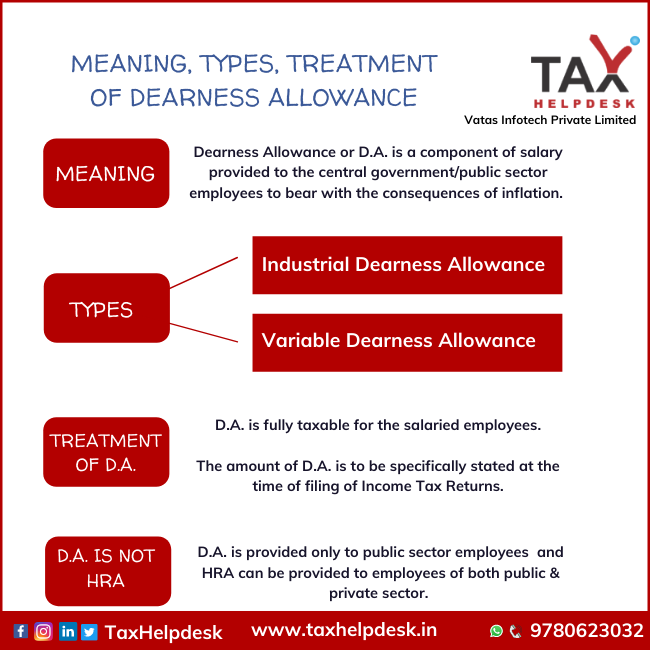

Dearness Allowance under income tax act or D.A. essentially is considered to be as a component of salary, which is some fixed percentage of the basic salary. It is provided to the central government/public sector employees to bear with the consequences of inflation. Furthermore, the D.A varies from place to place and sector in which the employee is employed.

Types of Dearness Allowances under income tax act

There are two separate categories to calculate Dearness Allowance namely Industrial and Variable Dearness Allowance.

Industrial Dearness Allowance

Industrial dearness allowance or IDA is an allowance which is applicable to employees of public sector enterprises. D.A. for public sector enterprises is revised quarterly based on the relevant period’s Consumer Price Index (CPI), so as to compensate for the rising inflation in the country.

Variable Dearness Allowance

VAD or Variable dearness allowance is an allowance that is calculated every six months for central government employees. The calculation is arrived at by taking into consideration the Consumer Price Index, Base Index and variable DA amount fixed by the Government of India. Based on this calculation, the DA of employees is revised and rolled out.

Click here to know the Consumer Price Index for relevant period

Note:

Consumer Price Index is subject to change every month.

Base Index remains fixed for a particular period of time.

Variable DA amount that has been fixed by the Government remains fixed unless the government revises the basic minimum wages.

Also Read: Income Tax Slab Rates For Individuals Under The Old And New Tax Regime

Current Rate of Dearness Allowance for Central Government employees

The current rate of Dearness Allowance is 28%. Earlier this rate was 11%. The minimum basic pay recommended for Central Government Employees at the entry-level by the 7th Pay Commission is Rs 18,000. Therefore, the Central Government employees will get at least at Rs. 5040 as D.A. during each financial year.

Calculation of Dearness Allowance

D.A. is calculated as follows:

For Central Government employees:

Dearness Allowance % = ((Average of All India Consumer Price Index (Base Year 2001 = 100) for the past 12 months -115.76)/115.76)*100

For Central public sector employees:

Dearness Allowance % = ((Average of Average of All India Consumer Price Index (Base Year 2001=100) for the past 3 months -126.33)/126.33)*100

Treatment of Dearness Allowance under Income Tax

D.A. is fully taxable for the salaried employees. In cases where the employee has been provided with an unfurnished rent-free accommodation, it becomes that part of the salary up to which it forms the retirement benefit salary of the employee, provided that all other pre-conditions are met. The amount of D.A. is to be specifically stated at the time of filing of Income Tax Returns.

Also Read: Special Allowances Under Income Tax

Is Dearness Allowance and House Rent Allowance, a same thing?

The answer to this question is a big NO! Dearness Allowance under income tax act and House Rent Allowance are not a same thing. The D.A. is provided only to the public sector employees whereas, HRA can be provided to employees of both public and private sector. Additionally, there are certain Tax exemptions applicable to HRA which are not available for the DA.

If you still have more doubts about D.A., then simply drop a message in the chatbox or leave a comment in the comment box. You can also drop us a message on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Rules related to EPF Withdrawal | TaxHelpdesk

Pingback: Know all the Rules related to EPF Withdrawal | TaxHelpdesk