Updated Income Tax Return provision was introduced through the Union Budget, 2022. Thereby, there is an insertion of a new section namely Section 139(8A) in the Income Tax Act by Finance Act, 2022.

What is Updated Income Tax Return?

Updated Income Tax Return or ITR-U, as the name suggests is to update the already filed Income Tax Return or file the previous returns, if they have not been filed earlier. Through this ITR, the taxpayers can update their ITR of the last two assessment years. Therefore, as of now, returns for 2021-22, 2022-23 and 2023-24 fiscals can be updated. The filing, however, requires stating payment of additional tax. Further, the taxpayer will also have to give reasons for updating the income tax return.

Also Read: Do I need to file Income Tax Return?

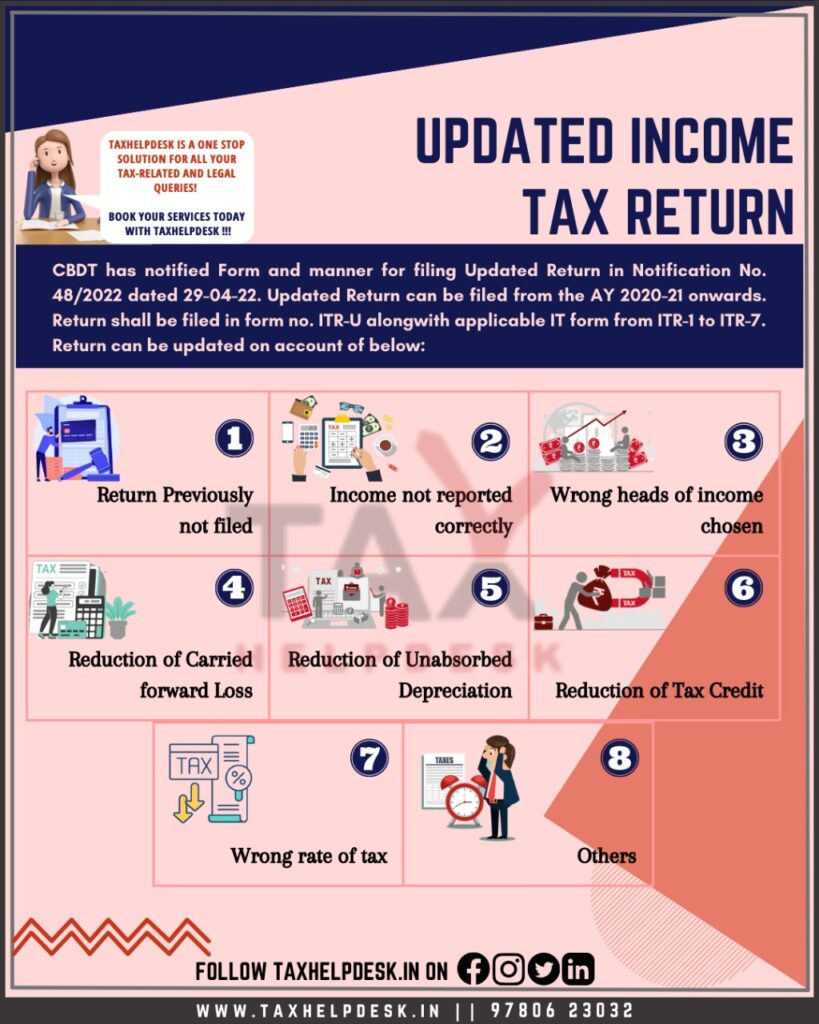

Cases where ITR-U can be filed

Following are the cases wherein filling of ITR-U is possible:

– Return previously not filed

– Incorrect reporting of income

– Incorrect choosing of the head of income

– Reduction of carried forward loss

– Reduction of unabsorbed depreciation

– Tax credit reduction

– Wrong rate of tax

– Any other case

Also Read: Know Reasons Why You Should File Your Income Tax Return

Cases where Updated Income Tax Return cannot be filed

The filing of ITR-U is not possible in the following cases:

– If there is decreasing tax liability or increasing refund or claiming losses due to the return

– If any assessment or reassessment proceedings are due with respect to the assessee for these assessment years

– When an investigation has been done with respect to the assessee, then for every assessment year and the assessment year before these assessment years

– If any prosecution proceedings are due for these assessment years.

– When any data from a foreign jurisdiction is obtained under the tax treaty and that is discussed by the assessee for the related assessment year.

– The tax officer poses the data beneath several acts such as smugglers, Benami, black money, money laundering, and others, and that is told to the assessee

– CBDT mentions that these assessees shall not qualify to furnish the updated return

Also Read: Avoiding Mistakes & Errors While Filing Income Tax Return

Refund in case of filing of Updated Income Tax Return

Refund in case of filing of ITR-U has three cases

– Firstly, where no ITR was filed prior to the updated return

– Secondly, earlier ITR was filed but there was no refund

– Thirdly, earlier ITR was filed and there was refund

Where no ITR was filed prior to the updated return

If no return was filed prior to the updated return and the updated return is the first return for the assessment year, then no refund can be claimed in the updated return.

Earlier ITR was filed but there was no refund

If earlier returns were filed under Sections 139(1), 139(4), 139(5) and no refund was there, then in the updated return also no refund can be claimed.

Earlier ITR was filed and there was refund

If earlier returns were filed under Sections 139(1), 139(4), 139(5) and a refund was there, then the refund can be there in the updated return but it should not be more than the refund in earlier returns. It can be at the same amount or less amount in the updated return.

Also Read: Documents to be submitted to the employer to claim tax benefits

FAQs

A taxpayer would be permitted to file only one updated return per assessment year.

Only amount of income to be offered to tax is to be specified under the prescribed income heads. No break-up of income or any details information is required to be submitted, unlike the regular ITR forms. Further, the exact reason for filing the updated return is to be submitted in the form itself.

If there is an ongoing prosecution proceeding by issuing notice for a particular Assessment Year, taxpayers cannot avail updated return benefits in that particular year.

If a taxpayer files an updated return and does not pay the additional taxes, then the return will be invalid.

The additional tax liability for filing of ITR-U is 25% or 50%. 25% additional tax liability is applicable where the filing of ITR is within a year (12 months) from the end of relevant assessment year. Whereas, 50% additional tax liability is applicable if the filing of ITR is after a year (12 months) but before 24 months from the end of relevant AY.

If want to update your Income Tax Return, then drop a comment in the comments section below. You can also DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on Telegram!

Disclaimer: The views of the author are personal. TaxHelpdesk owes no liability for any matter whatsoever!