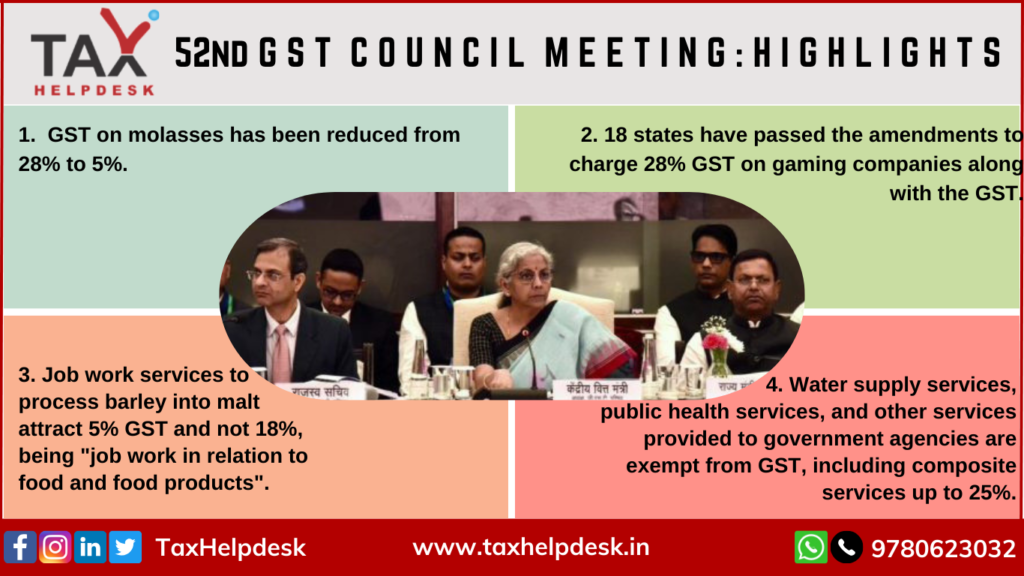

The 52nd GST Council Meeting was held on 7th October, 2023 at Sushma Swaraj Bhawan, New Delhi. Now, let us have a look at the highlights of this GST Council Meeting.

52nd GST Council Meeting: Key Highlights

Changes in GST Rates of Goods

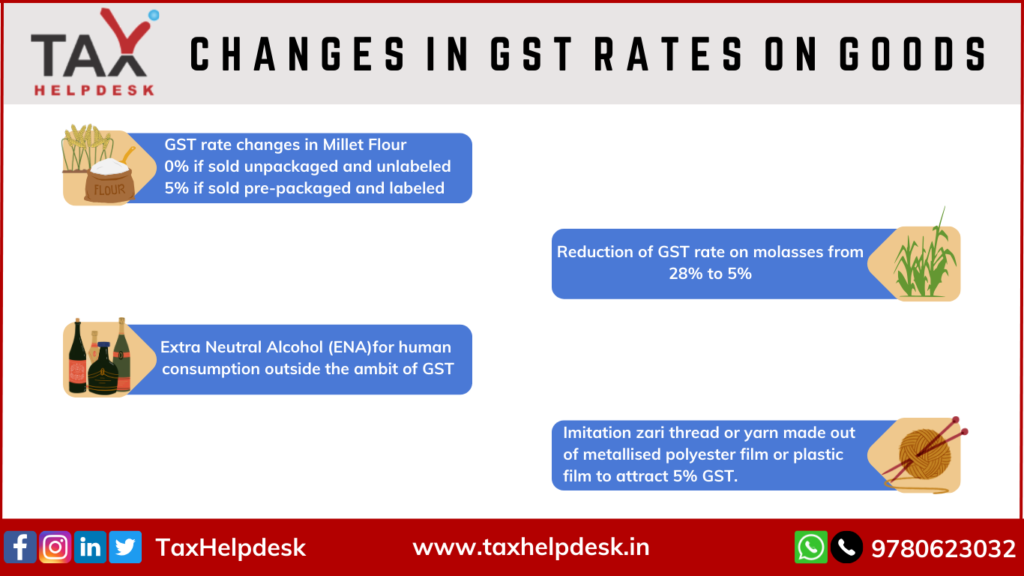

- The GST Council has made a recommendation to charge Goods and services tax in India at nil rate for food preparation of millet flour in powder form and containing at least 70% millets by weight, if the sale is in loose form. On the other hand, this GST rate is 5% if the selling of flour has packaging and labelling form. Having said this, the Government has made this move because the year 2023 is the “International Year of Millets”. And, to provide the easy access of millets to the general public.

- Reduction of GST rate on molasses from 28% to 5%. Molasses is a byproduct of sugar production and has its uses in making alcohol as well as ethanol. This move will benefit the sugar mills as well as the sugarcane farmers. This is because the reduction of GST rates will increase the liquidity in the mills. Accordingly, it will enable faster clearance of sugarcane dues to the farmers.

- Further, the Council recommends to keep the Extra Neutral Alcohol (ENA)for human consumption outside the ambit of Goods and services tax. On the other hand, if the ENA use is for industrial purpose, then it will attract 18% GST under a separate tariff HSN code.

- Imitation zari thread or yarn made out of metallised polyester film or plastic film to attract 5% GST. This will be without refund due to inversion.

Changes in GST Rates on Services

Apart from the changes in GST rates on services, the 52nd GST Council Meeting has made recommendations to provide changes in GST rates on services. And, these are as follows:

Also Read: Reverse Charge Mechanism Under GST Regime

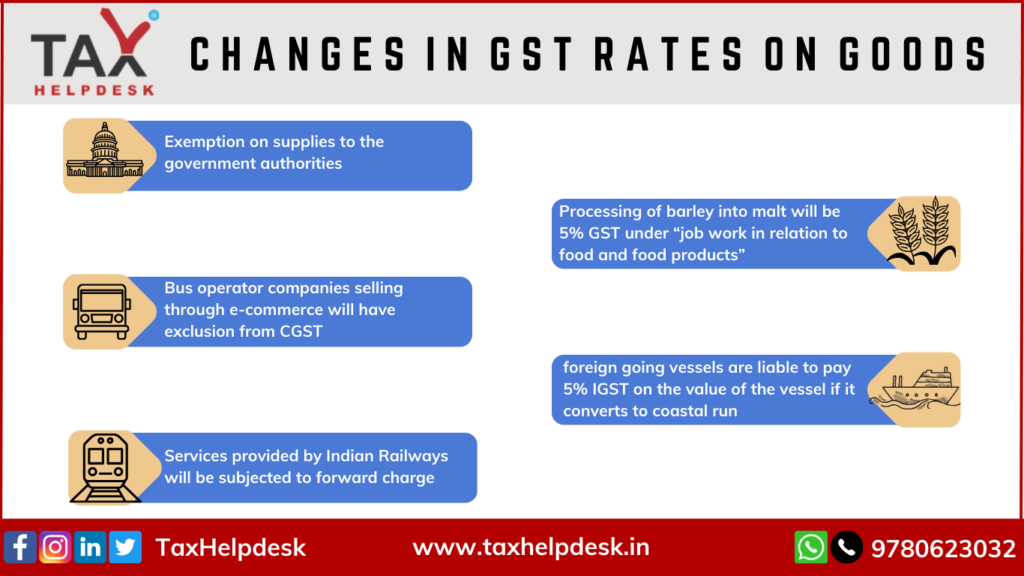

- Firstly, the GST council has made a recommendation to provide exemption on water supply services, public health etc supplied to the government authorities, including composite services with up to 25% of the above services.

- Secondly, the 52nd GST Council Meeting has made a clarification that the GST rate on job work services. The processing of barley into malt will be 5% under “job work in relation to food and food products.”

- Thirdly, w.e.f., 1st January 2022, the bus operator companies selling through e-commerce will have exclusion from CGST. This, accordingly will allow them to pay goods and services tax (GST) and avail ITC claims.

- Fourthly, foreign going vessels are liable to pay 5% IGST on the value of the vessel if it converts to coastal run. GST Council recommends conditional IGST exemption to foreign flag foreign going vessel when it converts to coastal run subject to its reconversion to foreign going vessel in six months.

- Lastly, all services provided by Indian Railways will be subjected to forward charge, with ITC available for discharging liabilities.

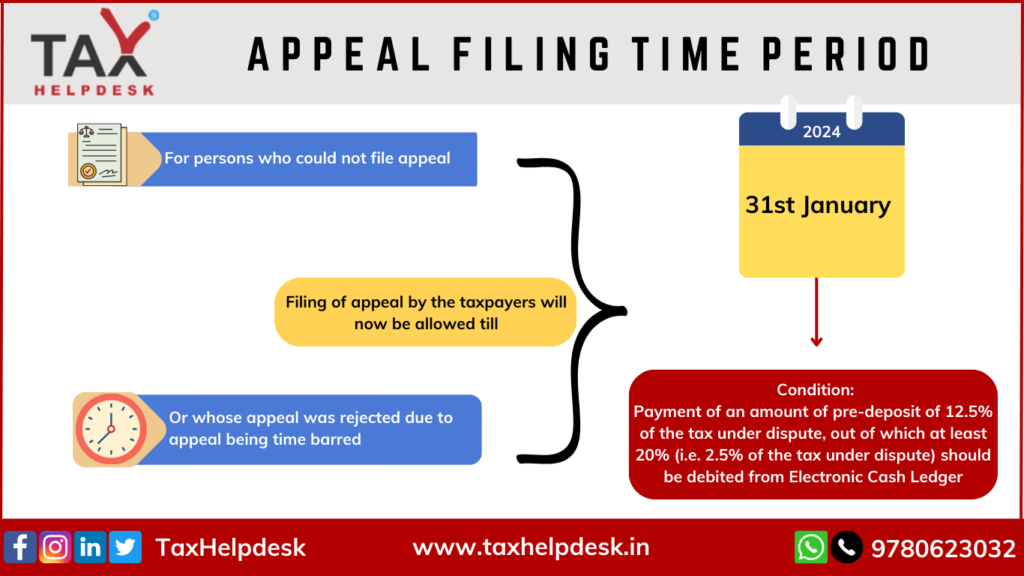

Amnesty Scheme for Filing Appeals

Amnesty Scheme for filing of appeals against demand orders:

The Council has made recommendations providing an amnesty scheme through a special procedure for taxable persons, who could not file an appeal against the demand order or whose appeal against the said order was rejected solely on the grounds that the said appeal was not filed within the time period. In all such cases, filing of appeal by the taxpayers will be allowed against such orders upto 31st January 2024. This is subject to the condition of payment of an amount of pre-deposit of 12.5% of the tax under dispute, out of which at least 20% (i.e. 2.5% of the tax under dispute) should be debited from Electronic Cash Ledger. This will facilitate a large number of taxpayers, who could not file appeal earlier within the time period.

GST on Online Gaming, Horse Racing and Casinos

The amended legal provisions and rules for online gaming, horse racing and casinos came into effect from October 1, bringing into effect the 28 per cent GST at face value at entry level, and mandatory GST registration for offshore online gaming companies in India. As of now, 18 states have brought the required amendments in their state GST laws.

Clarifications on the Place of Supply

The Council has made recommendations to issue a Circular to clarify the place of supply in respect of:

(i) Supply of service of transportation of goods, including by mail or courier, in cases where the location of supplier or the location of recipient of services is outside India;

(ii) Supply of advertising services;

(iii) Supply of the co-location services.

Also Read: Various Types of Supply Under GST

Tribunal Reforms

- An advocate for ten years with substantial experience in litigation under indirect tax laws in the Appellate Tribunal, Central Excise and Service Tax Tribunal, State VAT Tribunals, High Court or Supreme Court to be eligible for the appointment as judicial member;

- The minimum age for eligibility for appointment as President and Member to be 50 years;

- President and Members shall have tenure up to a maximum age of 70 years and 67 years respectively.