Union Budget, 2023 was presented by Finance Minister Smt. Nirmala Sitharaman in Parliament on 1st February, 2023.

Keeping in view the vision for “Amrit Kaal”, the government is looking forward to the economy on the basis of technology as well as knowledge. In addition to this, the government also aims to have powerful public finances and a robust financial sector.

To achieve the above milestones, the government has proposed many changes through the Union Budget, 2023. Let us understand through this blog the changes in the Direct Tax.

Union Budget 2023 Highlights: Direct Tax

New Tax Regime Income Tax Slab Rates

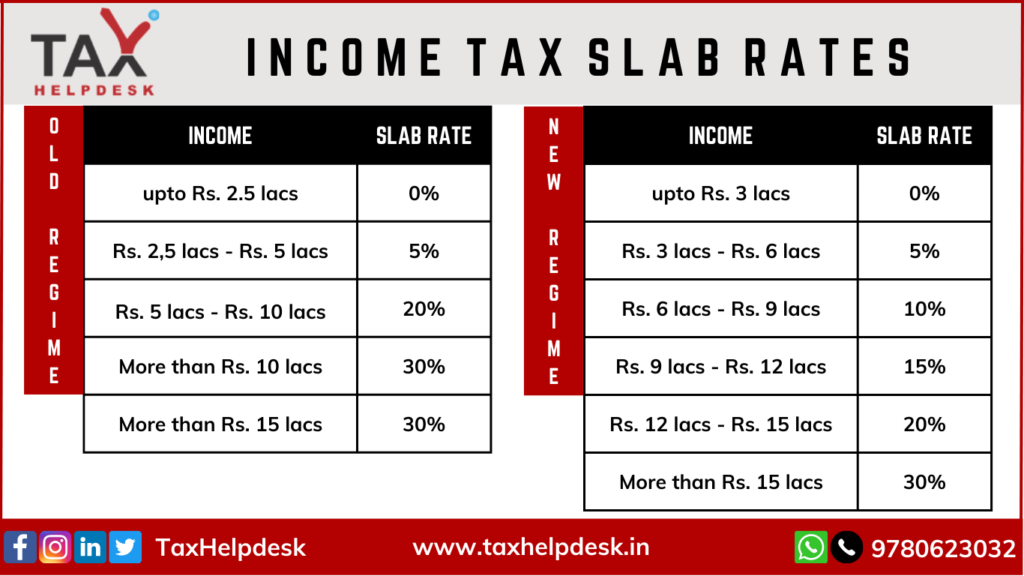

The first and foremost update in the Income Tax regime through the Union Budget, 2023 is the change in the Income Tax Slab Rates under the New Tax Regime. On the other hand, there are no changes in the income tax slab rates under the Old Tax Regime.

Also Read: Which Tax Regime Suits You: Old V. New?

The reason for making changes in the income tax slab rates is that there were many slab rates under the new tax regime. Due to these various tax slab rates, there used to be a lot of confusion in the minds of individuals. Therefore, to curb this confusion and increase the number of filers under the new tax regime, the government has put up changes in this tax regime.

Default Tax Regime

Apart from the changes in the income tax slab rate, the new tax regime will now be the default tax regime while filing the Income Tax Return. If the individual wishes to file his ITR under the old tax regime, then he can simply select the option and file the ITR.

Also Read: Income Tax Under New Regime Understand Everything

Standard Deduction

Now even under the new tax regime, the standard deduction of Rs. 50,000 will be available to the ITR filers. Please note that earlier the standard deduction was available only under the old tax regime.

Tax rebate

In addition to the above, the government seeks to increase the tax rebate limit of Rs. 5 lacs to Rs. 7 lacs under the new tax regime. In other words, if the individual having taxable income below Rs. 7 lacs opts for the new tax regime, then he will have zero tax. Whereas, under the old tax regime, the tax rebate limit is still Rs. 5 lacs.

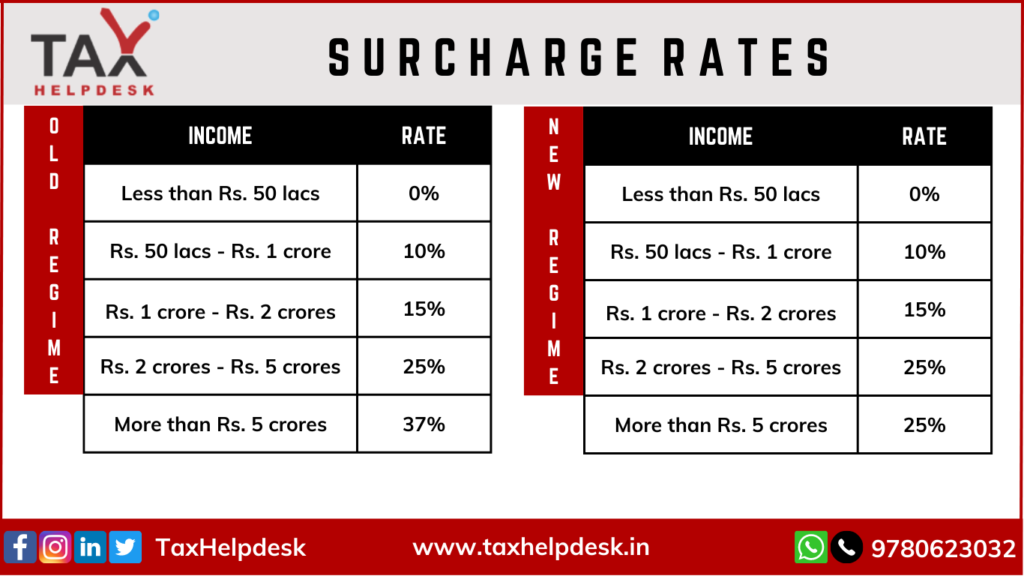

Surcharge limit

Fifthly, the highest surcharge limit under the new tax regime will now be 25% from 37%. Conversely, the highest surcharge limit under the old regime remains the same i.e., 37%.

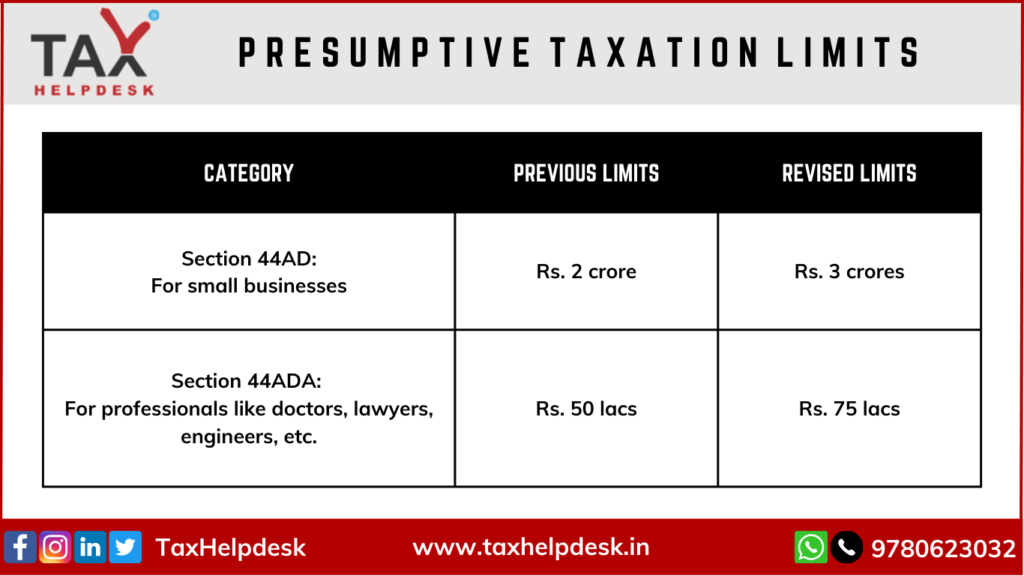

Presumptive Taxation Limits

Through the Union Budget, 2023 the presumptive taxation limits are also set to increase. The new threshold limits are as follows:

Please note that the above threshold limits are applicable only when 95% of the receipts are through online transactions.

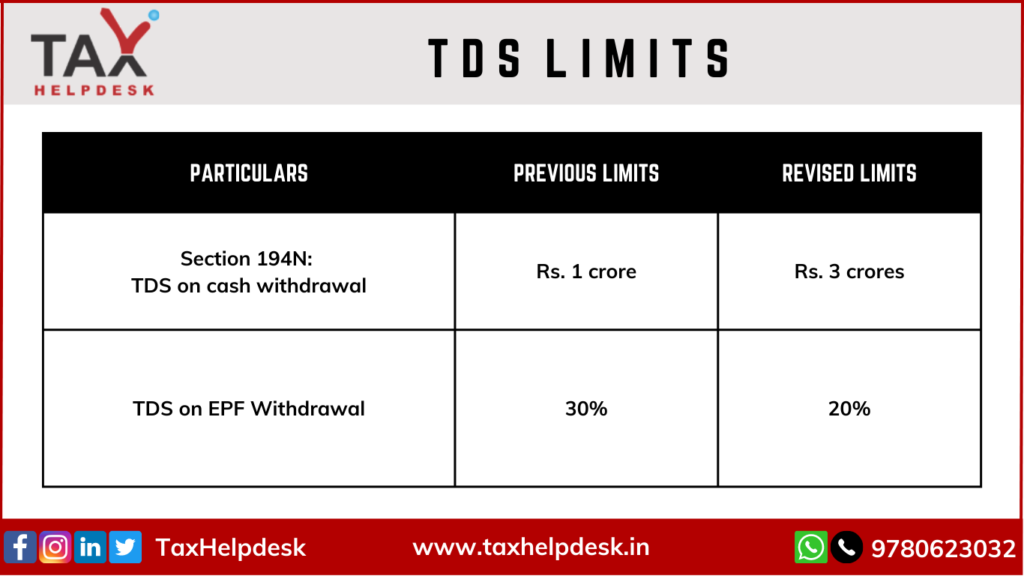

TDS limits

The Union Budget has also set to increase certain threshold limits, which are as follows:

Leave encashments

For non-government employees, the exemption level for leave encashment has been raised from Rs 3 lacs to Rs 25 lacs. As a result, at the time of retirement, leave encashment up to Rs. 25 lakhs for a maximum of 10 months is tax-free under Section 10(10AA).

Capital Gains Exemption Limits

The government has set a limit of Rs. 10 crores. on claiming capital gains tax exemption under Section 54 to Section 54F. Previously, there was no such limit.

Also Read: Taxability of Capital Assets in India

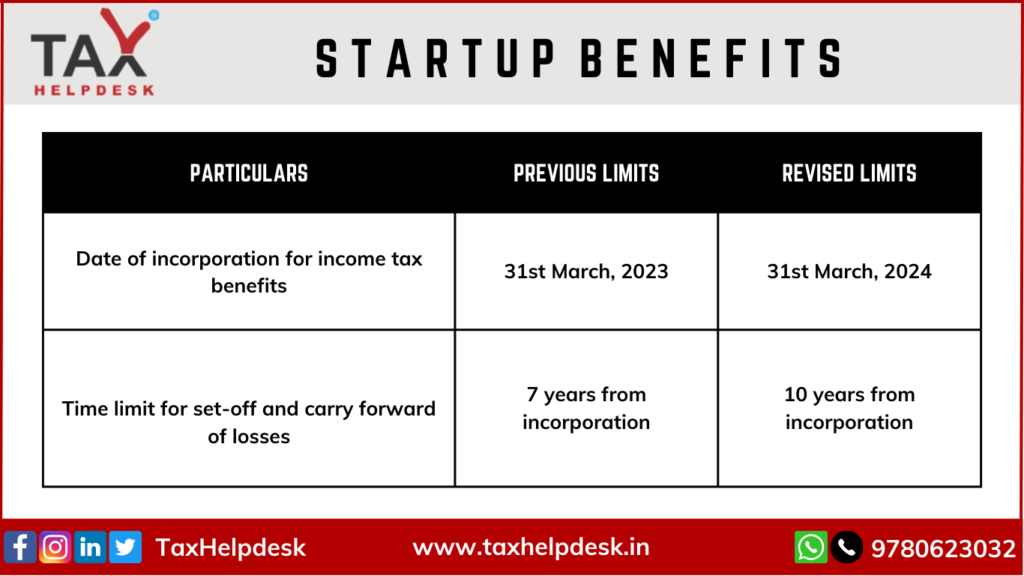

Startups

There is an extension of the benefits to the startup through the Union Budget, 2023. This is as follows:

Cooperative Societies

New manufacturing initiatives: There is an extension of a 15% concessional tax rate benefit to new cooperatives that start production by March 31, 2024.

Sugar cooperatives: They can now claim the expenditure that was disallowed to them prior to 2016-17, by making an application to the assessing officer.

What are your views regarding the Union Budget, 2023? Do let us know in the comments section. To know more about Budget 2023, you can follow us on Facebook, Instagram, LinkedIn and Twitter.