There was exemption on the taxability of dividend income for shareholders till the Assessment Year 2020-21. Accordingly, the companies were liable to pay taxes on such dividend income.

Taxability of dividend income

The taxability of dividend income lies in the hands of companies as well as shareholders.

Before 31st March, 2020

The taxability on the dividends received from an Indian company that was exempted until 31 March 2020 (FY 2019-20). This was because the company declaring such a dividend. They already paid dividend distribution tax (DDT) before making the payment.

Also Read: How to treat income from transfer of shares

From 1st April, 2020 onwards

There was a withdrawal of exemption to the shareholders in respect of taxability of the dividend income from Assessment Year 2021-20. Therefore, the dividends received during the Financial Year 2020-21. Furthermore, onwards is now taxable in the hands of the shareholders.

Treatment of tax on dividends

Taxability of dividend income depends upon whether the shareholder receiving the dividend deals in it either as a trader or as an investor. If he earns dividend income by way of trading activities. Then it is taxable under the head business income. Accordingly, if the person holds shares for trading purposes. After this the dividend income shall be taxable under the head “Income from Business or Profession”. On the other hand, if the person holds dividends for investment purposes. Then dividend income shall be taxable under the head of “Income from Other Sources”.

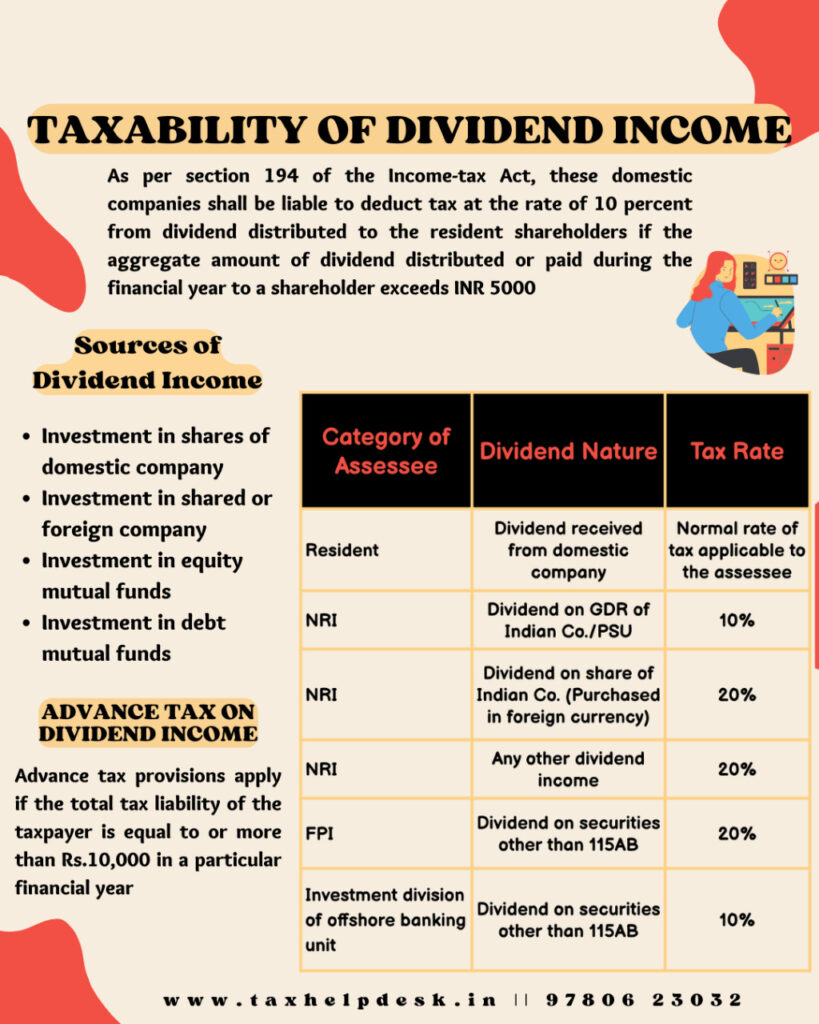

Sources of dividend income

The sources of dividend income can be from investment in

– Shares of a domestic company, or

– Shares of a foreign company, or

– Equity mutual funds, or

– Debt mutual funds

Also Read: Know Types & Taxability Of Mutual Funds SIP

Depending on the source of dividend income, relevant tax incidence would be applicable.

Classification of dividend income on basis of time and taxability

The classification of the dividend income on the basis of time is of two types:

– Firstly, interim dividend income, and

– Secondly, final dividend income.

An interim dividend income is taxable in the previous year in which the amount of such dividend is unconditionally made available by the company to the shareholder. In other words, an interim dividend is chargeable to tax on a receipt basis.

Also Read: Know Incomes Free From Taxes In India

On the other hand, final dividend income including deemed dividend shall be taxable in the year. In this, it is declared, distributed, or paid by the company, whichever is earlier.

Deduction of expenses from dividend income

If the dividend income is assessable to tax as a business income. Then the assessee can claim the deductions of all those expenditures which have been incurred to earn that dividend income. These expenditures could be such as collection charges, interest on loans etc.

Also Read: Comprehensive Guide On Consequences Of Non-TDS Deduction Compliances

Whereas if the dividend income is taxable under the head of income from other sources. Moreover, the assessee can claim a deduction of only interest expenditure which has been incurred to earn that dividend income to the extent of 20% of total dividend income. Further, there shall be no allowance of the deduction for any other expenses including commission or remuneration to a banker or any other person for the purpose of realizing such dividend.

TDS on dividend income

As per Section 194, TDS shall be applicable on the distribution of dividends, declaration of dividends or payment of dividends on or after 01-04-2020. Further, an Indian company shall deduct tax at the rate of 10% from dividend distributed to the resident shareholders. If the aggregate amount of dividend distributed or paid during the financial year to a shareholder exceeds Rs. 5,000.

Note

No tax shall be required to be deducted from the dividend paid or payable to Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC) or any other insurer in respect of any shares owned by it or in which it has full beneficial interest.

However, where the dividend is payable to a non-resident or a foreign company. The tax shall be deducted under Section 195 in accordance with relevant DTAA.

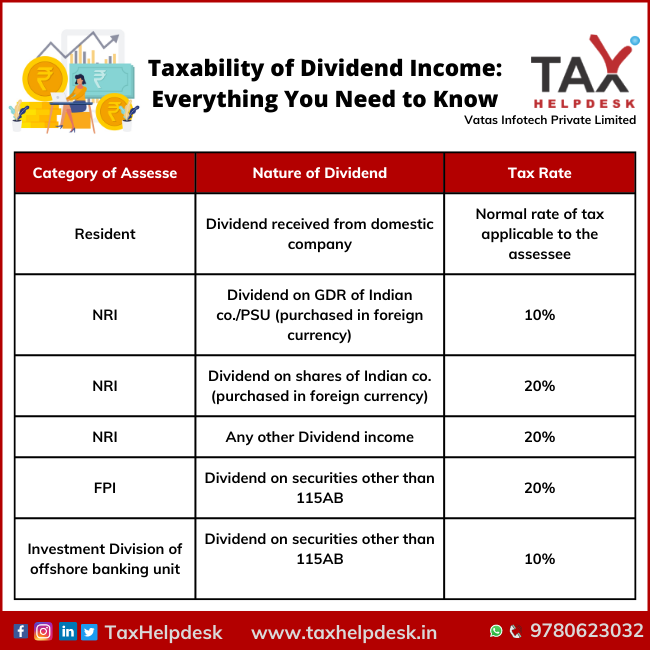

Rates of TDS on dividend income

Rates of TDS on dividend income depend upon the type of assessee receiving the dividend and the instrument of dividend distribution. This can be easily understandable via the following table:-

| Category of Assessee | Dividend nature | Rate of Tax |

|---|---|---|

| Resident | Dividend received from domestic company | Normal rate of tax applicable to the assessee |

| NRI | Dividend on GDR of Indian co./PSU (purchased in foreign currency) | 10% |

| NRI | Dividend on shares of Indian co.(purchased in foreign currency) | 20% |

| NRI | Any other Dividend income | 20% |

| FPI | Dividend on securities other than 115AB | 20% |

| Investment Division of offshore banking unit | Dividend on securities other than 115AB | 10% |

Advance tax on dividend income

The provisions of advance tax apply, if the total tax liability of the taxpayer is equal to or more than Rs.10,000 in a particular financial year. In addition to this, there shall be a levy of interest as well as a penalty in case of non-payment or short payment of the advance tax liability.

Submission of Form 15G/15H

A resident individual receiving dividend income and whose annual income is below the exemption limit. To submit Form 15G to the company or mutual fund paying the dividend.

Also Read: Know Who Should File Form 15G And Form 15H?

Similarly, a senior citizen whose annual tax payable is nil can submit Form 15H to the company paying the dividend.

The company or mutual fund informs the shareholder about the dividend declaration on their mail ID and requires submission of Form 15G or Form 15H to claim dividend income without TDS.

Double Taxation Relief on dividend income

Dividend income from a foreign company is taxable both in India as well as in the home country of the foreign company.

However, if the tax on an international company’s dividend has been paid twice (i.e. paid in both countries), then the taxpayer can claim double taxation relief.

The claiming of can be either as per the provisions of Double Taxation Avoidance Agreement (DTAA) entered into by the Government of India, with the country to which the foreign company belongs, or he can claim relief as per Section 91 (in case no such agreement exists). Through this, the taxpayer does not have to pay tax on the same income twice.

If you want to know more about TDS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!