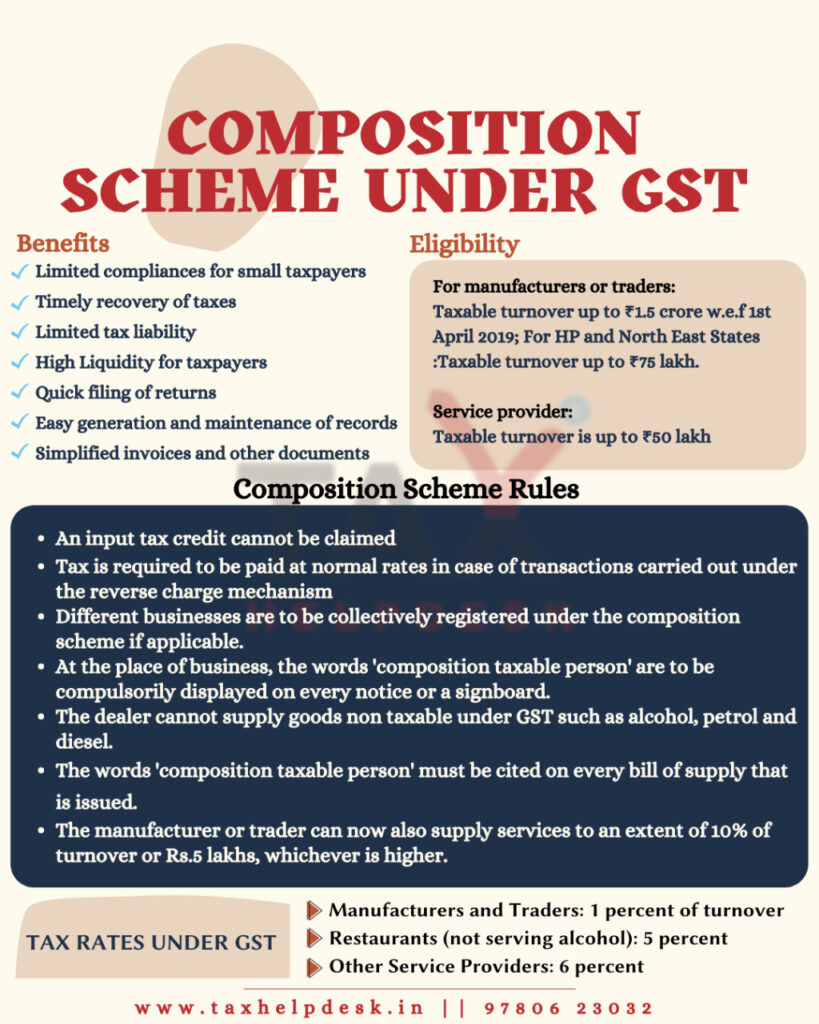

Composition Scheme under GST can be opted by a taxpayer whose turnover is below Rs 1.5 crore (Rs. 75 lacs for North Eastern States and Himachal Pradesh). However, for services, the turnover limit is Rs. 50 lacs.

Conditions for opting Composition Scheme

In order to opt for Composition Scheme, following conditions must fulfill:

– Firstly, composition scheme dealer cannot claim any input tax credit.

– Secondly, the dealer cannot supply non-taxable goods under goods and services tax (GST) such as alcohol, petrol and diesel.

– Thirdly, tax is to be paid at normal rates in case of transactions carried out under the Reverse Charge Mechanism.

– Fourthly, different businesses are to be collectively register under the composition scheme, if applicable.

– Fifthly, the words “Composition Taxable Person” are to be compulsorily display on every notice or signboard of place of business.

– Sixthly, the words “Composition Taxable Person” must cite on every bill of supply that is issued.

– Lastly and most importantly, the manufacturer or trader can now also supply services to an extent of 10% of turnover or Rs. 5 lacs, whichever is higher.

Also Read: GST Registration for multiple businesses

Who cannot opt for Composition Scheme?

GST Composition Scheme cannot be opted by person who makes

– any supply of goods which are not liable to be taxed under goods and services tax Act in India

– inter-state outward supplies of goods

– supplies through electronic commerce operators who require to collect tax under section 52.

– a manufacturer of notified goods – ice cream, pan masala and tobacco.

– a casual dealer

– Furthermore, a Non-Resident Foreign Taxpayer

– a person registered as Input Service Distributor (ISD)

– a person registered as TDS Deductor/Tax Collector

Also Read: GST E-Way Bill [Ultimate Guide]

When can you opt for this scheme?

In order to avail composition scheme under GST, you need to file an online application to opt for Composition Levy with the tax authorities. Having said that, taxpayers who can opt for this scheme are as follows:

New Taxpayers: Any person who becomes liable to register under GST Act, after the appointed day, needs to file his option to pay composition amount in the Application for New Registration in Form GST REG-01.

Existing Taxpayers: Any taxpayer who is registered as normal tax payer under Goods and services tax needs to file an application to opt for Composition Levy in Form GST-CMP-02 at GST Portal prior to the commencement of financial year for which the option to pay tax under the aforesaid section is exercised.

Also Read: Know Types of Composition Levy Scheme Forms

Can composition dealer issue invoice?

Under the GST composition scheme, the composition dealer cannot issue an invoice. This is so because the dealer cannot charge tax from its customers. Having been said that, the composite dealers have to pay taxes on their own and they cannot claim any input tax credit on it. Therefore, these dealers can issue bill of supply. The dealer should also mention “composition taxable person, not eligible to collect tax on supplies” at the top of the bill of supply.

Also Read: Types of invoices under GST

GST Rates applicable under Scheme

The GST rates applicable under Composition Scheme are as follows:

| Type of Business | CGST | SGST | Total |

|---|---|---|---|

| Manufacturers and Traders (Goods) | 0.5% | 0.5% | 1% |

| Restaurants not serving Alcohol | 2.5% | 2.5% | 5% |

| Service Providers | 3% | 3% | 6% |

| Manufacturers of bricks (including building bricks, bricks of fossil meals or similar siliceous earths, earthen or roofing tiles, and fly ash bricks and blocks ) | 3% | 3% | 6% |

GST Payment under Composition Scheme

As stated above, the composition dealer cannot levy tax on its customers and has to pay taxes on its own. The GST payment by composition dealer involves payment of:

– GST on supplies made

– Tax under reverse charge

– Tax on purchase from unregistered dealers on specified category of goods.

Returns to be filed under Composition Scheme

The GST returns to be filed in composition scheme under Goods and services tax (GST) are as follows:

– CMP-08: Quarterly statement to be filed by 18th of the month after the end of the quarter.

– GSTR-4: GST Return to file annually by 30th April of the next financial year w.e.f., 2019-20 onwards

– In addition, GSTR-9A: Annual GST Return to be filed by 31st December of the next financial year.

FAQs

To opt for the Composition Scheme, following steps must perform on the GST portal:

1. Log in to the GST Portal

2. Go to Services > Registration > Application to Opt for Composition Levy

Fill the form as per the form specification rules and submit

No, the composition dealer is not required to maintain detail records for the purposes of GST.

If you want to know more about GST composition scheme or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!