Tax rebate is the refund of taxes if the tax liability of individual is less than the taxes paid. In other words, by way of the rebate, the individual gets back the whole amount of taxes at the end of the financial year. Having said that, the rebate is different from the basic exemption limit.

Tax rebate under the tax regimes

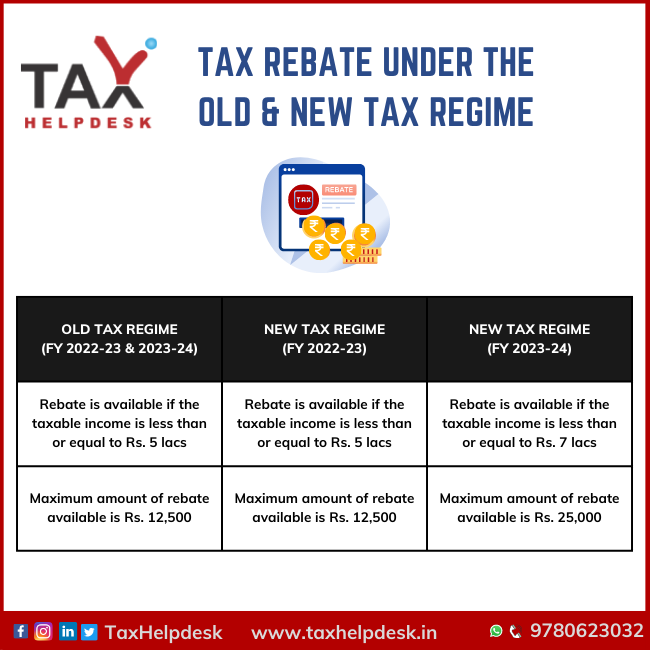

Until the Financial Year 2022-23, the rebate limit under the old as well as the new tax regime. The taxpayers choosing any of the regimes till this financial year would be eligible for a rebate of up to Rs. 12,500, if their income does not exceed Rs. 5 lacs.

New rebate limit of Tax under the New Tax Regime

Through the Union Budget, 2023, there is an increase in tax rebate limit under the new tax regime. The individuals opting for new tax regime and having a taxable income of up to Rs. 7 lacs can claim a rebate of upto Rs. 25,000 under Section 87A. In other words, the limit under the new tax regime has been increased from Rs. 12,500 to Rs. 25,000 under the new tax regime.

Therefore, if an individual opts for the new tax regime in the Financial Year 2023-24 and his taxable income does not Rs. 7 lacs. Then he will be eligible to claim a rebate of up to Rs. 25,000.

Rebate limits under the Old Tax Regime

Under the old tax regime, there is no change in the rebate limit under Section 87A. Therefore, if an individual opting for the old tax regime can claim a rebate of up to Rs. 12,500 only if his taxable is up to Rs. 5 lacs.

How to claim Rebate benefits?

The tax rebate benefits can be claimed by following the steps below:

1. Calculate your gross total income for the relevant financial year

2. Reduce all the exemptions, allowances as well as deductions (including standard deduction)

3. Declare this income while filing your Income Tax Return

4. If you have opted for new regime and your taxable income is less than Rs. 7 lacs, then you can claim rebate of Rs. 25,000 or amount of taxes paid, whichever is less.

5. However, if you have opted for old regime and your taxable income is less than Rs. 5 lacs, then you can claim rebate of Rs. 12,500 or amount of taxes paid, whichever is less.

Illustration

| Particulars | Income under Old tax regime (Financial Year 2022-2023) (in Rs.) | Earnings or Income under New tax regime (Financial Year 2022-2023) (in Rs.) | Income under the Old Tax Regime (Financial Year 2023-24) (in Rs.) | Income under the New Tax Regime (Financial Year 2023-24) (in Rs.) |

|---|---|---|---|---|

| Gross Total Income | 6,00,000 | 5,00,000 | 7,00,000 | 7,00,000 |

| Standard Deduction | 50,000 | N/A | 50,000 | 50,000 |

| Deductions under Section | 1,50,000 | N/A | 1,50,000 | N/A |

| National Pension Scheme deduction | 50,000 | 50,000 | 50,000 | 50,000 |

| Total Income | 3,50,000 | 4,50,000 | 5,00,000 | 6,00,000 |

| Income Liable to Tax at Normal Rate | 5,000 | 10,000 | 10,000 | 15,000 |

| Rebate under Section 87A | 5,000 | 10,000 | 10,000 | 15,000 |