The legislature enacts various laws for maintaining law and order in the country. Similarly, the Goods and Services Tax Act, 2017 was enacted and various duties are imposed on the GST dealers to abide by the provisions of this law. If these dealers fail to abide by the law, then the role of administration comes into role. The administration can conduct inspection, search, seizure, and can even arrest the person. The administration has these powers to protect the interest of genuine taxpayers (as the Tax evaders, by evading the tax, get an unfair advantage over the genuine taxpayers) and as a deterrent for tax evasion. These provisions are also essential for safeguarding the Government’s legitimate dues.

Who can conduct Inspection, Search, Seizure & Arrest under GST?

Inspection, Search, or Seizure can only be made by an officer, of the rank of Joint Commissioner or above, if he has reasons to believe the existence of any exceptional circumstances. In such cases, the Joint Commissioner may authorise, in writing, any other officer to cause inspection, search, and seizure.

However, in the case of arrests, the same can be made only where the person is accused of offences specified for this purpose and the tax amount involved is more than the specified limit. In addition to this, the arrests under GST Act can be made only under authorisation from the Commissioner.

What is Inspection?

Inspection is a provision that enables officers to inspect any place of business or of a person engaged in transporting goods or who is an owner or an operator of a warehouse or godown.

When can inspection be conducted?

The authorization of conducting an inspection can be given in writing in FORM GST INS-01 by officer of the rank of Joint Commissioner or above. And, inspection is possible if the officer has reasons to believe that person has involvement in either of the following actions:

(a) Suppression of any transaction relating to the supply of goods or services or stock in hand

(b) Claiming of excess input tax credit

(c) Contravention of any provisions of the Act or the Rules to evade tax

(d) Transporting or keeping goods that escape payment of tax or manipulating accounts or stocks which may cause evasion of tax

Also Read: Rules related to setting off of Input Tax Credit

Note:

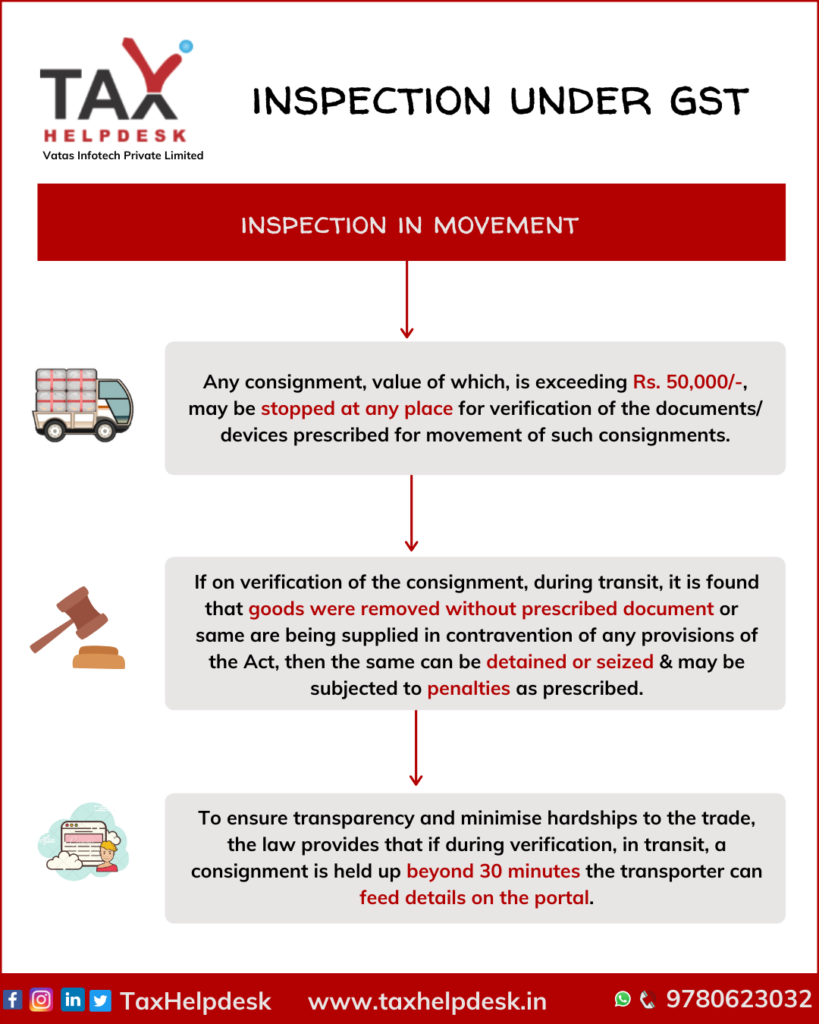

Inspection can also be done of the conveyance, carrying a consignment of value exceeding specified limit. The person in charge of the conveyance has to produce documents/devices for verification and allow inspection. Inspection during transit can be done even without authorisation of Joint Commissioner.

What is Search?

Under the GST law, search is an action of a government official authorised to go and look through or examine carefully a place, person, object etc. in order to find something concealed or to discover evidence of a crime.

When can Search be carried?

Search can be carried out only under authorisation in writing in FORM GST INS-01, from an officer not below the rank of Joint Commissioner, if he has a reason to believe that:

– The person concerned has concealed /secreted the goods liable to confiscation, or

– Any documents/books/records/things, which may be useful for or relevant to any proceedings are secreted.

What is Seizure?

Seizure, as the name suggests is to seize i.e., taking away the possession of a thing. It is the act of taking over person or property by force through legal process, such as the seizure of evidence found at the scene of a crime. It generally implies taking possession forcibly against the wishes of the owner.

Where can the Seizure be done?

The seizure can also be done only under authorisation in writing FORM GST INS-02, from an officer not below the rank of Joint Commissioner and if he has a reason to believe that:

The person concerned on whose premise the search has been conducted to seize goods which are liable to confiscation and documents, books or things (relevant for any proceedings under CGST/SGST Act) from the premises searched.

Also Read: Do You Know About GST Refunds?

What is Arrest?

An arrest is using legal authority to deprive a person of his or her freedom of movement.

When can a person be arrested under Goods and services laws?

Arrest under the GST laws can be done if the Commissioner of CGST/SGST believes a person has committed an offence under Section 132 of the GST Act. Such offences are:

– if he has committed specified offences (not any offence) and

– The tax amount is exceeding rupees 100 lakhs.

Specified offences are:

– A taxable person supplies any goods/services without any invoice or issues a false invoice.

– He issues any invoice or bill without supply of goods/services in violation of the provisions of GST.

– He collects any goods and services but does not submit it to the government within 3 months.

– Even if he collects any goods and services in contravention of provisions, he still has to deposit it to the government within 3 months. Having said that, failure to do so will be an offence under GST

– Falsifies documents to evade payment of tax.

– Obstructs or prevents any officer in discharging his duties

– Tampers with or destroys any material evidence or documents

– He has already been convicted earlier under Section 132 i.e., this is his second offence.

Tenure of Arrest for evading tax or wrongly claiming Input tax credit

Arrest under GST

| Type of Offence | Amount of default | Period of imprisonment | Type of offence |

| Any offence | Rs. 100 lacs – Rs. 200 lacs | Up to 1 year | Bailable |

| Certain offences specified under the Act | Rs. 200 – Rs. 500 lacs | Up to 3 years | Bailable |

| Certain offences specified under the Act | Exceeding Rs. 500 lacs | Up to 5 years | Non-bailable |

| Assists in commission of certain specified offences | Any amount | Up to 6 months | Bailable |

| Repetition of offences | Any amount | Up to 5 years | Non-bailable |

If you have any suggestions/feedbackor want to take help of GST experts, then please drop us a message in the chat box. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp, channel on Telegram or follow us on Facebook, Instagram, Twitter and LinkedIn!

The views of the author personal and TaxHelpdesk does not owe any liability whatsoever.

Pingback: GST Registration on basis of State & Turnover | TaxHelpdesk