The due date of filing of Income Tax Return is almost around the corner. If you are the one who has not filed the Income Tax Return for the current filing period, then read this blog to know mistakes and errors to be avoided while filing the ITR.

Considering the fact that the new Income Tax Portal came into existence from the current filing season, there are chances of committing mistakes by persons because everybody is new to this Income Tax Portal.

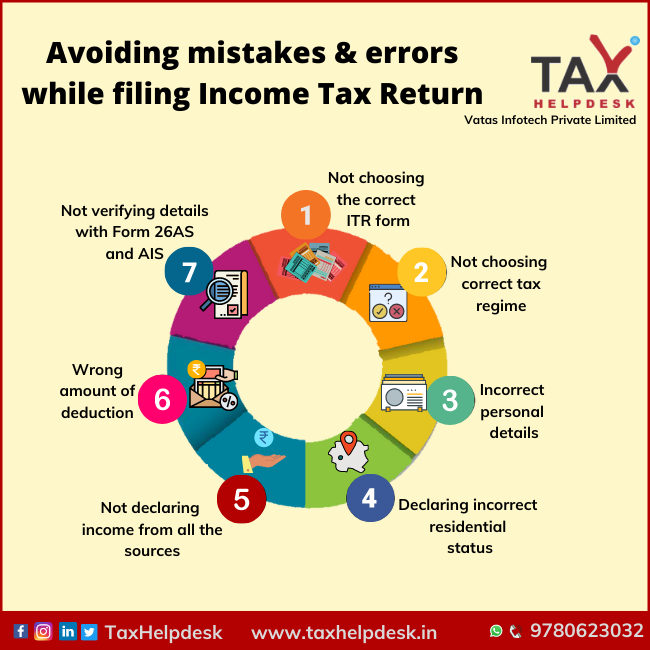

List of Common Mistakes & Errors to be avoided while filing Income Tax Return

– Not choosing the correct ITR form

– Not choosing the correct tax regime

– Incorrect personal details

– Declaring incorrect residential status

– Not declaring income from all the sources

– Not declaring correct amount for deduction under Chapter VI-A

– Not verifying details with Form 26AS and Annual Information Statement

Not choosing the correct Income Tax Return form

For filing of Income Tax Return, choosing of ITR form is the foundation step. The ITR form explains the details of income earned in a relevant financial year and it is to be filed compulsorily in case the income of the person exceeds the exemption limit of Rs. 2.5 lacs. Having stated that, if the return is filed through incorrect ITR form, then the whole return can be treated as a defective and if not corrected, then it will be classified as person has not filed the ITR at all. In such a case, the person will also have to bear penalties.

Also Read: Do I need to file Income Tax Returns?

The following table represents which ITR should a person choose before filing return:

Not choosing the correct tax regime

From the current filing season (FY 2020-2021 | AY 2021-2022), the individuals and HUFs are given an option to choose between the old and the new tax regime. If the person opts for the new tax regime (lower tax slab rates), then he will have to forego majority of the exemptions and deductions, which however, will continue to remain available under the old tax regime. It is the duty of the person filing return to see which regime suits him better and accordingly choose the option.

Note:

If you have not made any investments for the current financial year and do not have income from many sources, then you must opt for the new tax regime.

Also Read: Which Tax Regime Suits You : Old or New?

Incorrect personal details

Income tax filling online further requires all personal details such as PAN, Email ID, contact number, bank account number, IFSC, etc. In case even if one of these details are inappropriate, the Income Tax department can reject the e-filing because there could be a mismatch of data.

For instance, if the person has provided incorrect contact/email details, then he will not be able to verify his return through return or if at all return is verified through other ways also, the person can miss out the important messages and updates from the Income Tax department.

Not declaring correct residential status

As per the Income Tax Act, residential status of the person is determined by the number of days he has stayed in India and ultimately his tax liability is ascertained. For instance, if an Indian citizen or person of Indian origin has spent 182 days or more during the previous financial year in India, she would fall in the ‘resident’ category. However, there are several other conditions that come into play while determining whether she is resident and ordinarily resident or resident but not ordinarily resident.

If a resident Indian falsely or mistakenly shows himself as NRI/RNOR and it comes to the notice of the Income Tax Department, then he may be severely penalised for the non payment of taxes as per his true residential status.

Not declaring income from all the sources

Although now the Income Tax Return contains almost all the prefilled data, it is still the duty of the person to declare income from all the sources. The income from all the sources could be the following:

– Income from salary

– Income from house rent

– Interest on home loan

– House Rent Allowance

– Income from shares, mutual funds and dividends

– Income from fixed deposits, etc

If the person has switched jobs during the relevant financial year, then he must declare his income earned from both the jobs.

If the person fails to report income from all the sources or hides them for the purposes of saving taxes, then he get notice from the Income Tax Department. So it is always better to be safe than to be sorry!

Not declaring correct amount for deduction under Chapter VI-A

The persons while filing Income Tax Return can claim deductions under Section 80C to Section 80U of the Income Tax Act. However, while claiming these deductions the persons must mention the correct details and should not mention any amount just for the purpose of saving tax. If the person has put incorrect details to reduce his tax liability, then also there are complete chances of getting notice from the Income Tax Department. One should also make sure that the amount of the deduction is mentioned in its respective column only and must avoid all the mistakes and errors while tax filing in India.

Also Read: 10 Ways to Save Your Taxes!

Not verifying details with Form 26AS and Annual Information Statement

Lastly but not the least, while filing ITR, the person must cross check the details in his Form 26AS and Annual Information Statement. If there is any mismatch in the details of ITR and details in Form 26AS/AIS, then again he will get a notice from the Income Tax Department.

Now that you are aware of the common mistakes and errors while tax filing in India, make sure that you do not repeat them.

If you want to know more about ITR filing in India or take TaxHelpdesk’s Income consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever

Pingback: Avoiding Mistakes & Errors while filing Inc...