conditions mentioned in Section 80G(5)

- Government or any local authority, to be utilized for any charitable purpose other than the purpose of promoting family planning

- Any authority constituted in India for the purpose of dealing with and satisfying the need for housing accommodation or for the purpose of planning, development or improvement of cities, towns, villages or both

- Any corporation referred to in Section 10(26BB) for promoting the interest of the minority community

- For repairs or renovation of any notified temple, mosque, gurudwara, church or other places.

Mode of payment to claim the deduction under Section 80G

This deduction can only be claimed when the contribution has been made via a cheque or a draft or in cash.

Also Read: Deduction Under Section 80E – Interest Paid On Higher Education

Note:

The amount of donations in cash should not exceed Rs. 2,000 to claim deduction under Section 80G.

Details to be mentioned to claim deduction

In order to claim deduction under Section 80G, following details of donee must be submitted in Income Tax Return:

– Name

– PAN

– Address

– Amount of contribution

FAQs

The deduction under Section 80G can be claimed by all the Individuals – Resident or Non Resident Indians. Therefore, you as a NRI can also claim deduction under Section 80G.

No, the deduction under Section is available only under Old Tax Regime.

If you still have doubts regarding Section 80G, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Deductions on interest earned by Senior Citizens | Section 80TTB | TaxHelpdesk

Pingback: How to claim deductions if you do not get HRA? | Section 80GG | TaxHelpdesk