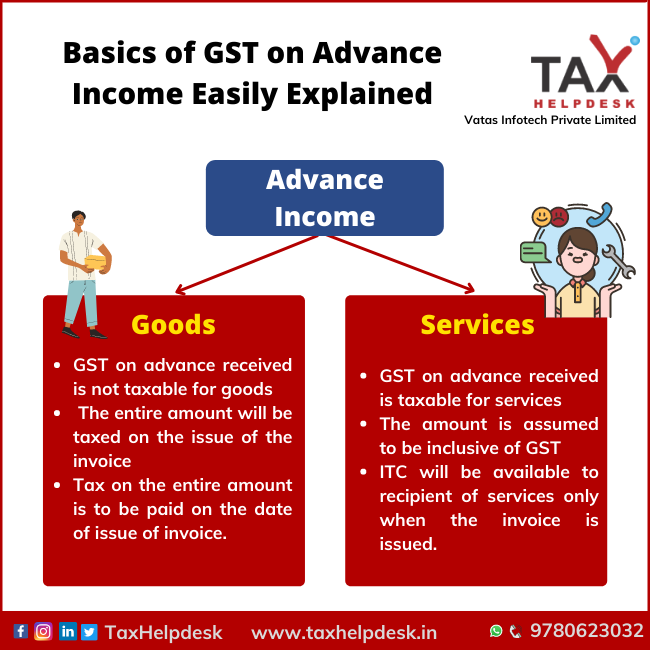

Basics of GST on Advance Income Easily Explained

Advance income, as the name suggests is said to be when the payment of income is made before its actual time. This advance income may sometimes be required by the …

Basics of GST on Advance Income Easily Explained Read More »