Who has to submit Form 15G and Form 15H?

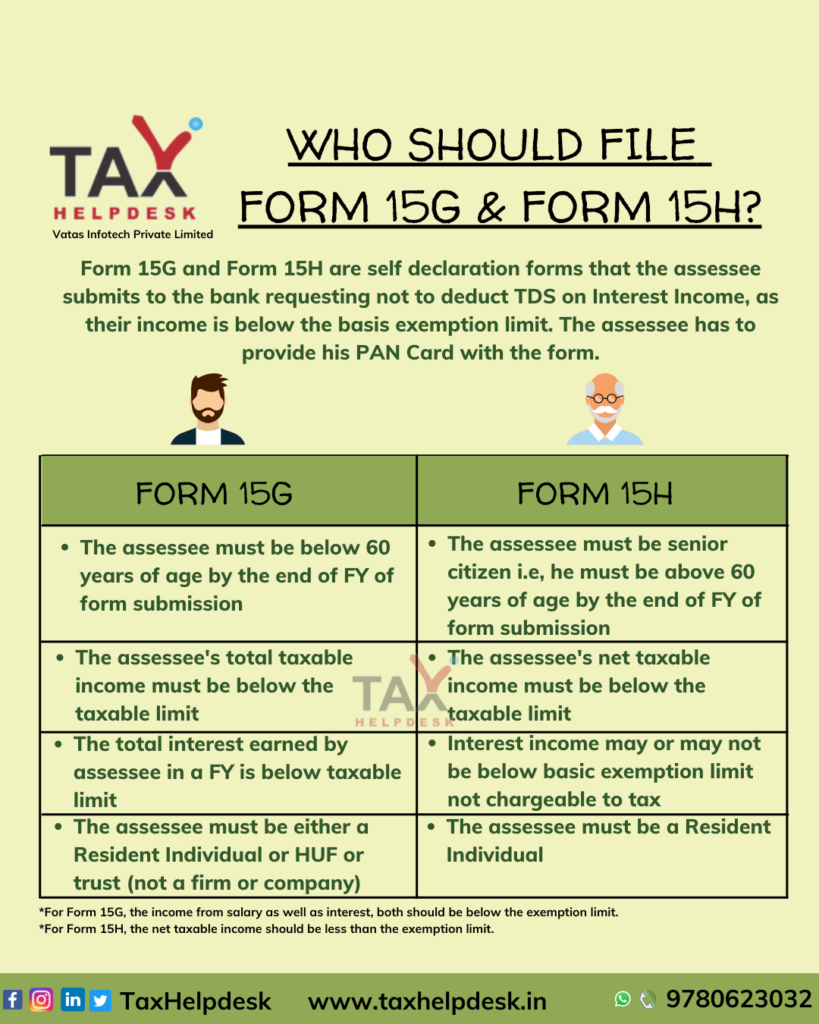

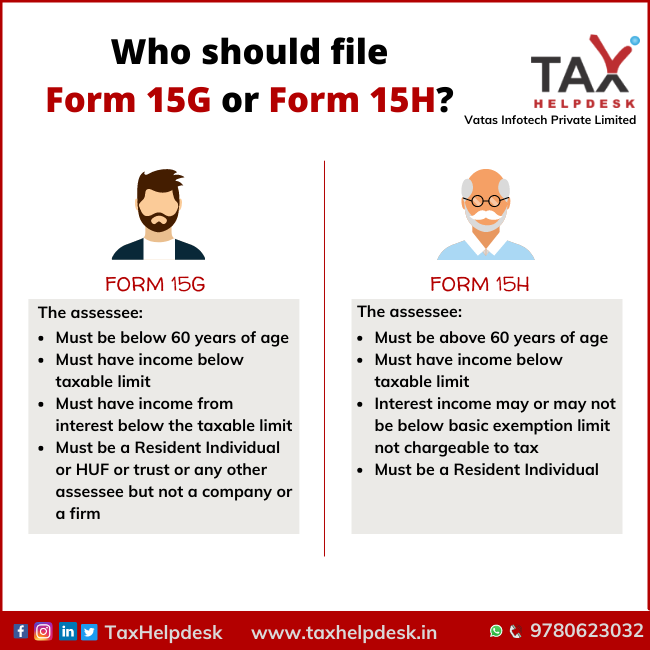

| Particulars | Form 15G | Form 15H |

|---|---|---|

| Applicable to | Individual or HUF aged below 60 years | Individual aged above 60 years |

| Criteria to apply | Must have taxable income or income from interest below the basic exemption limit | Must have taxable income below the basic exemption limit. The interest income may or may not be below the basic exemption limit. |

The assessee must make sure to submit his Form 15G or Form 15H, as the case may be, with the bank right at the beginning of the Financial Year to avoid unnecessary TDS on interest accruing to him. If excess amount gets deducted or if the assessee is eligible for non-deduction of TDS but the amount has been deducted, then he can claim for a refund at the time of filing of Income Tax Return.

Also Read: Know about tax saving 5 years fixed deposits

Illustration:

| Particulars/Name | Ram | Lakshman | Karan | Arjun |

|---|---|---|---|---|

| Age | 58 years | 45 years | 65 years | 75 years |

| Residential Status | Resident of India | Resident of India | Resident of India | NRI |

| Income from salary/pension | Rs. 1,40,000 | Rs. 0 | Rs. 0 | Rs. 2,50,000 |

| Income from interest | Rs. 80,000 | Rs. 3,50,000 | Rs. 2,90,000 | Rs. 30,000 |

| Form to Submit | Form 15G | None | None | Form 15H |

In the above case,

For Ram:

– He is below 60 years of age.

– His income is below the taxable limit during the relevant financial year.

– The interest earned on Fixed Deposits is below the exemption limit.

– He is a Resident of India.

Therefore, Ram can submit Form 15G

For Lakshman:

– He is below 60 years of age.

– He has no income from salary.

– His income from interest on Fixed deposits is above the exemption limit.

– He is a resident of India.

Since, Lakshman’s income from interest on Fixed Deposits is above the exemption limit, he cannot submit Form 15G.

For Karan:

– His age is above 60 years of age.

– He has no income from salary/pension.

– His net taxable income is less than the exemption limit.

– He is a Resident of India.

Therefore, Karan is eligible to submit Form 15H. Even if the income from interest exceeds the exemption limit, the net taxable income is below the exemption limit.

For Arjun:

– He is above 60 years of age.

– His income from pension is below the exemption limit.

– His net taxable income is less than the exemption limit.

– He is not a resident of India.

Since, Arjun is not a resident of India, he cannot submit Form 15H.

Note: In the above illustration, the assessees have opted for Old Tax Regime. The exemption limit for assessees below 60 years of age is Rs. 2.5 lacs and for assessees above 60 years of age, the exemption limit is Rs. 3 lacs.

Also Read: Which Tax Regime Suits You: Old or New?

Conclusion:

Additionally, Form 15G and Form 15H can also be filled in other cases involving TDS such as:

– Withdrawals are made of a value more than Rs. 50,000 from an EPF account for a service period below 5 years provided that the earlier conditions are met.

– Income from corporate bonds exceeding Rs. 5,000.

– Interest from Post Office Deposits exceeding Rs 10,000.

– Rental income exceeding Rs. 2.4 lakhs annually.

– Insurance commissions exceeding Rs. 15,000.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!

The views of the author are personal.

Pingback: Can I claim HRA even if I’m staying at my parents’ house? | TaxHelpdesk