The new tax regime slabs was introduced through the Union Budget, 2020. Under this tax regime, the income tax slab rates are lower and if the person chooses to opt for this regime, then he will have to miss out on a majority of the deductions.

Who can opt for New Tax Regime Slabs?

Only individuals and Hindu Undivided Families (HUFs) can opt for the new tax regime slabs. In other words, partnership firms, companies, Association of Persons, Juridical persons, and trusts cannot opt for this tax regime.

Are there any changes in the New Tax Regime?

Although the new tax regime was introduced through the Union Budget, 2020 but it has undergone multiple changes through the Union Budget, 2023. These changes are as follows:

1) Standard deduction

Earlier under the previous new tax regime, there was no provision for the standard deduction. That is to say, the individuals could not claim the standard deduction on their income. But now, through the Union Budget 2023, individuals can claim this standard deduction, which is worth Rs. 50,000.

Also Read: Union Budget 2023: Know About The Direct Tax Reforms

2) Default tax regime

The new tax regime will now be the default tax regime while filing the Income Tax Return. However, if the person wishes to file his ITR through the old tax regime, then he will have to manually select that option.

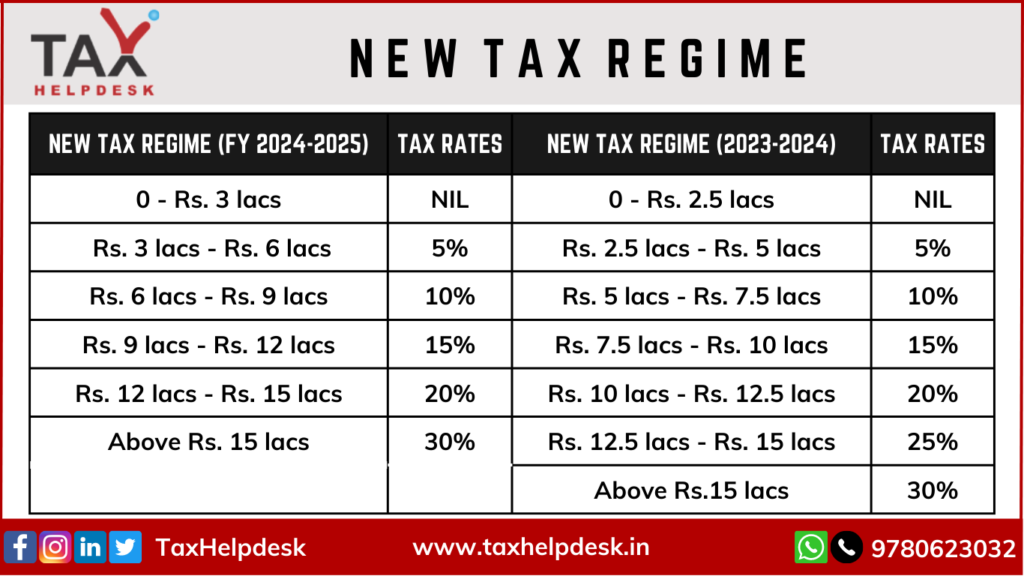

3) Changes in Income Tax Slab Rates

The previous new tax regime rates had various income tax slab rates. This used to create a lot of confusion in the minds of the people. Therefore, to ease this situation, the government has made changes in the Income Tax Slab rates. Further, there is also a reduction in tax liability through the latest new tax regime slab rates.

4) Basic exemption limit

Under the latest new tax regime, the basic exemption limit has been increased from Rs. 2.5 lacs to Rs. 3 lacs. On the other hand, this limit remains the same under the old tax regime i.e., Rs. 2.5 lacs.

Also Read: Understand About Deductions Under Old And New Tax Regime

5) Rebate

Apart from the above, the rebate limit under the latest new tax regime is now Rs. 7 lacs from Rs. 5 lacs. This is to say that if the person opting for the new tax regime has a taxable income below Rs. 7 lacs, then he will have to pay zero tax on his income. Whereas, under the old tax regime, this limit remains the same i.e., Rs. 5 lacs.

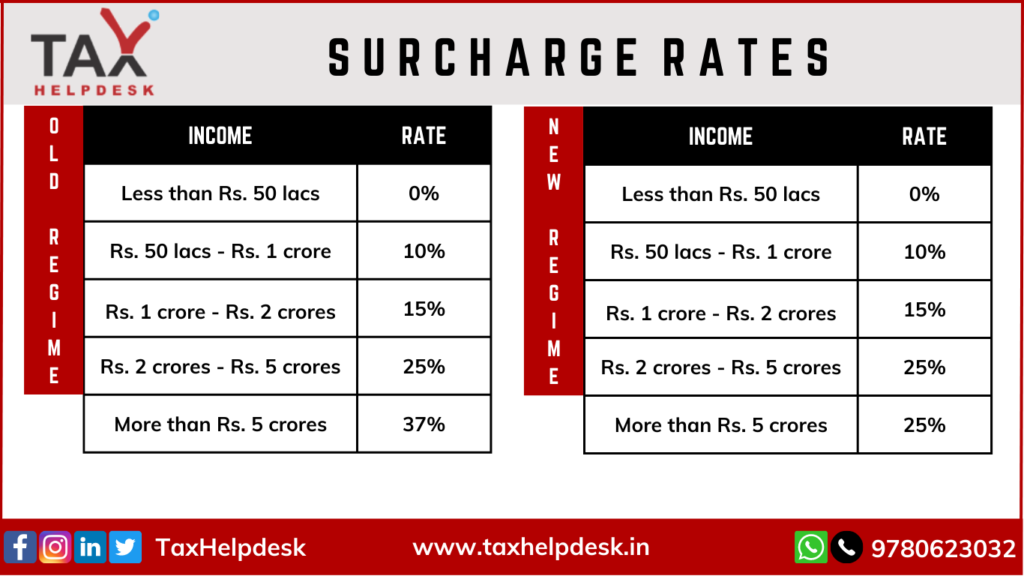

6) Surcharge

Lastly, under the latest new tax regime, the maximum surcharge rate is now 25% from 37%. Needless to say, this rate is the same under the old tax regime as it was earlier i.e., 37%.

Reasons for bringing changes in the New Tax Regime Rates

The possible reasons for bringing changes in the new tax regime rates are as follows:

– Firstly, to provide ease of filing returns to the people.

– Secondly, to ensure more and more people file Income Tax Returns.

– Lastly, to provide a maximum tax refund.

Comparison of Income Tax Slab rates under the previous and new rates under the New Tax Regime

| Slab |

New Tax Regime (FY 2022-23 (AY 2023-24) |

New Tax Regime FY 2023-24 (AY 2024-25) |

|---|---|---|

| ₹0 – ₹2,50,000 | – | – |

| ₹2,50,000 – ₹3,00,000 | 5% | – |

| ₹3,00,000 – ₹5,00,000 | 5% | 5% |

| ₹5,00,000 – ₹6,00,000 | 10% | 5% |

| ₹6,00,000 – ₹7,50,000 | 10% | 10% |

| ₹7,50,000 – ₹9,00,000 | 15% | 10% |

| ₹9,00,000 – ₹10,00,000 | 15% | 15% |

| ₹10,00,000 – ₹12,00,000 | 20% | 15% |

| ₹12,00,000 – ₹12,50,000 | 20% | 20% |

| ₹12,50,000 – ₹15,00,000 | 25% | 20% |

| > ₹15,00,000 | 30% | 30% |

How are the latest new tax regime rates better than the old one?

Well! This can be well explained with the help of the following illustration:

| Income | Previous Tax Liability | New Tax Liability | Tax Benefits |

|---|---|---|---|

| Rs. 7 lacs | Rs. 33,800 | 0 | Rs. 33,800 |

| Rs. 8 lacs | Rs. 46,800 | Rs. 36,400 | Rs. 10,400 |

| Rs. 9 lacs | Rs. 62,400 | Rs. 46,800 | Rs. 15,600 |

| Rs. 10 lacs | Rs. 78,000 | Rs. 62,400 | Rs. 15,600 |

| Rs. 12 lacs | Rs. 1,19,600 | Rs. 93,600 | Rs. 26,000 |

| Rs. 15 lacs | Rs. 1,95,000 | Rs. 1,56,000 | Rs. 39,000 |

From the above illustration, it is safe to say that there is a reduction in tax liability if the person chooses to file ITR through the latest new tax regime rates.

What are your views regarding the new tax regime? Do let us know on Facebook, Instagram, Twitter or WhatsApp!