What is GST Return?

GST return is a document containing details of income which a registered GST dealer is required to file with the tax officials, Government of India. Through this filing, the income of the registered GST dealer is ascertained and tax liability is calculated.

Generally, GST Returns include

– Purchases (Input)

– Sales (Output)

– Tax collected on purchases (Input Tax)

– Tax collected on sales (Output Tax)

In order to file GST Returns, invoices comprising of purchases and sales are required.

Who should file GST Returns?

GST Returns are to be filed by all the business entities who are a registered dealer of GST. The type of GST return to be filed depends upon the nature of the business of the registered GST dealer.

How many GST Returns are to be filed?

GST Returns are filed either monthly or quarterly and annually by the GST registered dealer, depending upon their nature of business and availability of option to file return monthly or quarterly.

For regular taxpayers, two monthly returns and one annual return are to be filed. Therefore, in total 25 GST Returns are to be filed in a year.

For taxpayers opting Quarterly Return and Monthly Payment Scheme (QRMP), 8 quarterly returns and one annual return are to be filed. Therefore, total 9 GST Returns are to be filed in a year.

Note: Under the QRMP scheme, taxpayers having an aggregate turnover at PAN level up to Rs. 5 crores can opt for quarterly GSTR-1 and GSTR-3B filing.

What are the various types of GST Returns, their period of filing and due dates?

Also Read: What are the various types of GST Returns, filing period and their due dates?

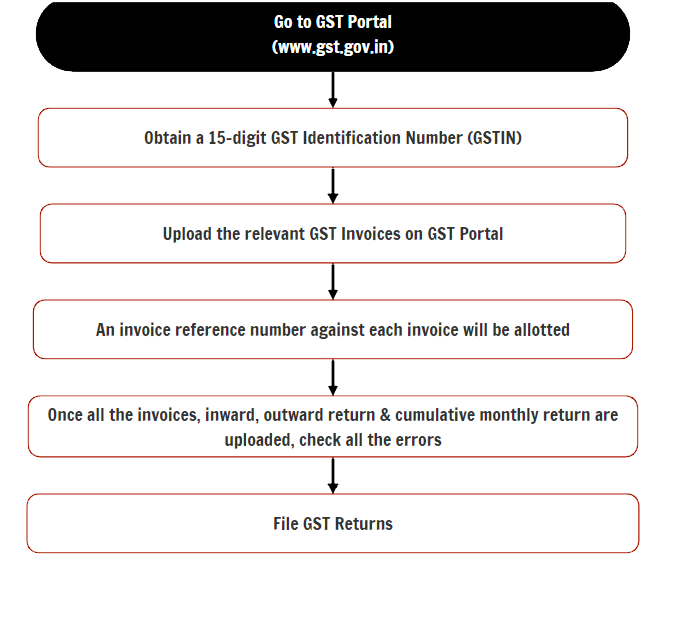

What is the process of filing GST Returns?

What is the penalty for late filing of GST Returns?

As per the GST, the penalty for late filing of GST is Rs. 100 per day for each

Central Goods and Service Tax and State Goods and Services Tax. Thus, the total

penalty for late filing of GST Returns is Rs. 200 per day. The maximum penalty

that can be charged for late filing of GST Returns in Rs. 5,000/-. Apart from

this, the registered GST dealer will have to pay an interest at the rate of 18%p.a.

in addition to the late fees. The time period for determining penalty is

calculated from the due date of filing return till the actual date of filing of

return.

**Please note that if there have been any errors in filing of GST Return, then the same can be amended in the next month’s filing of GST Return. Under GST law, there is no provision to revise the filing of GST Returns.**

Still have doubts? Contact us today at TaxHelpdesk to get in touch with our experts and get your GST Return filed.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!

Pingback: Benefits of Filing GST Returns on Time | TaxHelpdesk