TDS under GST is required to be deducted by registered persons while making payment to the registered suppliers. Consequently, the TDS amount so deducted is to be deposited with the government.

Who has to deduct TDS under GST?

As per the TDS provisions under GST, the following persons are responsible for deduction of TDS under GST

– A department or establishment of the Central Government or State Government, or

– Local authority, or

– Governmental agencies, or

– Such persons or categories of persons as may be notified by the Government.

In addition to the above, as per the notification on the date 13th September, 2018, following entities also need to deduct TDS:

– An authority or a board or any other body set up by a Parliament or a State Legislature or by a government with 51% equity (control) owned by the government

– A society under the establishment of Central or any State Government or local authority and the society which has registration under the Societies Registration Act, 1960

– Public Sector Undertakings

Also Read: GST Registration for Multiple Businesses

When does deduction of TDS take place?

The deduction has to take place where the total value of taxable goods or services, under an individual contract, exceeds Rs. 2,50,000. Furthermore, the TDS rate under GST that is applicable is 2%.

Also Read: Works Contract under GST

On what amount is TDS applicable?

For TDS deduction, the value of supply is the amount excluding the tax on the invoice. This means there is no deduction of TDS on the CGST, SGST or IGST component of the invoice.

Also Read: Rules related to setting off of Input Tax Credit

For example, supplier BSNL makes a supply worth Rs. 10,000 to Ramit. The rate of GST is 5%. When Ramit pays BSNL, he/she will pay Rs. 10,000 (worth of Supply) + Rs. 500 (GST) to BSNL and Rs. 200 (RS. 10,000*2%) as TDS to the government. Therefore, in simple words, there is no deduction of TDS on the tax element (GST) of a transaction.

Cases where there is no deduction of TDS under GST

As per the TDS provisions under GST, there is no deduction of TDS under GST if the location of the supplier and the place of supply is in a State or Union Territory which is different from State or Union Territory of the recipient.

Registration requirements for TDS deductors

The TDS provisions under GST states that a person who is liable to deduct TDS has to compulsorily register and there is no threshold limit for this. Furthermore, the person can obtain GST Registration without PAN and by using the existing Tax Deduction and Collection Account Number (TAN). Thus, having a TAN is mandatory.

Due date of deposit of TDS to the Government

The due date of deposit of TDS by the deductor is 10th of the succeeding month. Consequently, the payment shall be made to the appropriate government, which is

– Central Government in the case of IGST and CGST

– State Government in the case of SGST

Also Read: GST e-way bill [Ultimate Guide]

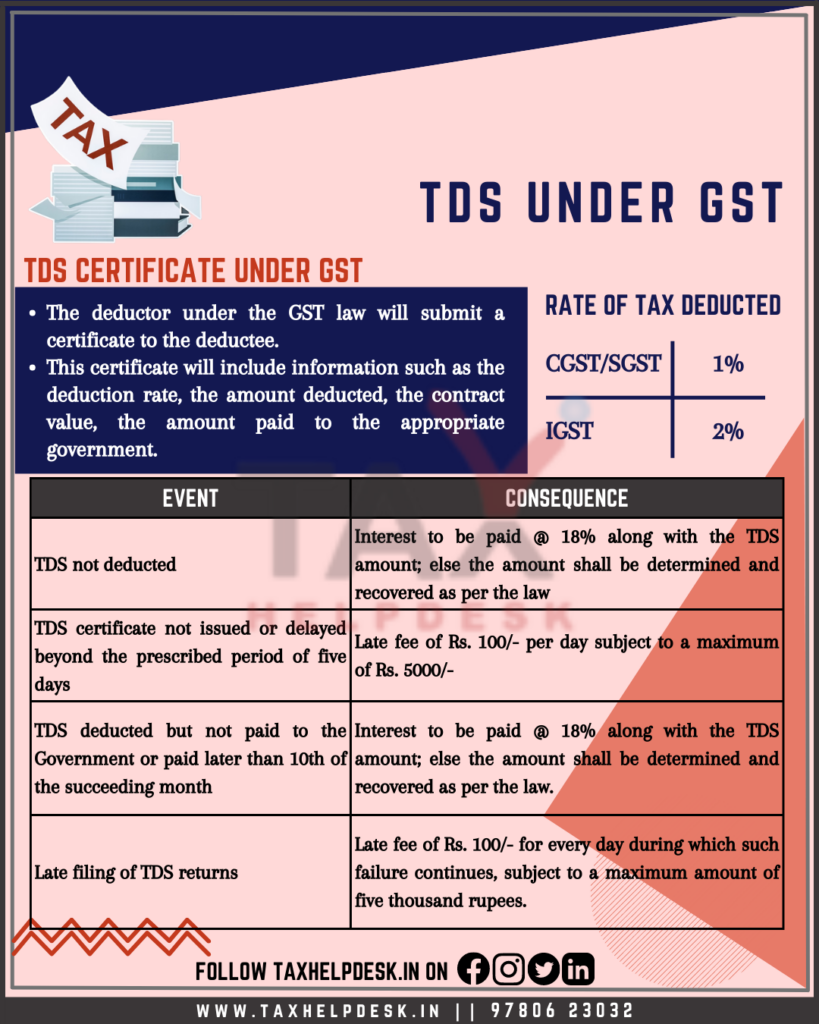

Issuance of TDS certificate under GST law

Similar to the Income Tax laws, the person deducting tax under GST has to issue the TDS certificate under GST. The TDS Certificate under GST is Form GSTR-7A. GSTR-7A is to be issued to the concerned person within 5 days of depositing the tax to the government. However, GST portal will automatically make GSTR-7A available to the deductee on the basis of GSTR-7 filed.

Penalties for not complying with TDS provisions under GST

| Non-Compliance | Penalty |

|---|---|

| Failure to Deduct TDS | 100% of the amount not deducted as TDS |

| Failure to Deposit TDS to Government | Interest at the rate of 18% per annum, calculated from the due date until the actual deposit date. |

| Non-Filing of TDS Return within the due date | Late fee of ₹100 per day, subject to a maximum of ₹5,000. |

| Furnishing Incorrect TDS Return or Information | Penalty of ₹10,000 or an amount equal to the tax evaded or input tax credit availed, whichever is higher. |

| Failure to Issue TDS Certificate to the Deductee | Penalty of ₹10,000 for each failure to issue a TDS certificate. |

| Failure to Furnish TDS Statement to the Government | Penalty of ₹100 per day, subject to a maximum of the total TDS amount. |

Also Read: Penalty Under GST Act Detailed Guide By TaxHelpdesk

Conclusion

| Scenario | TDS Deduction under GST |

|---|---|

| Purchase of Goods or Services from a Vendor | TDS will be deducted by the recipient |

| Payment to a Contractor for Works Contract | TDS will be deducted by the principal |

| Rent Payment for Immovable Property | TDS will be deducted by the tenant |

| Payment for Professional or Technical Services | TDS will be deducted by the recipient |

| Payment to Government Departments | TDS will be deducted by the payer |

| Payment to Non-Resident or Foreign Company | TDS will be deducted by the payer |

| Intra-state Purchase of Goods or Services | TDS is not applicable for intra-state supplies |

| Purchase from Unregistered Vendors | TDS is not required for purchases from unregistered vendors |

| Payments below the Threshold Limit | TDS is not applicable if the payment is below the specified threshold limit |

| Personal Use or Consumption | TDS is not applicable for personal use or consumption |

If you want to know more about GST or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!