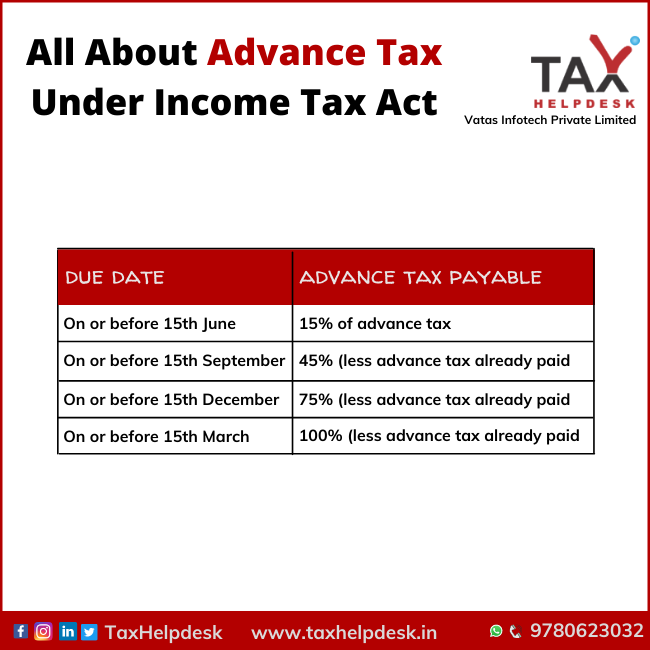

All about Advance Tax under Income Tax Act

Advance tax, as the name suggests is the tax which is to be paid in advance by the assessee during each financial year. It is also known as ‘Pay as your Earn’ Tax and is different from the usual income tax. For paying this tax, the assessee has to estimate his income beforehand for the entire financial year and pay the tax accordingly. This Advance tax collection is to ensure that the government is able to collect taxes uniformly throughout the year.