TDS on interest on Fixed Deposits is applicable if the income from fixed deposits exceeds a certain threshold limit. Having said this, the threshold limit for the deduction of TDS on FDs is dependent upon the age of the FD holder.

TDS on Interest on Fixed Deposits: Why Is It Taxable?

The interest income that you earn from the FDs becomes a part of your total taxable income. That is to say that there is clubbing of income from FDs interest with your annual income. Therefore, if the interest amount exceeds the threshold limit, there is deduction of TDS on interest on fixed deposits.

Also Read: Tax Saving Fixed Deposit : 12 Things You Should Know

Threshold Limit for Deduction of TDS

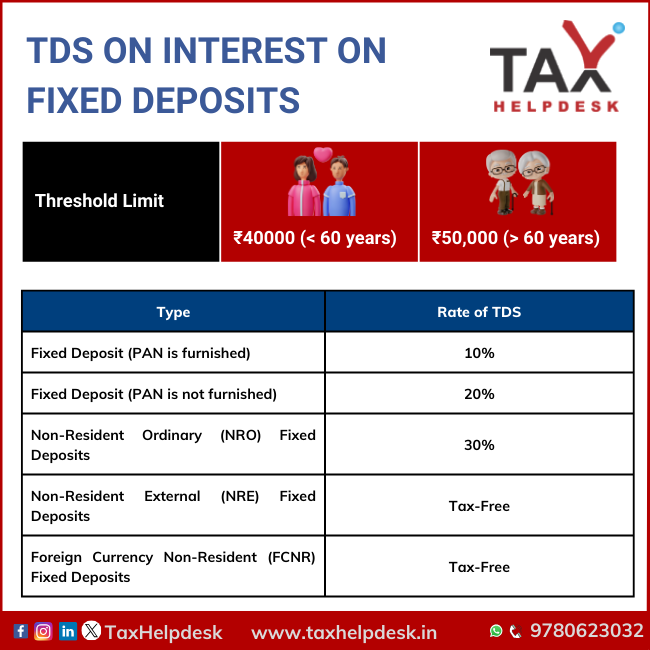

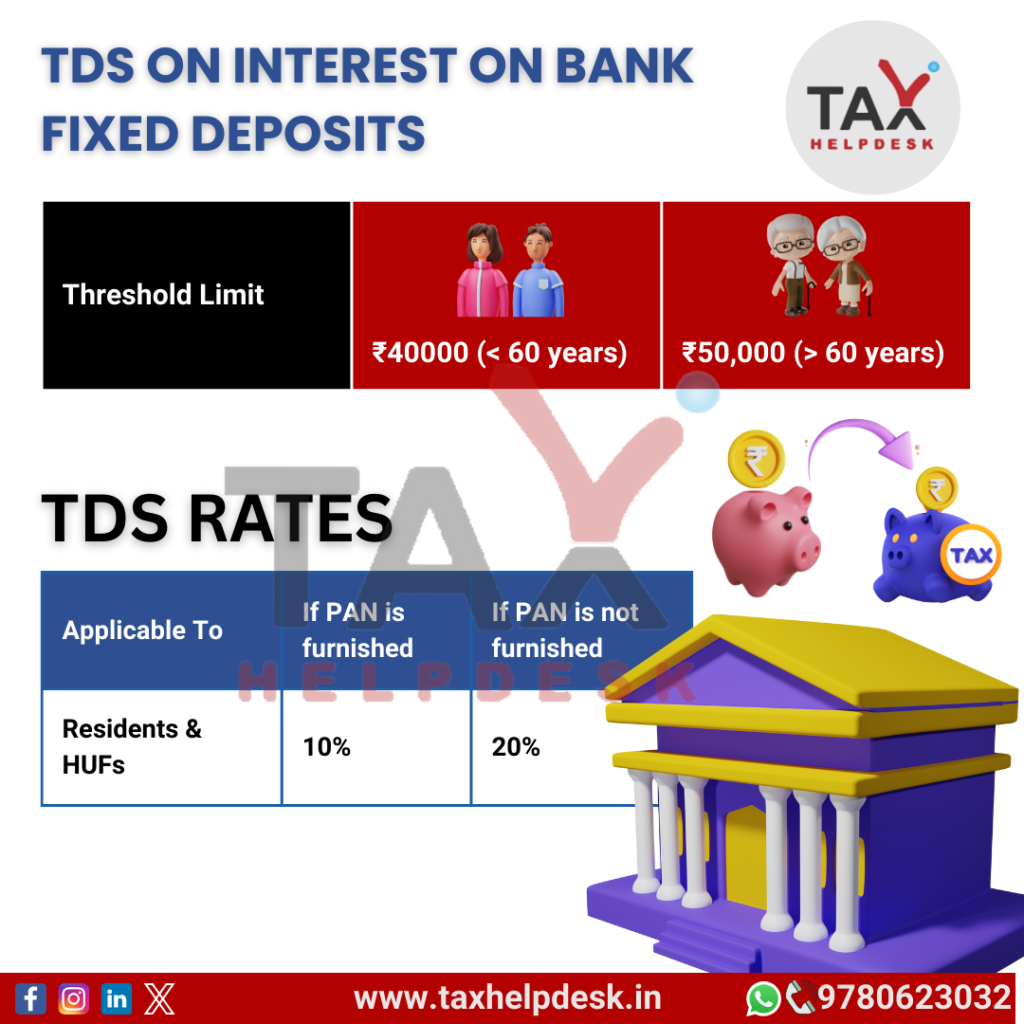

The threshold limit for deduction of TDS on interest on fixed deposits is as follows:

| AGE | THRESHOLD LIMIT | |

|---|---|---|

|

Below 60 years | ₹40,000 |

|

Above 60 years | ₹60,000 |

Note:

In case of NBFCs, the threshold limit for deduction of TDS is Rs. 5,000.

Who Deducts TDS on Interest on FDs?

The person responsible to deduct TDS on interest on FDs is the one where the FD holder deposits FDs. So, the person liable to deduct TDS can be either of the following:

– Banks

– Post Offices

– Non-Banking Financial Companies.

Also Read: Deductions on Interest on Deposits in Savings Account: Section 80TTA

What is the rate of TDS applicable on Interest on Fixed Deposits?

| Type | Rate of TDS |

|---|---|

| Fixed Deposit (PAN is furnished) | 10% |

| Fixed Deposit (PAN is not furnished) | 20% |

| Non-Resident Ordinary (NRO) Fixed Deposits | 30% |

| Non-Resident External (NRE) Fixed Deposits | Tax-Free |

| Foreign Currency Non-Resident (FCNR) Fixed Deposits | Tax-Free |

Do You Need to Pay TDS Even If Your Income Is Below The Basic Exemption Limit?

In case, your income is below the basic exemption limit, then in order to prevent deduction of TDS from banks/post 0ffices, you need to submit Form 15G/Form 15H to the deductor.

Also Read: Know rules related to premature withdrawal of fixed deposits

Forms 15G and 15H are self-declaration forms that indivuiduals can submit to avoid TDS on specific income. Having said that, Form 15G is for individuals below 60 years while Form 15H is for senior citizens (above 60 years).

If the total income is below the taxable limit, the individuals can make use of these forms to declare that no tax is payable.

Further, by submitting these forms, individuals can save TDS on interest income from Fixed Deposits (FDs), Recurring Deposits (RDs) as well as other sources ensuring they receive the full amount without any tax deduction.

The basic exemption limit is as follows:

Individuals

AGE GROUP

OLD TAX REGIME

NEW TAX REGIME

Individuals below 60 years

₹2,50,000

₹3,00,000

Individuals between 60 – 80 years

₹3,00,000

₹3,00,000

Individuals above 80 years

₹5,00,000

₹3,00,000

Note:

In case, the individual opting for old tax regime has taxable income of Rs.5 lacs (Rs. 7 lacs in case of new tax regime), then he is eligible for tax rebate under Section 87A. Accordingly, such individuals can also prevent themselves against the deduction of TDS on interest on FDs.

Illustration: Individuals below 60 years age

| Name | Age | Income | Interest on Fixed Deposits | Threshold Limit for TDS Deduction | PAN | TDS Rate | Form 15G/Form 15H |

|---|---|---|---|---|---|---|---|

| Alia | 25 | ₹2,20,00 | ₹35,000 | ₹40,000 | Available | N/A | N/A |

| Deepika | 30 | ₹2,45,000 | ₹45,000 | ₹40,000 | Not Available | 20% | Should submit Form 15G since her age is below 60 years and has income below exemption limit. |

| Sonam | 35 | ₹4,75,000 | ₹49,000 | ₹40,000 | Available | 10% | Should submit Form 15G since her age is below 60 years and has income below Rs. 5 lacs, wherein she can claim the tax rebate. |

| Aishwarya | 40 | ₹5,25,000 | ₹59,000 | ₹40,000 | Not Available | 20% | Not applicable. Since her income is above the basic exemption limit. |

Illustration: Individuals below 60 years age

| Name | Age | Income | Interest on Fixed Deposits | Threshold Limit for TDS Deduction | PAN | TDS Rate | Form 15G/Form 15H |

|---|---|---|---|---|---|---|---|

| Sharukh | 61 | ₹3,20,00 | ₹45,000 | ₹50,000 | Available | N/A | N/A |

| Salman | 65 | ₹3,45,000 | ₹55,000 | ₹50,000 | Not Available | 20% | Should submit Form 15H since his age is above 60 years and has income below exemption limit. |

| Amir | 70 | ₹4,75,000 | ₹60,000 | ₹50,000 | Available | 10% | Should submit Form 15H since his age is above 60 years and has income below exemption limit. |

| Akshay | 72 | ₹5,25,000 | ₹59,000 | ₹40,000 | Not Available | 20% | Not applicable. Since his income is above the basic exemption limit. |

Be a part of our WhatsApp Community and stay updated with the amendments wrt to taxation & financial compliances.