Understanding the difference between EPF vs PPF is essential because both of these scheme are the major tax saving schemes. While one is Employees’ Provident Fund, the other is Public Provident Fund. Accordingly, the difference between EPF & PPF is not of just one word but it has various other parameters too. In this blog, we will explain in detail the difference between the two Provident Funds. Consequently, you will be able to determine which scheme is better for saving money.

EPF vs PPF: Key Differences

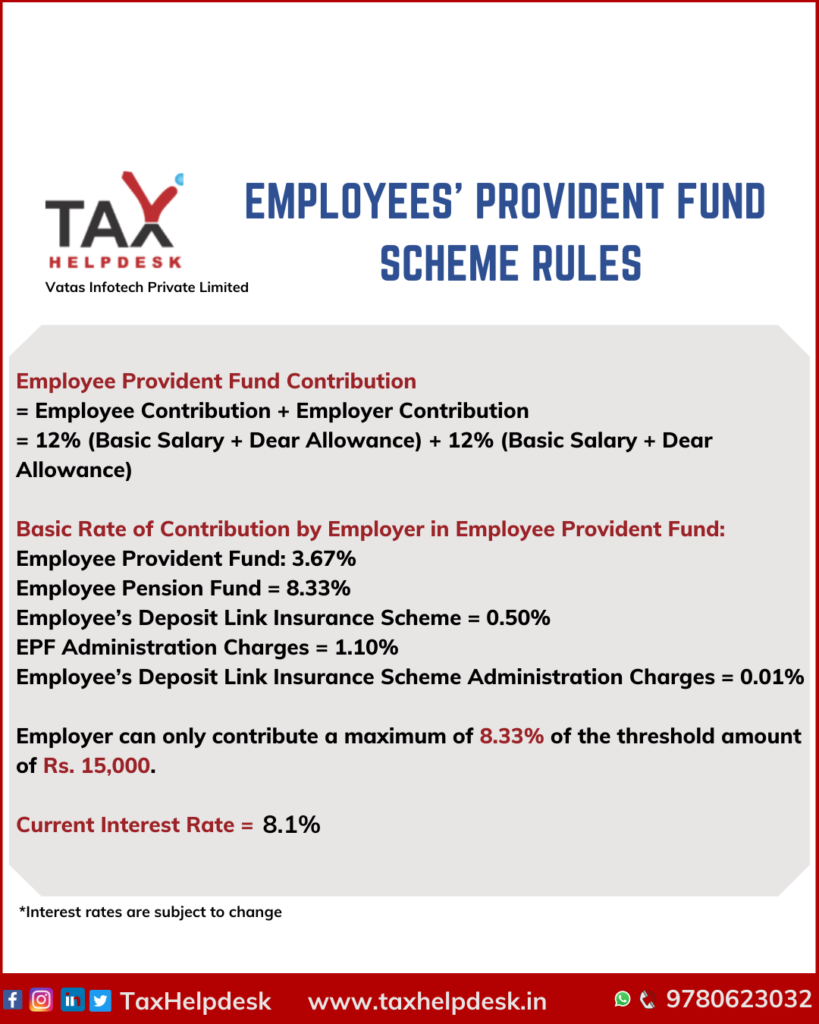

EPF or Employees’ Provident Fund is a government saving scheme for the employees. In addition to this, the EPF Scheme is regulated and controlled under the Employees Provident Fund and Miscellaneous Provisions Act, 195. And, the governing statutory body of EPF is Employee Provident Fund Organisation (EPFO). This statutory body announces the EPF interest every year and the current interest rate is 8.1%. Further, under the EPF Scheme, both employer and employee contributes towards the EPF Account.

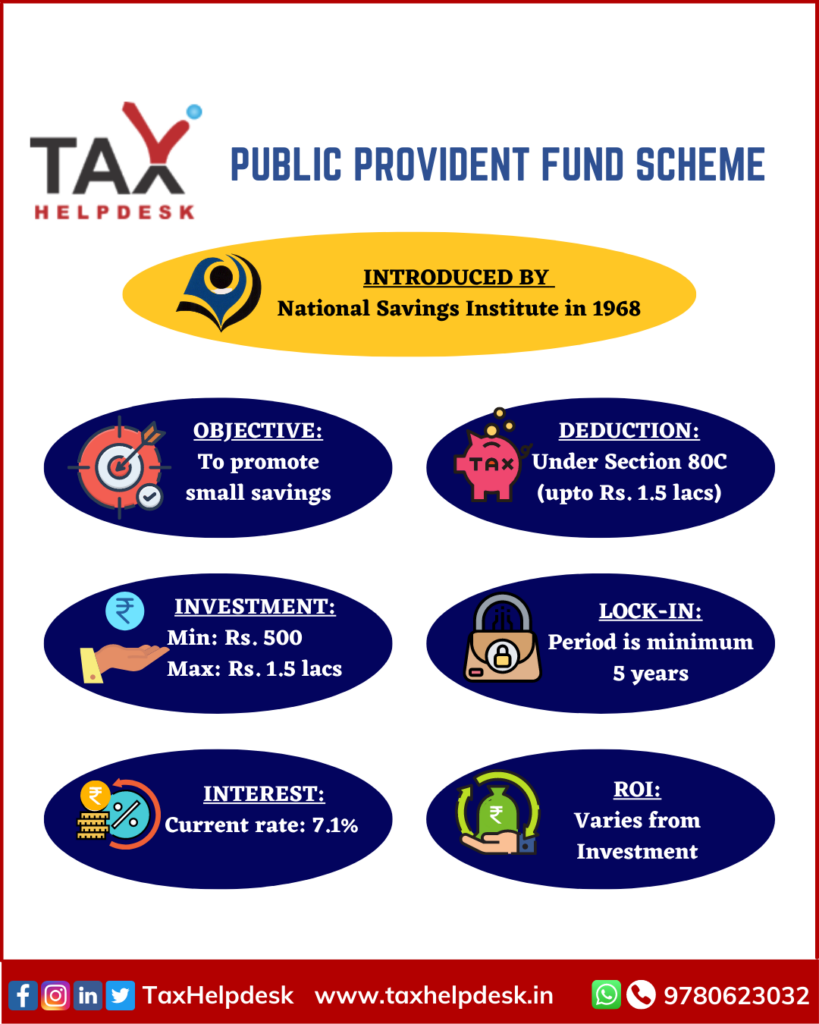

On the other hand, PPF or Public Provident Scheme is also a government saving scheme and can be opted for by everyone. Therefore, even the unemployed, employed or retired persons can invest in the PPF Scheme. Further, the PPF Scheme is under the management of National Savings Institute, Ministry of Finance. The current PPF interest is 7.1%.

Here are the key differences between the two:

| Parameter | Employee Provident Fund (EPF) | Public Provident Fund (PPF) |

|---|---|---|

| Interest Rate | 8.15% | 7.10% |

| Eligibility to Invest | Only for salaried employees | All Indians except for NRI |

| Investment Amount | 12% of Basic Salary | Minimum amount – Rs 500 Maximum amount – Rs 1.5 lakh |

| Lock-in Period | Retirement or Resignation | 15 Years, Extendable in 5 years block |

| Contributor to Fund | Both Employer and Employee | Self or Parent in case of a minor |

| Tax-on Withdrawal | If withdrawn before 5 years | No |

| Nature of the Account | Retirement-cum savings scheme | Savings scheme |

| Loan | Yes – Only in special cases | Yes – From 3rd Year to 6th Year |

| Scheme Offered by | Employee Provident Fund Organisation (EPFO) | Selected public sector banks and Post Offices |

In EPF vs PPF, which one is more safe?

When it comes to safety in EPF vs PPF, both are considered as equally safe. This is so because both the schemes are government savings schemes. The regulatory bodies for EPF and PPF are Employee Provident Fund Organisation and National Savings Institute respectively. Therefore, one should not doubt on the safety of these instruments.

Also Read: Know Incomes Free From Taxes In India

Should you invest in PPF if you have EPF?

As already stated above, one can invest in EPF only if he is an employee. Whereas, under the PPF scheme, there is no such restriction and there can be PPF account even in the name of a minor. In addition to this, both PPF and EPF are tax saving schemes and helps in the accumulation of the corpus. Moreover, the interest on PPF amount is completely tax free and under the EPF, there is no tax on interest amounts of upto Rs. 2.50 lacs. Therefore, investing in both schemes can be beneficial for all the employees.

Also Read: Taxability of various instruments under Section 80C

Which one has more liquidity in EPF v. PPF?

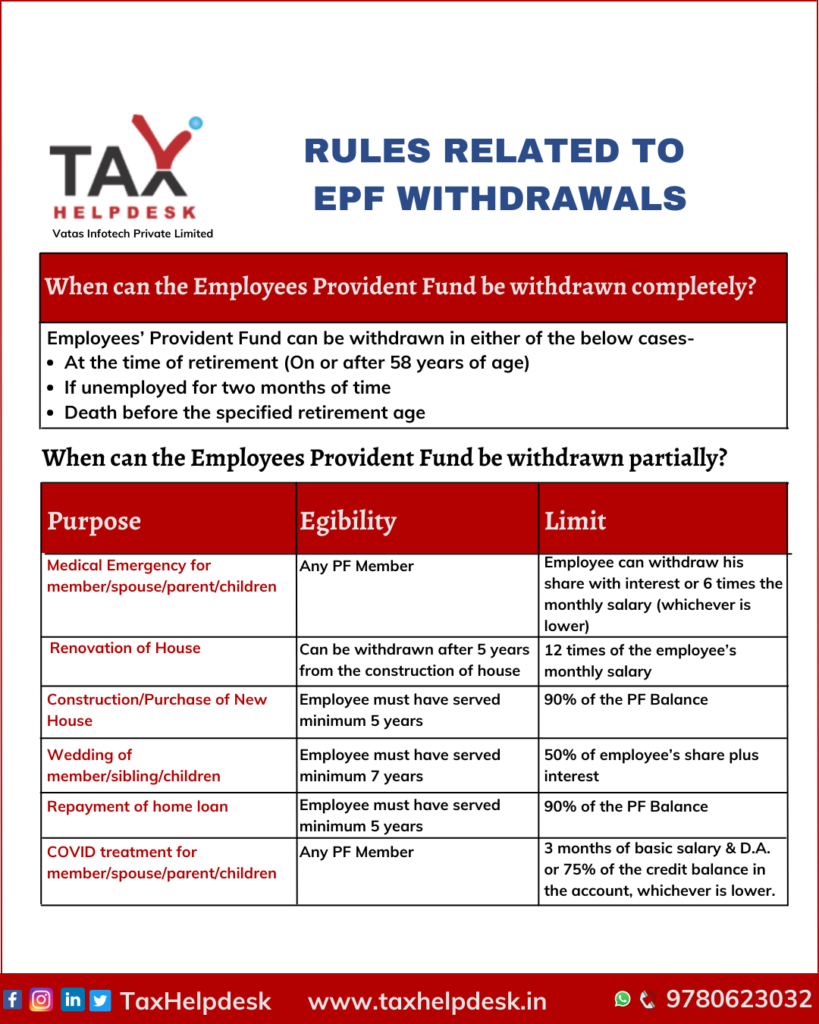

When it comes to liquidity in EPF v. PPF, the EPF Scheme is more liquid than the PPF. This is because one can withdraw from PPF only after the expiry of 5 years from the account opening. The rules related to EPF withdrawal are as follows:

Conclusion

Keeping in view the above-mentioned points, if you are an employee, then it is advisable that you must invest in EPF scheme. This is because both you and your employer invests in this scheme in your account. On the other hand, if you are not an employed person, then you must open a PPF account which will not only help you in saving your taxes but will also help in accumulation of the corpus. Accordingly, you can make use of this corpus at the time of your retirement, children’s higher education, children’s marriage and many other areas.