Advance tax, as the name suggests is the tax which is to be paid in advance by the assessee during each financial year. It is also known as the ‘Pay as you Earn’ Tax. Further, it is different from the usual income tax. Having said this, to pay this tax, the assessee has to estimate his income beforehand for the entire financial year and accordingly, pay the tax. This Advance tax collection is to ensure that the government is able to collect taxes uniformly throughout the year.

Who is bound to pay Advance Tax?

If the assessee falls under any of the below criteria, then he is bound to pay the advance tax:

Total Tax liability is Rs. 10,000 and above in a financial year (Section 208 of the Income Tax Act)

If the value of income is above Rs. 10,000/-, then the assessee is subject to payment of Advance Tax. Having said that, income can be from any source like capital gains on shares, income from interest on Fixed Deposits, income from winnings from the lottery, rent or income from house property, etc.

Note:

Senior citizens above 60 years of age, who are not having any income from business or profession do not have to pay advance tax.

Also Read: Income Tax Slab Rates under the Old and New Tax Regime

Presumptive income for Businesses–

The taxpayers opting for a presumptive taxation scheme under section 44AD of the Income Tax Act have to pay the whole amount of their advance tax in one installment on or before 15th March. However, they also have an option to pay all of their tax dues by 31st March.

Also Read: Know all About Presumptive Taxation Scheme

Presumptive income for Professionals–

Independent professionals such as doctors, lawyers, architects, etc. come under the presumptive scheme under Section 44ADA of the Income Tax Act. They have to pay the whole of their advance tax liability in one installment on or before 15th March. However, they can also pay the entire amount by 31st March.

Illustration 1:

Shyam is running a bakery business. The turnover of the business for the financial year 2022-23 is Rs. 1,84,00,000. And, he wants to declare income under section 44AD at 8% of the turnover. Further, he does not have any other source of income. Will he be liable to pay advance tax?

Shyam satisfies the criteria of section 44AD of the Act in respect of the provision store business. Hence, he can adopt the provisions of section 44AD and declare income at 8% of the turnover. Accordingly, if Shyam adopts the provisions of section 44AD, he is also liable to pay advance tax in respect of income generated from the bakery business.

Illustration 2:

Krishna (age 39 years) is running a pharma store. The turnover of the store for the financial year 2022-23 amounts to Rs. 40,00,000. And, his accounts reveal a net profit of Rs. 2,60,000. Will he be liable to pay advance tax?

In this case, Krishna will be liable to pay advance tax in respect of income from the pharma store business, if his estimated tax liability for the financial year comes out to be Rs. 10,000 or more. Here, his taxable income is Rs. 2,60,000. And, tax on Rs. 2,60,000 is Rs. NIL. Hence, Krishna is not liable to pay any advance tax.

Also Read: How to pay advance tax online

How to calculate Advance Tax?

Step 1: Calculate Income Tax on estimated total income. The income could be from these major heads:

– Income from salary

– Income from interest on Fixed Deposits, savings account, etc

– Income from capital gains

– Any professional income

– Income from rent

– Income of minor, if any

– Any other income

Step 2: Add surcharge on estimated income

Step 3: Add Education and Secondary & Higher Education cess

Step 4: Deduct rebate under Section 87A, if applicable

Step 5: Deduct TDS

= Advance Tax Liability

Illustration 1:

For example, if your total income for FY 2022-23 is Rs.15,00,000 (including Rs. 50,000 standard deduction), then your estimated liability is Rs.2,73,000 (calculation is as follows:

| Particulars | Amount |

|---|---|

| Income from salary | Rs. 15,50,000 |

| Standard Deduction | (Rs. 50,000) |

| Net Taxable Income | Rs. 15,00,000 |

| Income Tax Liability | Rs. 2,62,500 |

| Cess @4% | Rs. 10,500 |

| Total Tax Liability | Rs. 2,73,000 |

The calculation of Advance Tax Liability is as follows:

| Description | Advance Tax liability |

|---|---|

| Advance tax payable upto June 15, 2023 (Cumulative) | Rs. 40,950 |

| Advance tax payable upto September 15, 2023 (Cumulative) | Rs. 1,22,850 |

| Advance tax payable upto December 15, 2023 (Cumulative) | Rs. 2,04,750 |

| Advance tax payable upto March 15, 2024 (Cumulative) | Rs. 2,73,000 |

| Advance tax payable upto March 31, 2024 (Cumulative) | Rs. 2,73,000 |

Bifurcation of Advance Tax Instalments is as follows:

| Description | Installment |

|---|---|

| First installment payable for the period April 1, 2023 to June 15, 2023 | Rs. 40,950 |

| Second installment payable for the period June 16, 2023 to September 15, 2023 | Rs. 81,900 |

| Third installment payable for the period September 16, 2023 to December 15, 2023 | Rs. 81,900 |

| Fourth installment payable for the period December 16, 2023 to March 15, 2024 | Rs. 68,250 |

| Last installment payable for the period March 16, 2024 to March 31, 2024 | 0.00 |

*Assuming that you have opted for the older tax regime and have invested no other amount to claim deductions under Section 80C to Section 80U. Further, there is no TDS Refund claim also.

Arjun is a taxpayer who earned income under the head ‘Business and Profession’.

Estimated Gross Receipts for the financial year= Rs 22,00,000

Estimated Expenses related to income earned= Rs 10,00,000

Receipts on which TDS is expected to be deducted= Rs 4,00,000

In addition to the above, he has Interest Income= Rs 50,000

| Particulars | Amount (Rs) | Amount (Rs) |

| Gross Receipts for the financial year | 22,00,000 | |

| Expenses related to income earned | 10,00,000 | |

| Income From Profession | (22,00,000 – 10,00,000) | 12,00,000 |

| Income From Other Sources (Interest on Fixed Deposit) | 50,000 | |

| Total Income Chargeable to Tax | 12,50,000 | |

| Less: Deductions under Chapter VI-A | ||

| Investment in PPF Account | 50,000 | |

| Investment in ELSS Mutual Funds | 70,000 | |

| Investment in Tax-Saving Fixed Deposit | 30,000 | |

| Deduction under Section 80D | 30000 | 1,80,000 |

| Total Taxable Income | 10,70,000 | |

| Tax Payable | 1,33,500 | |

| Less: TDS Deducted by other taxpayers | (4,00,000 * 10%) | 40,000 |

| Tax Payable in Advance | 93,500 |

What are the due dates for payment of advance tax?

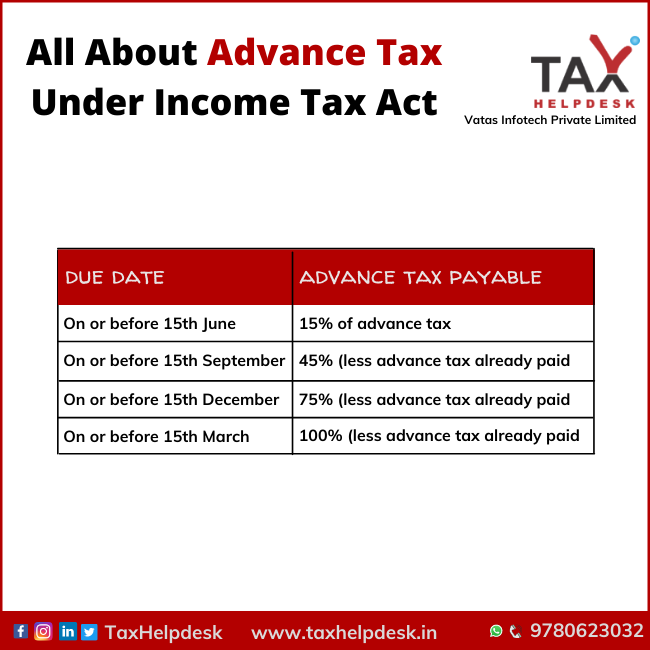

Due dates for both individual and corporate taxpayers

| Period | Due Date | Advance Tax Payable |

|---|---|---|

| 1 April – 15 June | 15th June | 15% of the advance tax |

| 16 June – 15 September | 15th September | 45% (less advance tax already paid) |

| 16 September – 15 December | 15 December | 75% (less advance tax already paid) |

| 16 December – 15 March | 15 March | 100% (less advance tax already paid) |

Due dates for taxpayers who have opted for Presumptive Taxation Scheme under section 44AD & 44ADA – Business Income

| Due Date | Advance Tax Payment Percentage |

|---|---|

| On or before 15th March | 100% of advance tax |

Consequences of not paying Advance Tax

If advance tax paid by you is less than 90% of the assessed tax, then you will be charged an interest of 1% every month under Section 234B of the Income Tax Act. The interest is computed as 1% interest on the defaulted amount for every month until the tax is paid off completely. Also, the same interest penalty will be applicable if you don’t pay by the second or third deadline.

Under Section 234C of the Income Tax Act, if you do not pay your advance tax installment on time, then you will be charged an interest rate of 1% from the due date of individual installment till the date of actual payment.

If you have any suggestions/feedback, then please drop us a message in the chat box. And, for more updates on Taxation, Financial and Legal matters, join our group on WhatsApp, channel on Telegram or follow us on Facebook, Instagram, Twitter as well as Linkedin!

Please note that the views of the author are personal.

Pingback: Decoding Section 87A: Rebate Provision under Income Tax Act | TaxHelpdesk

Pingback: Extended Due Dates of Income Tax: AY 2021-22 | TaxHelpdesk

Pingback: How to pay Advance Tax Online? (Challan 280) | TaxHelpdesk