The GST Council determines the GST slab rates for both goods and services. Additionally, the GST Council also reviews these slab rates on a regular basis.

What are GST Slab Rates?

GST slab rates are the rates of taxes imposed on sale of the goods or services under the CGST, SGST and IGST Acts. The rate of tax under the CGST and SGST are almost the same as they are intra-state transactions. Whereas, the rate of tax under the IGST is the sum total of CGST and SGST (approx.) and is an inter-state transaction.

These GST slab rates classification is into 5 rates namely

0%

5%

12%

18%

28%

GST Slab Structure

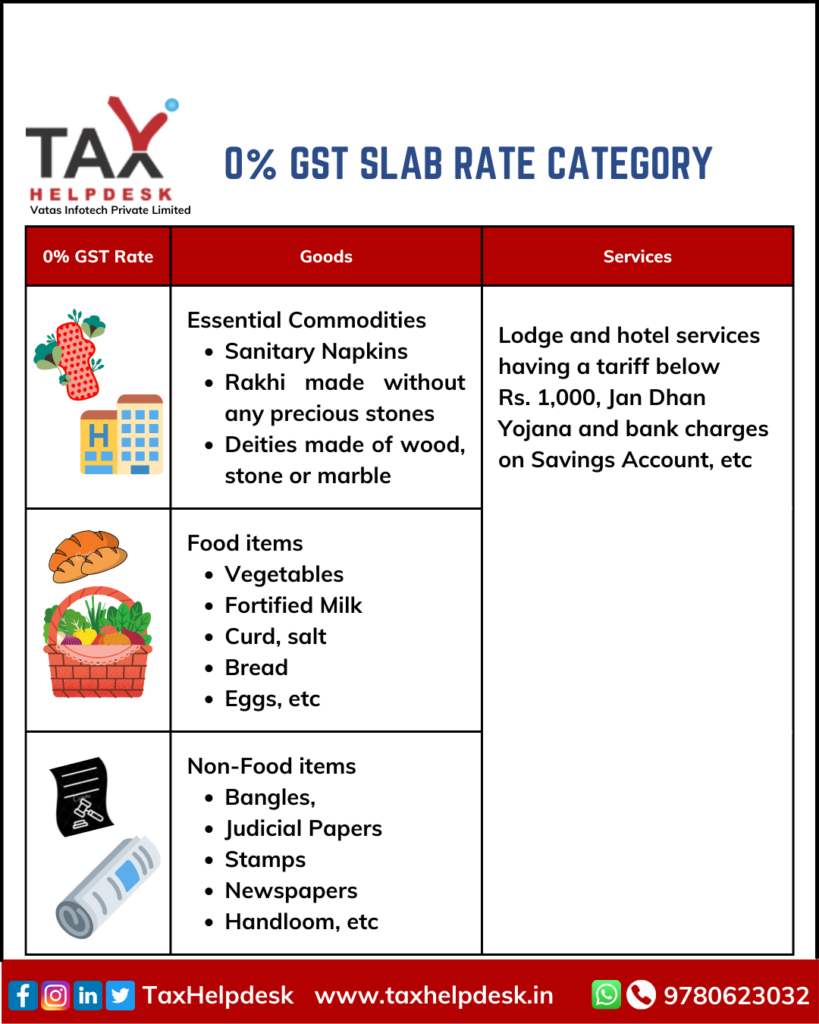

0% GST Slab Rate Category

The goods and services that attract no tax i.e., 0% GST are as follows:

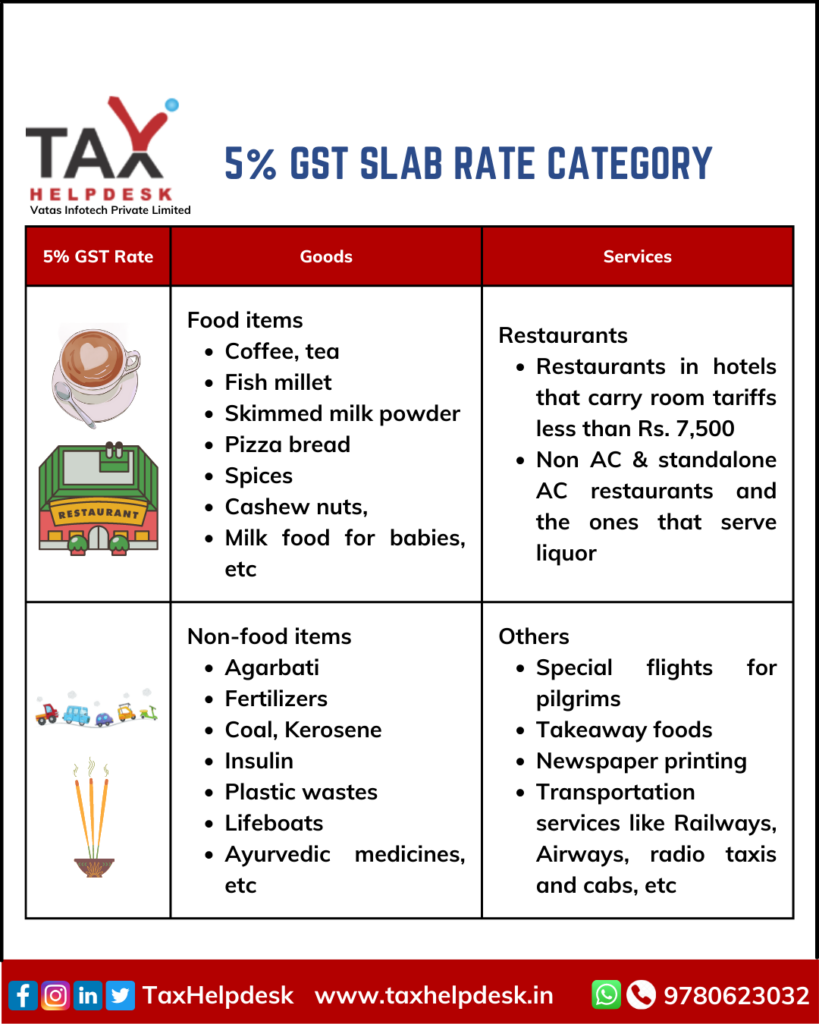

5% GST Slab Rate Category

List of goods and services on which 5% GST rate is applicable are as follows:

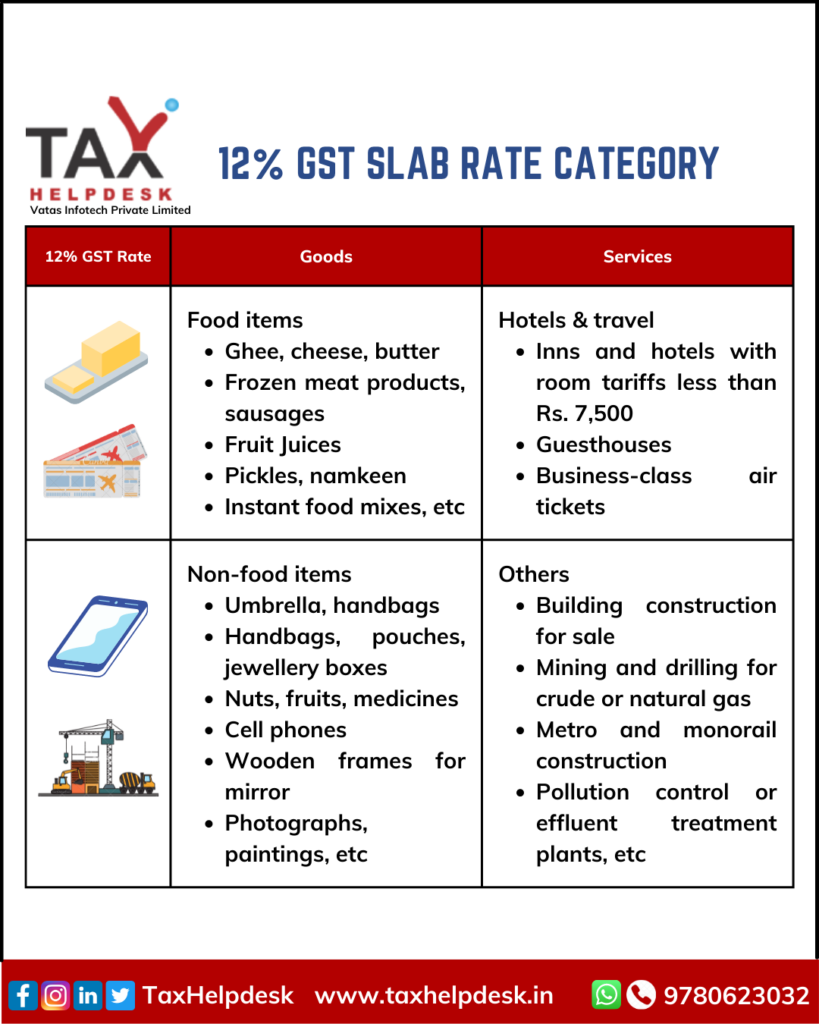

12% GST Slab Rate Category

12% GST is attracted on the followed goods and services:

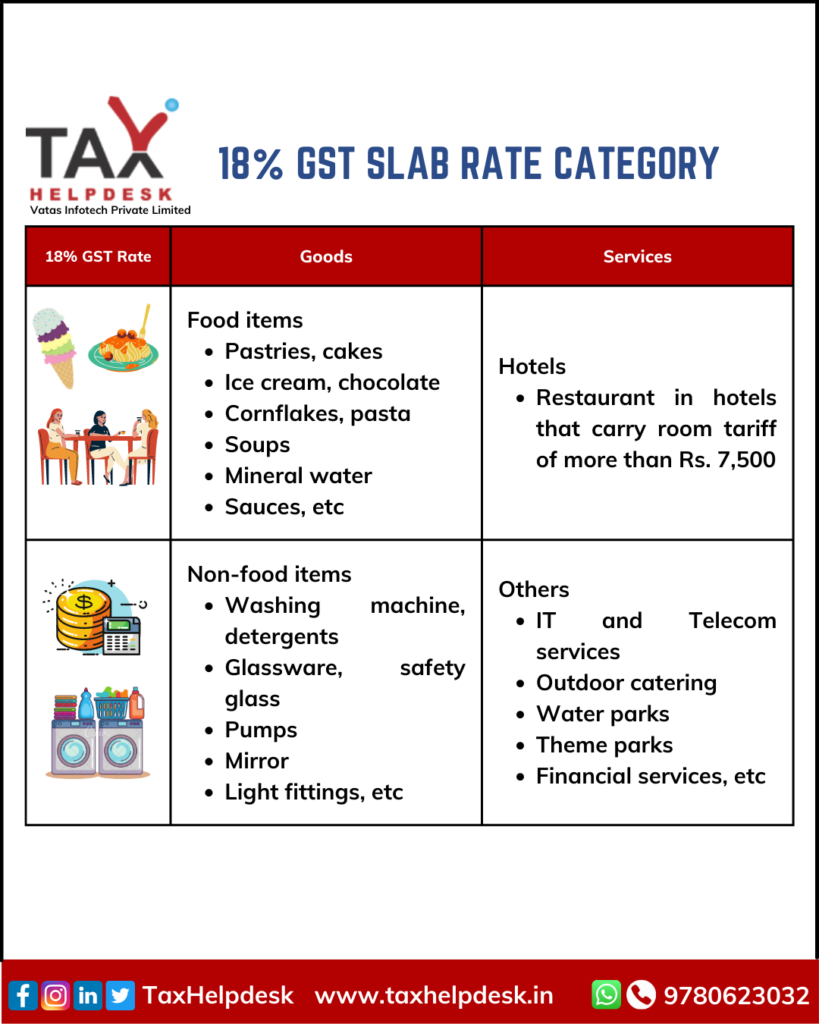

18% GST Slab Rate Category

Goods and services that attract 18% GST rate are as follows:

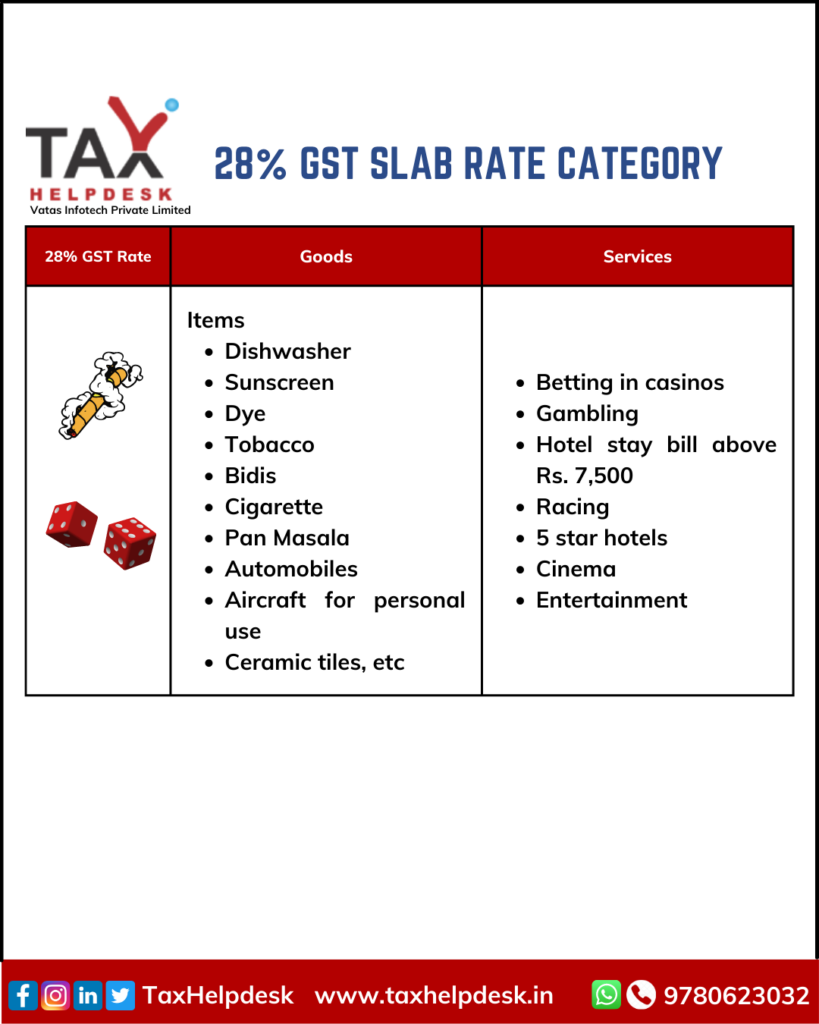

28% GST Slab Rate Category

Luxury items or items which are not a necessity usually attract 28% GST rate. The list of goods and services which attract 28% GST are as follows:

Latest GST Slab Rates Revisions

The revisions in GST slab rates have been made through the following GST Council Meetings:

– Firstly, 45th GST Council Meeting

– Secondly, 44th GST Council Meeting

– Thirdly, 43rd GST Council Meeting

– Lastly, 42nd GST Council Meeting

45th GST Council Meeting

45th GST Council was held on 17th September 2021. Accordingly, the amendments in GST rates are as follows

Extension of existing concessional rates on COVID-19 medicines

| Medicines | GST Rate recommended by GST Council |

|---|---|

| Tocilizumab | Nil |

| Amphotericin B | Nil |

| Anti-Coagulants like Heparin | 5% |

| Remdesivir | 5% |

| Any other drug recommended by the Ministry of Health and Family Welfare (MoHFW) and Dept. of Pharma (DoP) for Covid treatment | 5% |

Reduction of GST rates on COVID-19 medicines

| Medicines | Present GST Rate | GST Rate Recommended by GST Council |

|---|---|---|

| Itolizumab | 12% | 5% |

| Posaconazole | 12% | 5% |

| Infliximab | 12% | 5% |

| Favipiravir | 12% | 5% |

| Casirivimab & Imdevimab | 12% | 5% |

| 2-Deoxy-D-Glucose | 12% | 5% |

| Bamlanivimab & Etesevimab | 12% | 5% |

GST Rates on other goods

| Description | Present GST Rate | GST Rate recommended by GST Council |

|---|---|---|

| Ores and concentrates of metals such as iron, copper,aluminum, zinc, and few others | 5% | 18% |

| Specified Renewable Energy Devices and parts | 5% | 12% |

| Cartons, boxes, bags, packing containers of paper, etc. | 12%/18% | 18% |

| Waste and scrap of polyurethanes and other plastics | 5% | 18% |

| All kinds of pens | 12%/18% | 18% |

| Railway parts, locomotives & other goods in Chapter 86 | 12% | 18% |

| Miscellaneous goods of paper like cards, catalogs,printed material (Chapter 49 of tariff) | 12% | 18% |

| IGST on import of medicines for personal use, namelyZolgensma for Spinal Muscular AtrophyViltepso for Duchenne Muscular DystrophyOther medicines used in the treatment of muscular atrophy are recommended by the Ministry of Health and Family Welfare and the Department of Pharmaceuticals. | 12% | Nil |

| IGST exemption on goods supplied at Indo-Bangladesh Border | Applicable rate | Nil |

| Unintended waste generated during the production of the fish meal except for Fish Oil | Nil (for theperiod 1.7.2017 to 30.9.2019) |

GST Rates on other services

| Service | GST Rate |

|---|---|

| Coaching services to students provided by coaching institutions and NGOs under the central sector scheme of ‘Scholarships for students with Disabilities” | Exempt |

| Services by cloud kitchens/central kitchens are now covered under ‘restaurant service | 5% |

| Ice cream by parlors | 18% |

| Overloading charges at toll plazas | Exempt |

| Renting of vehicles by state transport undertakings and local authorities is now covered by the expression ‘giving on hire’ | Exempt |

| Grant of mineral exploration and mining rights | 18% |

| Admission to amusement parks with rides, etc. | 18% |

| Admission to facilities that have casinos | 28% |

| Alcoholic liquor for human consumption is not food and food products for the entry prescribing the 5% GST rate on job work services about food and food products. | NA |

44th GST Council Meeting

The revisions in GST rates through the 44th GST Council Meeting was in relation to COVID-19 items. The changes are as follows:

| Items | Old rate | Proposed rate |

|---|---|---|

| Tocilizumab | 5% | Nil |

| Amphotericin-B | 5% | Nil |

| Remedesivir | 12% | 5% |

| Anti-coagulants like Heparin | 12% | 5% |

| Any other drug (recommended by the Ministry of Health and Family Welfare (MoHFW) and the Dept. of Pharma (DoP) for COVID-19 treatment) | Existing rate | 5% |

| Medical Grade Oxygen | 12% | 5% |

| Oxygen concentrators/ generators (which include personal imports) | 12% | 5% |

| Ventilators and ventilator masks/ cannula/ helmets | 12% | 5% |

| BiPaP machine | 12% | 5% |

| High flow nasal cannula device | 12% | 5% |

| Pulse oximeters | 12% | 5% |

| COVID-19 testing kits | 12% | 5% |

| Specified Inflammatory Diagnostic Kits, namely D-Dimer, IL-6, Ferritin and LDH | 12% | 5% |

| Hand sanitiser | 18% | 5% |

| Temperature checking equipment | 18% | 5% |

| Gas/electric/other furnaces for crematoriums, including their installation, etc | 18% | 5% |

| Ambulances | 28% | 12% |

43rd GST Council Meeting

– GST on the export of relief goods will be exempted and will stay in effect until 31 August 2021.

– GST on the import of certain medicines are also placed under the exemption list.

– Any Covid-related relief item that’s been imported with the intention of donating to the government or any relief organization will be exempted from IGST till 31 August 2021.

– Amnesty Scheme was announced by the finance minister to reduce late fee returns. Small taxpayers can file GST returns under this scheme.

42nd GST Council Meeting

Sanitisers that are non-alcoholic will continue to be taxed at 18% GST.

Wish to know about GST, then drop a comment in the comments section below. You can also DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on Telegram!

Disclaimer: The views of the author are personal. TaxHelpdesk owes no liability for any matter whatsoever!