Goods and Services Tax for short: GST Returns is a document that contains all the details of input (purchases), output (sales), input tax (tax paid on purchases) and output tax (tax paid on sales). It is to be filed by all the individuals, traders, organizations and companies under GST. On filing of the returns, the tax liability ascertain and is to be paid to the relevant authority.

types of form for GST Returns filing

The register user has to submit 4 forms to file their returns namely

– Return for purchases,

– Return for sale/supplies,

– Monthly return/Quarterly return, and

– Annual return.

Note: For those who opt for composition scheme/QRMP (Quarterly Return and Monthly Payment) Scheme, quarterly returns are to be submitted.

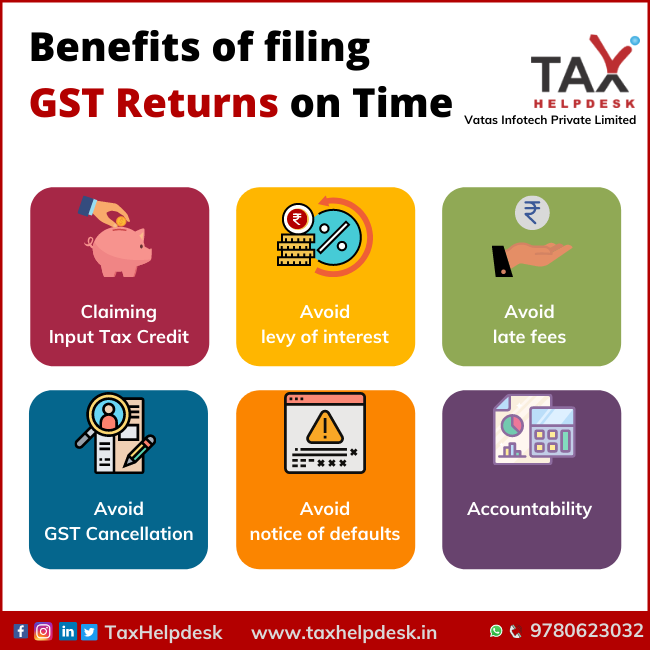

benefits of filing Returns

GST Returns are to be filed by all the users and the benefits filing of these returns on time are as follows:

– Claiming Input Tax Credit:

Input Tax Credit tax reduce from output tax payable on account of sales. This amount can use to reduce the tax liability of the register user. Moreover, in order to utilize the Input Tax Credit, one has to file GST Return on time.

Also Read: Rules related to setting off of Input Tax Credit

-Avoid levy of interest:

Every GST register taxpayer need to file GST Returns, irrespective of its tax liability. This means that the returns file even if there is no transaction. If the returns not file on time, then interest @18% p.a., on the amount of outstanding tax can be charged. In addition, the late fees period will calculate from the date of deadline to the date of actual payment.

– Avoid late fees:

As per the GST Act, late fees of Rs. 100 per day up to a maximum amount of Rs. 5,000 shall charge for delaying in filing of Returns. Furthermore, this late fees will not adjust against Input Tax Credit and this fees has to be deposited in cash.

– Avoid GST Cancellation:

As per the GST Act, the GST Officer is given power to the registered GST taxpayer if the user delays in filing of GST Returns for a continuous period of 6 months. Therefore, it is always to file all the GST Returns on time.

Also Read: GST Invoices: B2B, B2CL & B2CS

Some Other Benefits Of Filing Returns

– Avoid notice of defaults from GST Department:

The GST department keeps a track on the GST taxpayers through their GST Returns. If there is any irregularity in filing of returns, then the user may get a notice from the GST department.

– Accountability of the registered user

Under the GST regime, now all the taxes are paid online and their is not any major hassles of tax filling GST Returns. In addition, by paying these returns on time shows the accountability of the user.

Now filing GST Return on time is easy with TaxHelpdesk. Contact us and our top CA’s will get this done for you within a day.

If you want to know more about GST Returns or take help of TaxHelpdesk experts, then leave a message below in the comment box or drop us a message on any of these platforms: WhatsApp, Facebook, Instagram, LinkedIn and Twitter. For tax related information and updates, you can also join our WhatsApp group and Telegram Channel.

The views of the author are persona and Taxhelpdesk does not owe any liability.