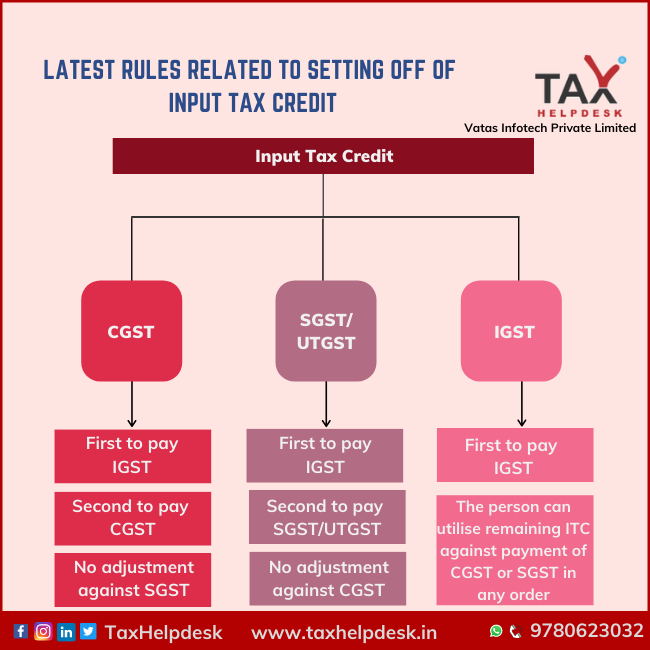

Latest Rules related to setting off of Input Tax Credit

Setting off of Input Tax Credit under New Mechanism

– For IGST Output: First set off through ITC of IGST, then CGST and lastly, SGST.

– For CGST Output: First set off through ITC of CGST and then, IGST. ITC of SGST cannot be utilized.

– For SGST/UTGST Output: First set off through ITC of SGST/UTGST and then, IGST. ITC of CGST cannot be utilized.