The latest changes in ITC rules related to setting off of input tax credit have come into effect from 29th March, 2019.

What are ITC Rules?

In order to understand what are ITC Rules, one must first know what is Input Tax Credit?

Input Tax Credit (ITC), in simple words, means that at the time of paying tax on output i.e., sales, the person can reduce the tax that he has already paid on input i.e., purchases.

Also Read: Know Whether You Can Claim Input Tax Credit On Food?

The ITC Rules help in the utilisation of credit in the electronic ledger and payment of taxes. Further, this credit in the Electronic Cash Ledger is available only for payment of taxes. In other words, this credit cannot be of use against payment of interests, late fees or any other penalty.

Types of taxes under GST for utilization of credit

Under GST, there are four types of taxes namely:

– Integrated Goods and Services Tax (IGST)

– Central Goods and Services Tax (CGST)

– State Goods and Services Tax (SGST)

– Union Territory Goods and Services Tax (UTGST)

IGST is a tax levied on inter-state goods and services transactions. Whereas, CGST, SGST and UTGST are the taxes levied on intra-state goods and services transactions.

Also Read: Penalty Under GST Act Detailed Guide By TaxHelpdesk

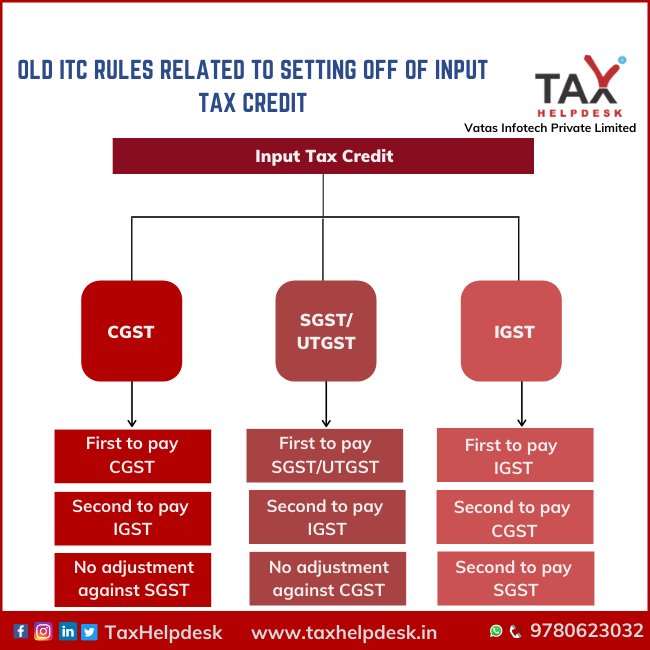

ITC Rules for Setting Off under Old Mechanism

As per the old ITC rules, the following was the priority of set off:

– For IGST Output: First set off through ITC of IGST, then CGST and lastly, SGST.

– For CGST Output: First set off through ITC of IGST and then, CGST. ITC of SGST cannot be utilized.

– For SGST/UTGST Output: First set off through ITC of IGST and then, SGST/UTGST. ITC of CGST cannot be utilized.

Also Read: Know About Late Fees And Interest On GST Returns

However, the changes were made to these rules through CGST (Amendment) Act, 2018 and there was an insertion of a new Section 49A into the Goods and Services Tax Act, 2017.

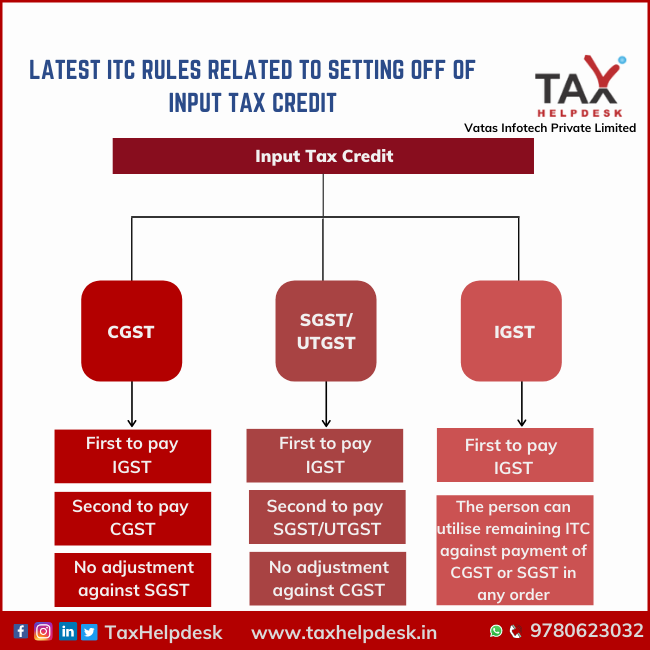

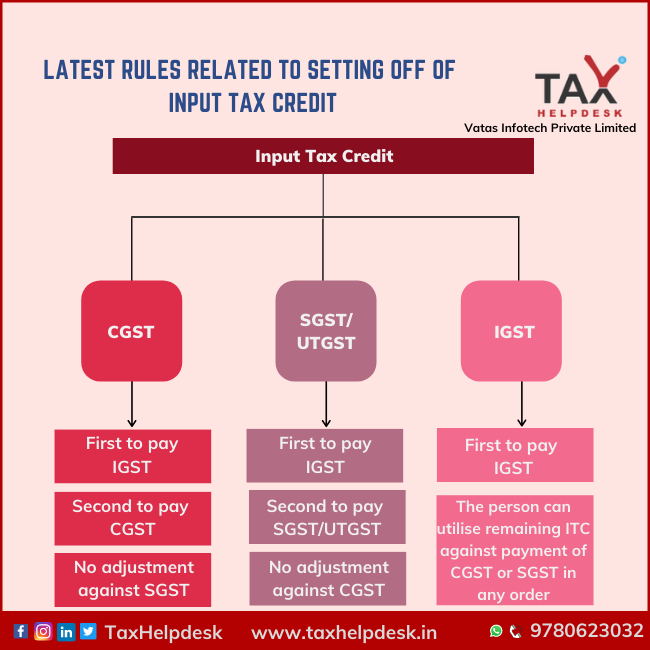

Setting off of ITC under New Mechanism

The new rules in relation to setting off of ITC were amended through GST Circular No. 98/17/2019 dated 23.04.2019. Through this circular, there is an insertion of two Sections namely Section 49A and Section 49B.

The provisions of Section 49A and Section 49B are as follows:

“Section 49A: Notwithstanding anything contained in section 49, the input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully towards such payment.

Also Read: GST Registration on the basis of State and Turnover

Section 49B: Notwithstanding anything contained in this Chapter and subject to the provisions of clause (e) and clause (f) of sub-section (5) of section 49, the Government may, on the recommendations of the Council, prescribe the order and manner of utilisation of the input tax credit on account of integrated tax, central tax, State tax or Union territory tax, as the case may be, towards payment of any such tax.”.

Also Read: Types of GST Returns and Due Dates

Amendment in ITC Rules

The amendments in ITC Rules were made through the insertion of Rule 88A. This rule has notified the above new provision via CT notification no. 16/2019 dated 29.03.2019.

Rule 88A reads as follows:

Rule 88A: Order of utilization of input tax credit:- Input tax credit on account of integrated tax shall first be utilised towards payment of integrated tax, and the amount remaining, if any, may be utilised towards the payment of central tax and State tax or Union territory tax, as the case may be, in any order. Provided that the input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully.

Also Read: What Is The Impact Of ITC On Capital Goods?

Confusion in utilization of IGST Credit

After the issue of this Rule, there was still confusion regarding the order of utilising of ITC after it has been utilised for IGST liability. Therefore, the clarification to the said circular was issued on 23.04.2019, which is as follows:

As per the Circular No: 98/17/2019 dated 23 April 2019, it has been clarified that- As per the provisions of Section 49 of the CGST Act, credit of integrated tax has to be utilised

– Firstly, for payment of integrated tax,

– Secondly, for payment of Central tax and

– Lastly, for payment of State tax, in that order mandatorily.

Also Read: Know Everything About GST ITC On Bank Charges

This led to a situation, in certain cases, where a taxpayer has to discharge his tax liability on account of one type of tax (say State tax) through electronic cash ledger, while the input tax credit on account of other types of tax (say Central tax) remains unutilised in electronic credit ledger.

The newly inserted rule 88A in the CGST Rules allows utilisation of input tax credit of integrated tax towards the payment of Central tax and State tax, or as the case may be, Union Territory tax, in any order subject to the condition that the entire input tax credit on account of integrated tax is completely exhausted first before the input tax credit on account of Central tax or State/Union Territory tax can be utilised.

It is clarified that after the insertion of the said rule, the order of utilisation of input tax credit will be as per the order (of numerals) given below:

Setting off of ITC

| Liability/ITC | IGST | CGST | SGST |

| IGST | 1 | 2 | 3 |

| CGST | 2 | 1 | Not allowed |

| SGST | 2 | Not allowed | 1 |

Illustration 1 (IGST Setting off)

ITC of IGST is available at Rs 10,000. IGST liability is Rs 1000, CGST liability is Rs 6000 and SGST liability is Rs 4000. ITC set-off will be as follows:

| Type of GST | Liability | Balance Credit | Setting off liability | Balance to be paid in cash |

|---|---|---|---|---|

| IGST | 1000 | 10000 | 1000 | – |

| CGST | 6000 | 9000 | 6000 | – |

| SGST | 4000 | 3000 | 3000 | 1000 |

or

| Type of GST | Liability | Balance Credit | Setting off liability | Balance to be paid in cash |

|---|---|---|---|---|

| IGST | 1000 | 10000 | 1000 | – |

| SGST | 4000 | 9000 | 4000 | – |

| CGST | 6000 | 5000 | 3000 | 1000 |

Illustration 2 (CGST Setting Off)

CGST ITC is available Rs 10,000. IGST liability is Rs 4,000, CGST liability is Rs 7,000 and SGST liability is Rs 4,000. ITC set-off will be as follows:

| Type of GST | Liability | Balance Credit | Setting off liability | Balance to be paid in cash |

|---|---|---|---|---|

| IGST | 4000 | 10000 | 4000 | – |

| CGST | 7000 | 6000 | 6000 | 1000 |

| SGST | 4000 | 0 | Not allowed | 4000 |

Illustration 3 (SGST Setting Off)

SGST ITC is available at Rs 10,000. IGST liability is Rs 4,000 and CGST liability is Rs 7,000 and SGST liability is Rs 4,000. ITC set-off will be as follows:

| Type of GST | Liability | Balance Credit | Setting off liability | Balance to be paid in cash |

|---|---|---|---|---|

| IGST | 4000 | 10000 | 4000 | – |

| SGST | 4000 | 6000 | 4000 | |

| CGST | 7000 | 0 | Not allowed | 7000 |

If you want to know more about ITC rules or take help of GST experts, then please drop us a message in the chat box. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp, channel on Telegram or follow us on Facebook, Instagram, Twitter and LinkedIn!

The views of the author are personal.

Thanks

Pingback: GST Registration on basis of State & Turnover | TaxHelpdesk

Pingback: How does Input Tax Credit Work? | TaxHelpdesk

Pingback: Inspection, Search, Seizure & Arrest under GST | TaxHelpdesk