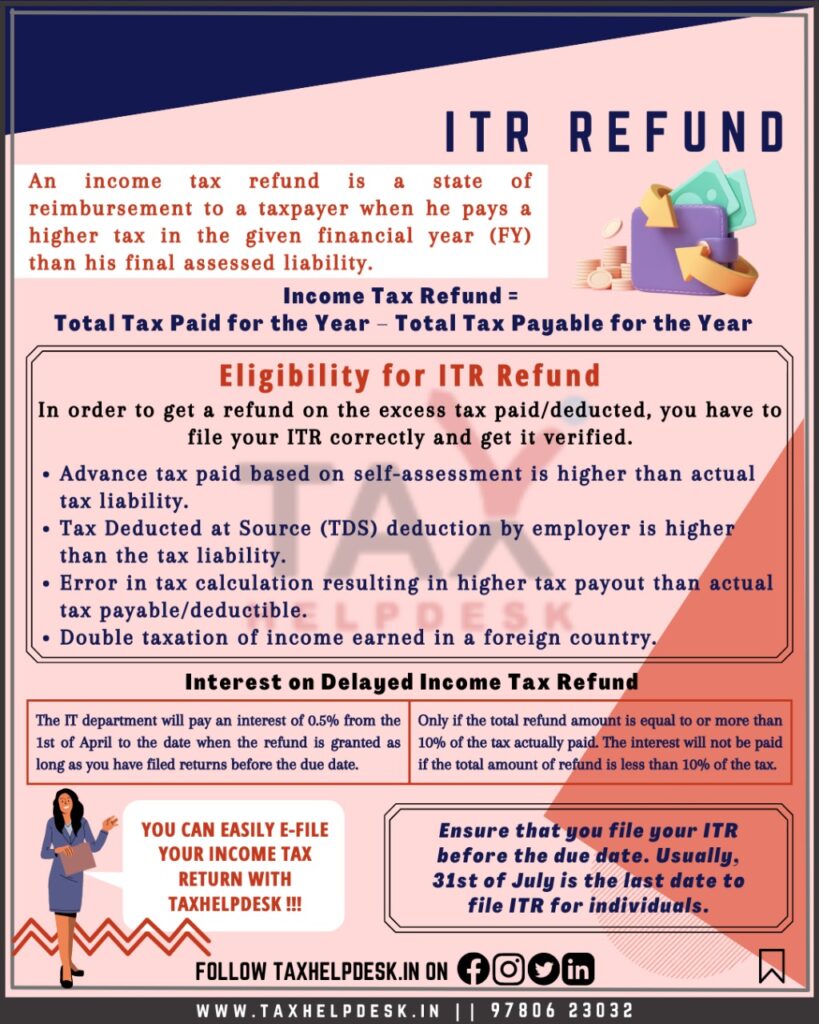

An ITR Refund or Income Tax Refund is a state of reimbursement to a taxpayer when he pays a higher tax in the given Financial Year than his final assessed liability.

Eligibility criteria for ITR Refund

You are eligible to claim an ITR refund if you have either of the following cases:

Firstly, if the payment of advance tax on self-assessment of tax is higher than the tax you are liable to pay as per the regular assessment.

Secondly, if the deduction of TDS on interest on salary, securities or debentures, dividends etc is more than the tax payable on regular assessment.

Also Read: TDS Rates Applicable for FY 2022-23

Thirdly, in case the income has been taxed in a foreign country as well as India. However, in this case, you will be able to claim a refund only if there is a Double Tax Avoidance Agreement between India and the applicable foreign country.

Fourthly, there was an imposition of higher tax due to the error in the assessment process.

Fifthly, the tax liability is negative after the payment of taxes and the claiming of deductions.

Lastly, you have investments that offer tax benefits and deductions, which you’re yet to declare.

Also Read: Do I Need To File Income Tax Return?

How much tax refund can you avail?

For calculating the tax refund, you need to calculate your tax liability. Further, this tax liability amount depends upon various factors namely – your total income, investments, allowances and exemptions. If you have made payment of taxes more than your tax liability, then you will get an extra amount as a tax refund.

Also Read: Major Exemptions & Deductions Claimed by Taxpayers in India

For instance, for Financial Year 2021-2022, your tax liability is Rs. 70,000. Your employer has deducted TDS of Rs. 75,000. Therefore, you have paid more than your tax eligibility and can claim a refund of Rs 5,000.

How to get the Income Tax refund?

For getting the Income Tax Refund, the easiest as well as the quickest way is to declare your investments in Form 16 and file your income tax return before the due date. Consequently, these investments can be in the form of LIC premiums payments, house rent payments, medical & health insurance, education loan for higher education etc. The declaration of investments is, however, necessary only when you choose to opt for the old tax regime. Further, if you fail to declare your investments and have to pay higher taxes, then you can avoid it by filling out Form 30.

Also Read: Income Tax Slab Rates under the Old & New Tax Regime

Form 30 is a form used for requesting that your case be looked into and analysed. Consequently, by filling out this form, you will be able to claim a refund on the extra payment of taxes.

Pro Tip: You can check your tax liability by viewing your Form 26AS and Annual Information Statement.

Due dates to claim ITR refund?

You can claim income tax refund only by filing Income Tax Return before or on the due date, which is usually 31st July. Further, the filed Income Tax Return must also be verified to process the refund. In addition to this, if you still do not get your refund, then you must claim it within one year from the date on which the assessment year ends.

Also Read: What happens if you do not verify your ITR within 120 days?

However, in certain cases, assessing officers may entertain refund claims that were filed after the due date. Those cases are as follows:

- Income tax refund claims was within completion of six successive assessment years.

- The refund amount was less than Rs. 50 lakh for a single assessment year.

- If the delayed claims require verification, the assessing officer could reconsider the claim.

Who processes the ITR Refund?

The duty of processing Income Tax Return is vested in the income tax authorities at Centralised Processing Centre (CPC), Bangalore. Consequently, they process the refund process as soon as you file and verify your ITR.

Mode of payment of IT Refund

Payment of IT refund can be either through direct transfer of refund in taxpayer’s bank account or through cheque.

Direct Transfer of Refund in Taxpayer’s Bank Account: Transferring of refund directly in the taxpayer’s account is the usual method for transferring the excess taxes. Further, this transfer can be either through NEFT or RTGS. Therefore, it becomes necessary for the taxpayer to make sure that all the details pertaining to his/her bank account are correct at the time of filing of Income Tax Returns.

Cheque: Payment of refund through cheque is an alternative to the payment of refund directly in the bank. In this method, if the assessing officer finds out that the details of bank account of taxpayer are incorrect or unclear, then he may issue cheque with amount of refund.

How to track status of your ITR Refund?

You can track your ITR by logging into your account on Income Tax Portal. Thereafter, click on My Account and click on Refund/Demand Status. Consequently, you will be able to see the following details:

– Assessment Year

– Status

– Reason (for refund failure if any)

– Mode of payment

Interest on delayed IT refund

The Income Tax Department shall pay interest @0.5% from 1st April to the date of granting of refund. This, however, is subject to the fact you have filed your ITR before or on the due date.

Also Read: Know penalty for late filing of ITR

Note

There shall be payment of interest only if the total refund amount is equal to or more than 10% of the tax actually paid. That is to say, there shall be no payment of interest if the total amount of refund is less than 10% of the tax.

Follow us on Instagram and Facebook for more updates on Income Tax, GST, Financial and Law.

The views of the author are personal.