As per the Income Tax Act, the ITR (Income Tax Return) must be verified within 120 days of filing through submitting ITR-V. In this blog, we will tell what happens if the ITR is not verified within 120 days, its consequences and remedies.

ITR not verified within 120 days

If an ITR is not verified within 120 days of filing, then your tax return will be treated as an invalid return by the Income Tax Department. Meaning thereby to say, it will have a status as if the ITR has not been filed at all by the person i.e., it is null and void in the eyes of law.

Also Read: Do’s and Don’ts of Filing of Income Tax Return

Consequences of not verifying the ITR

Verification has to be done within 120 days of filing of ITR. If it not done so, then the person should be ready to face the following consequences:

– The ITR will not be taken up for processing by the Income Tax Department

– No refund can be claimed by the person for the relevant period. Any tax refund claimed by the person will not be given to him unless he has filed a verified ITR and the same has been confirmed by the income tax department after processing.

– The person will not be allowed to claim the benefit of certain deductions and/or set off and carry forward of losses other than loss from house property loss, due to non-verifying or non-filing of the tax return within the prescribed due dates.

– The person may also have to face penalties which are applicable on non-verifying/non-filing of ITR

Remedy in case of ITR is not verified within 120 days

The Central Board of Direct Taxes (CBDT) has given wide powers to the Income Tax Department under Section 119(2)(b) of the Income Tax Act, 1961 to admit an application or claim for any exemption, deduction, refund or any other relief after the expiry of the period specified under the Act.

The relevant portion of the Section is as follows:

“Instructions to subordinate authorities.

(2) Without prejudice to the generality of the foregoing power,—

(b) the Board may, if it considers it desirable or expedient so to do for avoiding genuine hardship in any case or class of cases, by general or special order, authorise any income-tax authority, not being a Commissioner (Appeals) to admit an application or claim for any exemption, deduction, refund or any other relief under this Act after the expiry of the period specified by or under this Act for making such application or claim and deal with the same on merits in accordance with law;”

Thus, it allows Income Tax Department to condone the delay in specific cases like failure of verifying the Income Tax Return within 120 days from the date of filing ITR.

Also Read: Do I Need To File Income Tax Return?

Cases where condonation of delay is allowed:

The cases where condonation of delay is allowed by the Income Tax Department are dependent on the following criterion:

a) Claim is genuine and correct;

b) Income for which tax return is filed is not assessable in the hands of any other person;

c) There is genuine hardship faced by the taxpayer due to which ITR was not timely verified.

How to file request for condonation of delay?

The request for condonation of delay can be filed on the Income Tax Portal itself. The step by step procedure for the same is as follows:

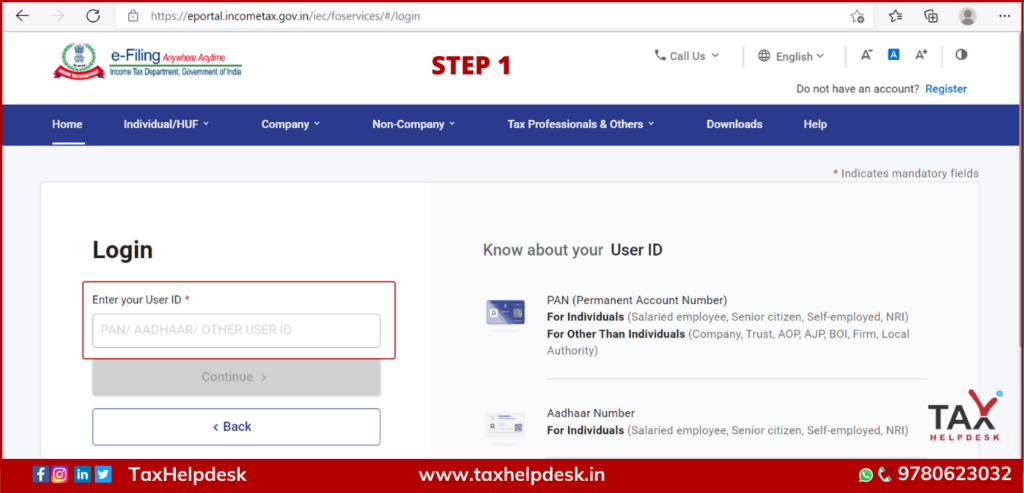

Step 1: Logon to the Income Tax Portal by putting your PAN/Aadhaar Number/Username and Password

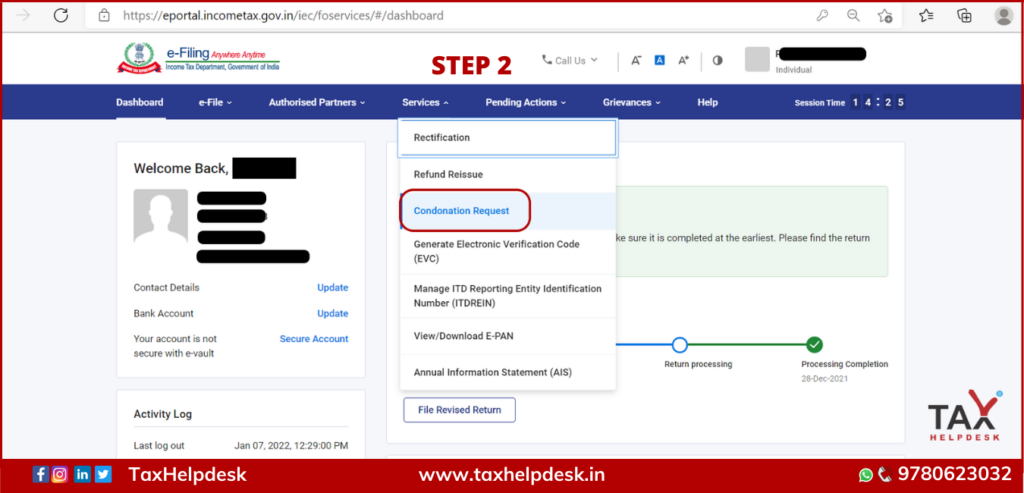

Step 2: Head over to “Services” –> “Condonation Request”

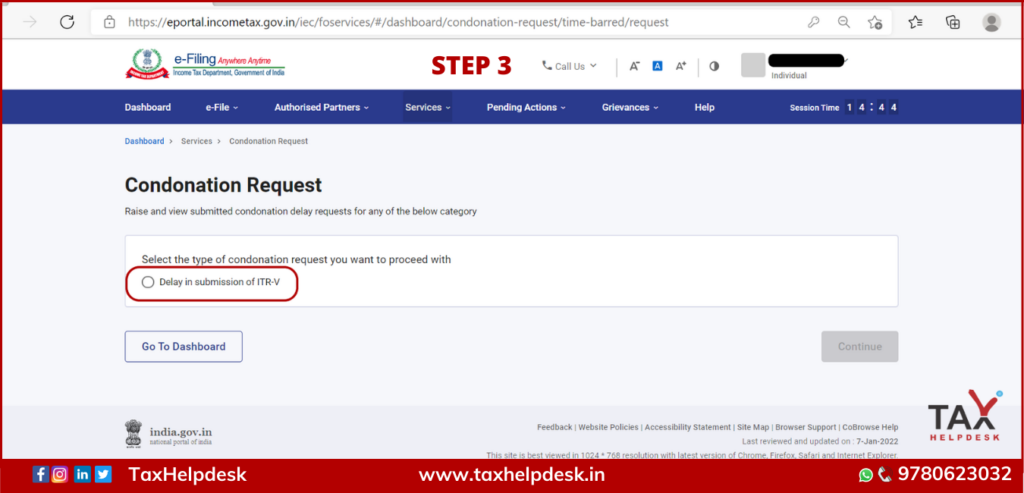

Step 3: Select “Delay in submission of ITR-V” and click on continue

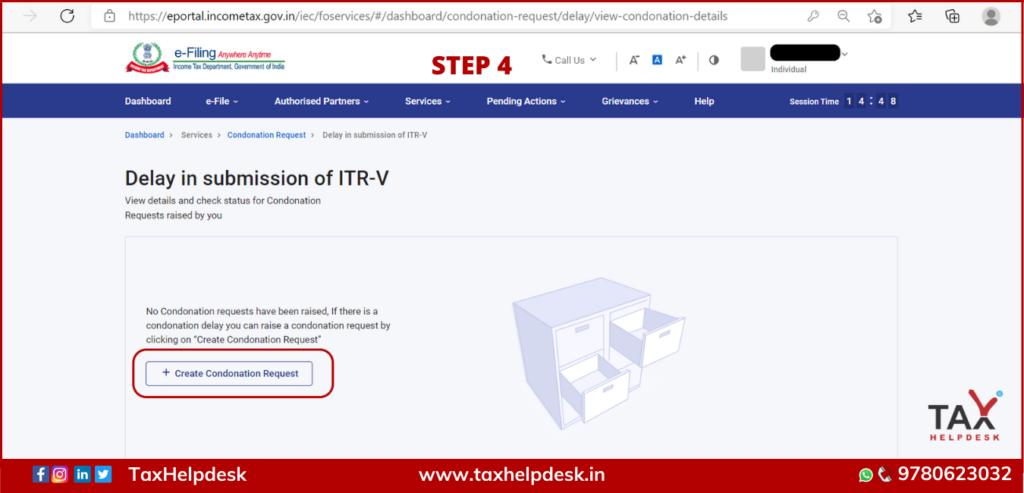

Step 4: Now click on button “+Create Condonation Request”

Step 5: Select the record for which you want to raise a condonation request for delay in ITR-V submission and click on Continue.

Step 6: Now select the reason for delay and click on Submit

Step 7: On successful submission, the message “Submitted Successfully” with Transaction ID will be reflected on your screen. Keep a note of the Transaction ID for future reference. You will also receive a confirmation message on the email ID and mobile number registered with e-Filing portal.

Time limit for filing request of Condonation of delay

Under the Income Tax Act, there is no specific provision which provides time limit for filing request of condonation of delay. However, CBDT vide Circular No. 9/2015 dated June 9, 2015, has provided that no condonation application for claim of refund/loss shall be entertained beyond six years from the end of the assessment year for which such application/claim is made.

What happens if the condonation of delay request is not accepted?

If the condonation of delay request is not accepted, then non verified return will be treated as invalid return and person will have to bear all the penalties related to non filing of Income Tax Return.

Penalties for not verifying ITR or non filing of ITR

The penalties for non filing of Income Tax Return are as follows:

- Late filing fees under Section 234F: Rs 1000, in case total income is below Rs. 5,00,000 and Rs. 5,000 in case the total income is more than Rs. 5,00,000.

- The taxpayer would also be subjected to interest under section 234A @1% per month or part of the month for any amount of tax remaining unpaid.

- In case of non-filing of tax return, the tax authorities will be of the view that the motive is tax evasion. They have the power to levy penalty under 270A on account of under-reporting of income which would be equivalent to 50% of the tax avoided by the taxpayer by way of non-filing of return.

- The authority can also initiate prosecution under section 276CC with respect to the defaulting taxpayer wherein he may be subjected to a rigorous imprisonment for a term which shall range from minimum 3 months to two years and along with fine, depending on the amount of tax evaded.

Now that you know what happens if you do not verify your Income Tax Return, it is advisable that you should not delay in verifying your ITR (if you have not verified it already)

If you have any opinions or feedback related to ITR filing, then do share it in the comment section below. You can also drop us a message on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!